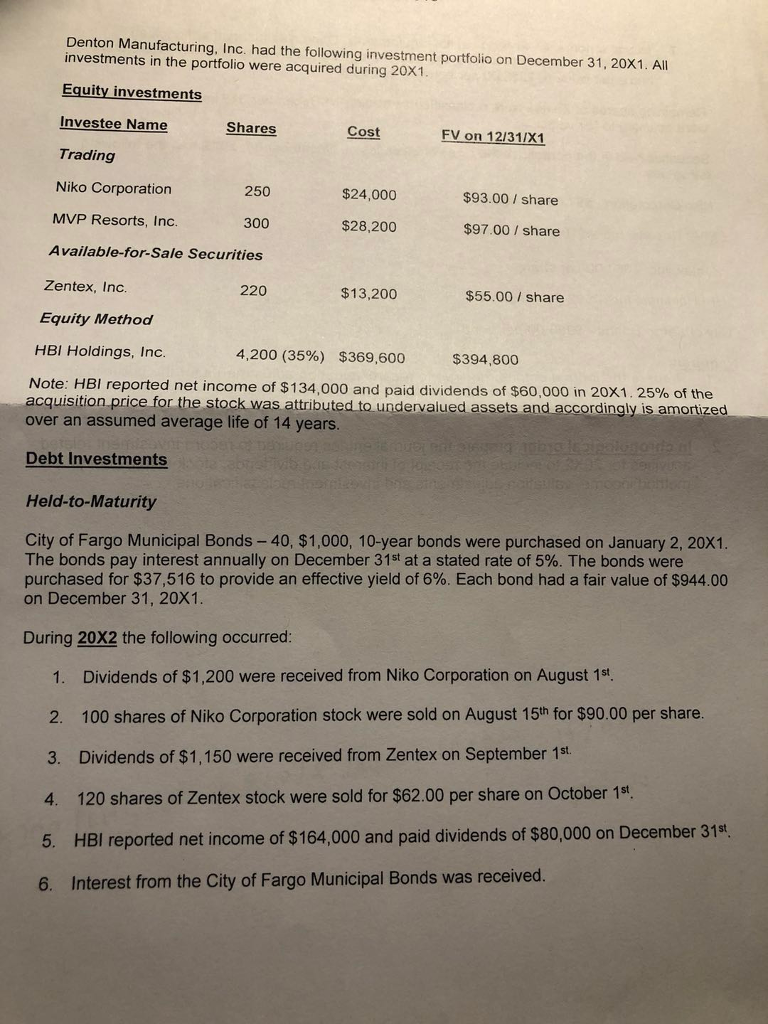

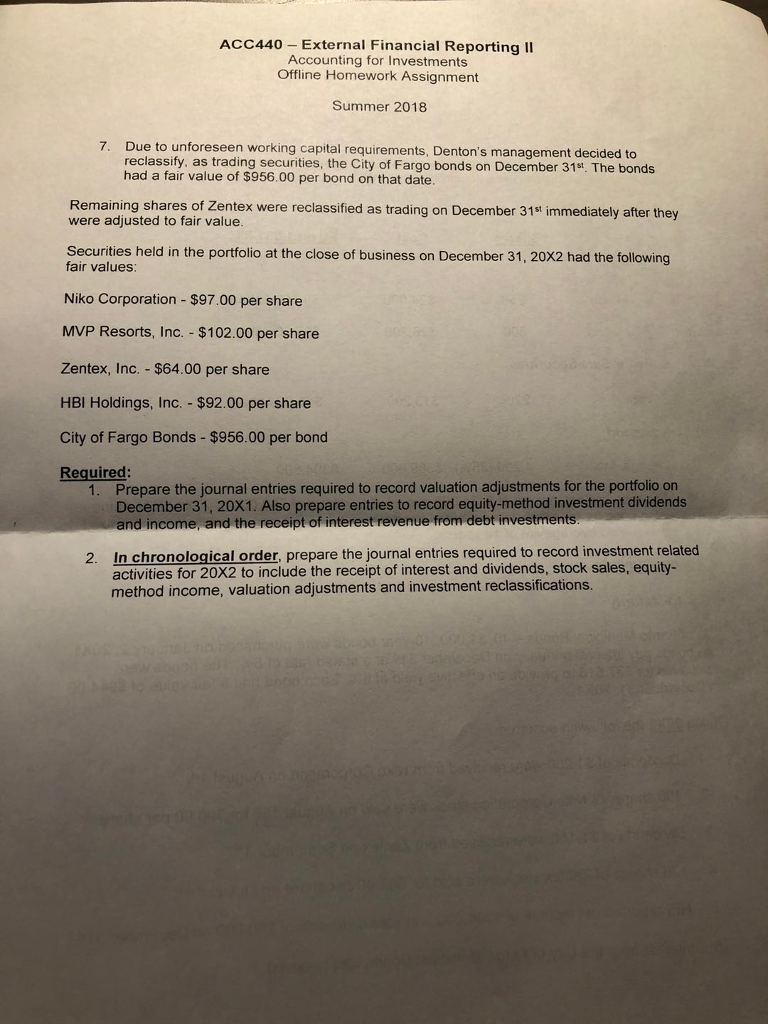

Denton Manufacturing, Inc. had the following investment portfolio on December 31, 20X1. All investments in the portfolio were acquired during 20x1 Equity investments Investee Name Shares Cost FV on 12/131/X1 Trading Niko Corporation 250 $24,000 $93.00 share MVP Resorts, Inc. 300 $28,200 $97.00 / share Available-for-Sale Securities Zentex, Inc. 220 $13,200 $55.00 share Equity Method HBI Holdings, Inc. 4,200(35%) $369,600 $394,800 Note: HBI reported net income of $134,000 and paid dividends of $60,000 in 20X1 , 25% of the cquisition price for the stock was attributed to undervalued assets and accordingly is amortize over an assumed average life of 14 years Debt Investments Held-to-Maturity City of Fargo Municipal Bonds -40, $1,000, 10-year bonds were purchased on January 2, 20X1. The bonds pay interest annually on December 31st at a stated rate of 5%. The bonds were purchased for $37,516 to provide an effective yield of 6%. Each bond had a fair value of $944 00 on December 31, 20x1. During 20X2 the following occurred: 1. Dividends of $1,200 were received from Niko Corporation on August 1st 2. 100 shares of Niko Corporation stock were sold on August 15th for $90.00 per share. 3. Dividends of $1,150 were received from Zentex on September 1st 4. 