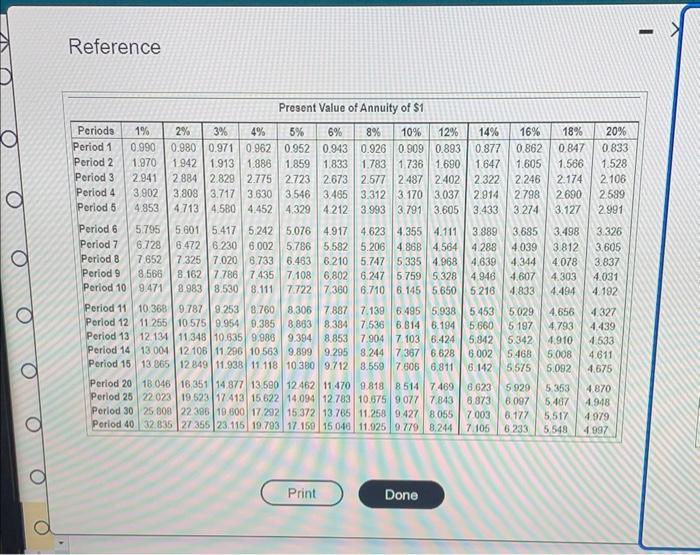

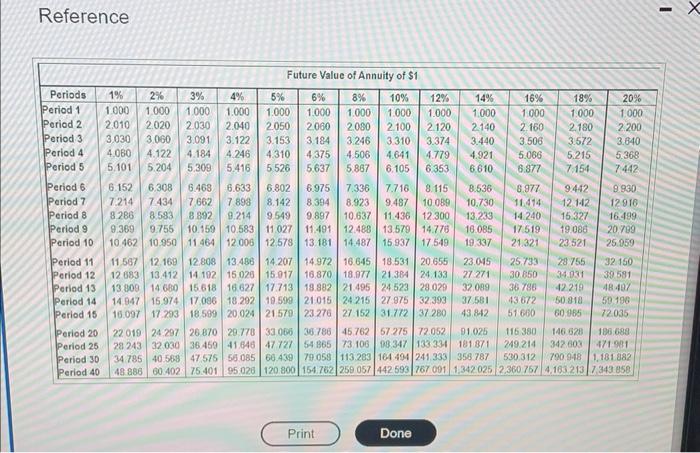

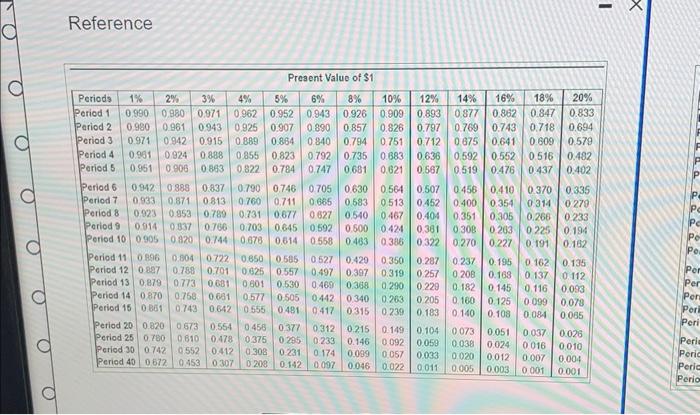

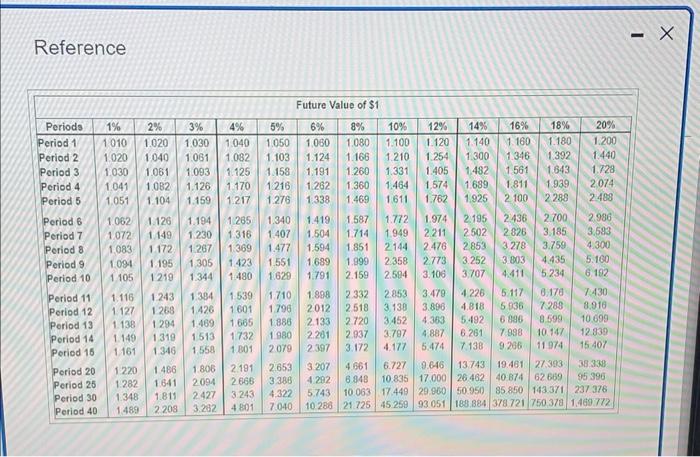

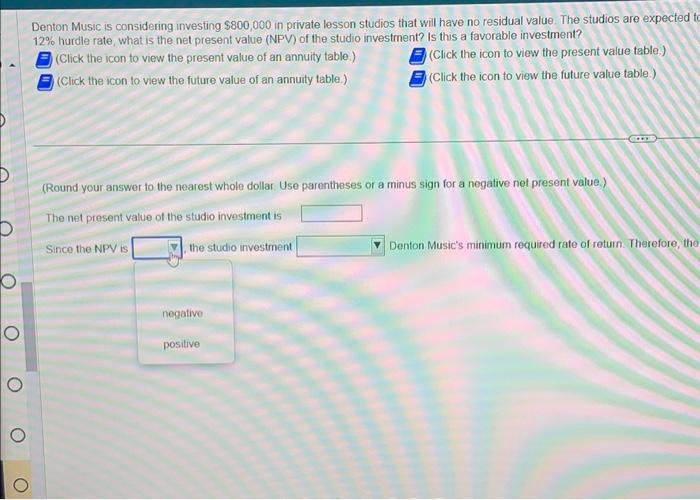

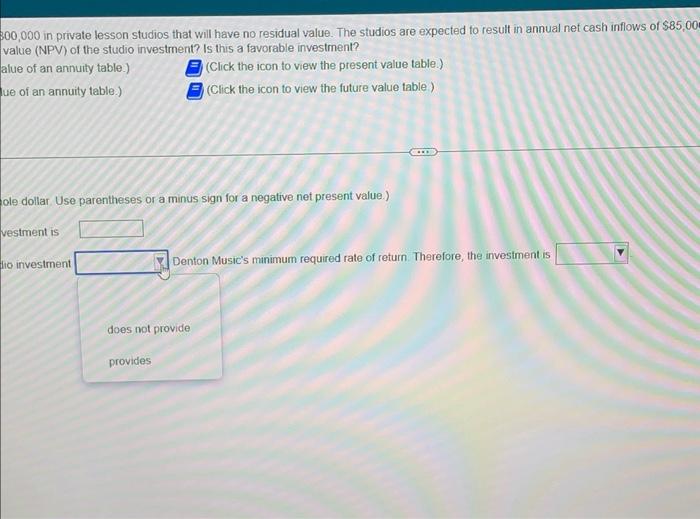

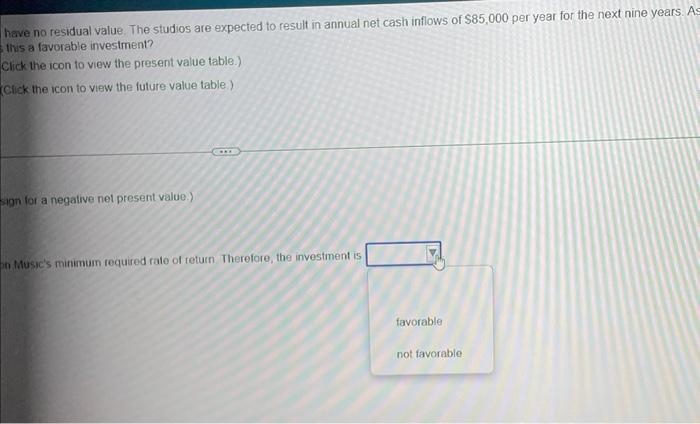

Denton Music is considering investing $800,000 in private lesson studios that will have no residual value. The studios are expected to resu Assuming that Denton Music uses a 12% hurdle rate, what is the net present value (NPV) of the studio investment? Is this a favorable inve (Click the icon to view the present value of an annuity table) (Click the icon to view the present value table.) (Click the icon to view the future value of an annuity table.) (Click the icon to view the future value table) (Round your answer to the nearest whole dollar Use parentheses or a minus sign for a negative net present value.) The net present value of the studio investment is Since the NPV is the studio investment Denton Music's minimum requred rate of return Therefore, the investm idios that will have no residual value. The studios are expected to result in annual net cash inflows of $85,000 per year for the next nine years t present value (NPV) of the studio investment? Is this a favorable investment? (Click the icon to view the present value table.) (Click the icon to view the future value table.) s or a minus sign for a negative net present value.) Denton Music's minimum required rate of return. Therefore, the investment is Reference Reference Reference Reference Denton Music is considering investing $800,000 in private lesson studios that will have no residual value. The studios are expected 12% hurdle rate, what is the net present value (NPV) of the studio investment? Is this a favorable investment? (Click the icon to view the present value of an annuity table.) (Click the icon to view the present value table.) (Click the icon to view the future value of an annuity table.) (Click the icon to view the future value table.) (Round your answer to the nearest whole dollar Use parentheses or a minus sign for a negative net present value.) The net present value of the studio investment is Since the NPV is the studio investment Denton Music's minimum required rate of retum. Therefore, th 00,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $85,00 value (NPV) of the studio investment? Is this a favorable investment? alue of an annuity table.) (Click the icon to view the present value table.) ve of an annuity table.) (Click the icon to view the future value table.) ole dollar Use parentheses or a minus sign for a negative net present value.) vestment is 10 investment Denton Music's minimum required rate of return. Therefore, the invesiment is have no residual value. The studios are expected to result in annual net cash inflows of $85,000 per year for the next nine years. As Whis a favorable investment? Click the icon to view the present value table.) Click the icon to view the future value table)