120 shares of Zentex stock were sold for $62.00 per share on October 1st 5. HBI reported net income of $164,000 and paid dividends of $80,000 on December 31st, 6. Interest from the City of Fargo Municipal Bonds was received. Denton Manufacturing, Inc. had the following investment portfolio on December 31, 20X1. All investments in the portfolio were acquired during 20x1 Equity investments Investee Name Shares Cost FV on 12/131/X1 Trading Niko Corporation 250 $24,000 $93.00 share MVP Resorts, Inc. 300 $28,200 $97.00 / share Available-for-Sale Securities Zentex, Inc. 220 $13,200 $55.00 share Equity Method HBI Holdings, Inc. 4,200(35%) $369,600 $394,800 Note: HBI reported net income of $134,000 and paid dividends of $60,000 in 20X1 , 25% of the cquisition price for the stock was attributed to undervalued assets and accordingly is amortize over an assumed average life of 14 years Debt Investments Held-to-Maturity City of Fargo Municipal Bonds -40, $1,000, 10-year bonds were purchased on January 2, 20X1. The bonds pay interest annually on December 31st at a stated rate of 5%. The bonds were purchased for $37,516 to provide an effective yield of 6%. Each bond had a fair value of $944 00 on December 31, 20x1. During 20X2 the following occurred: 1. Dividends of $1,200 were received from Niko Corporation on August 1st 2. 100 shares of Niko Corporation stock were sold on August 15th for $90.00 per share. 3. Dividends of $1,150 were received from Zentex on September 1st 4. 120 shares of Zentex stock were sold for $62.00 per share on October 1st 5. HBI reported net income of $164,000 and paid dividends of $80,000 on December 31st, 6. Interest from the City of Fargo Municipal Bonds was received