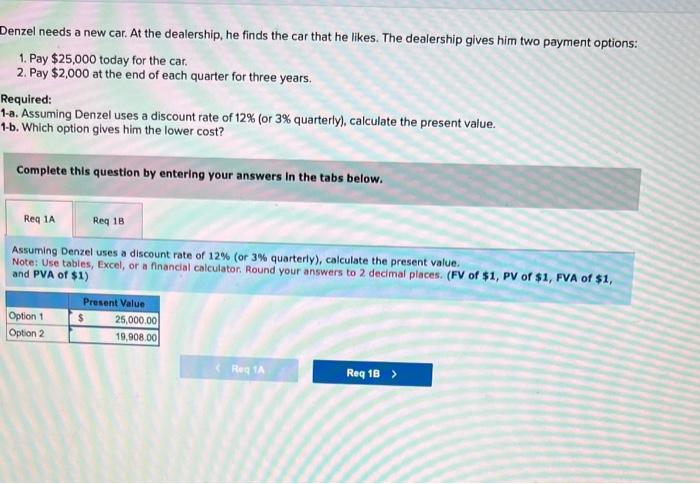

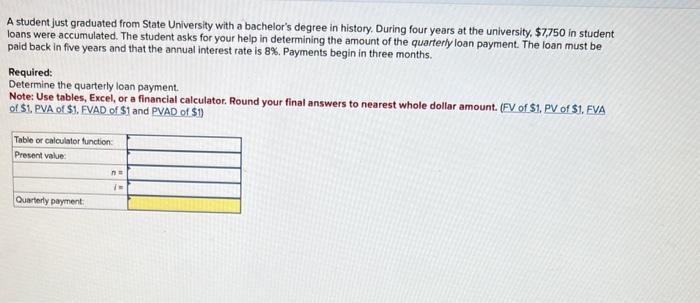

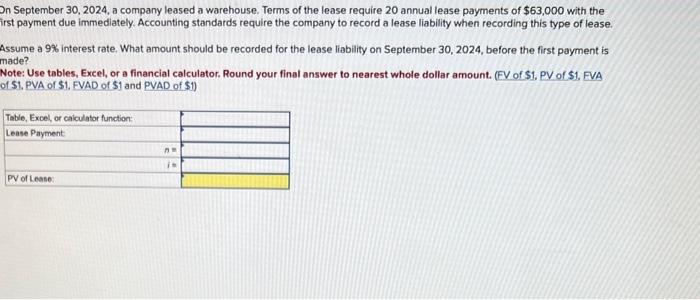

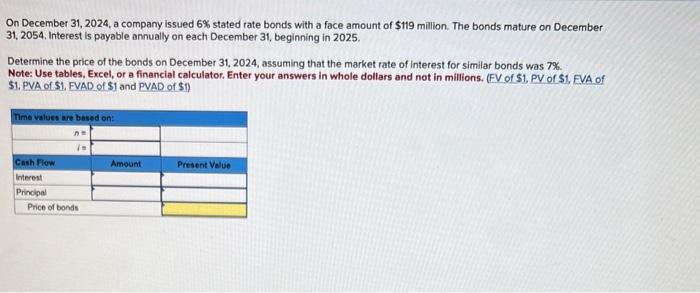

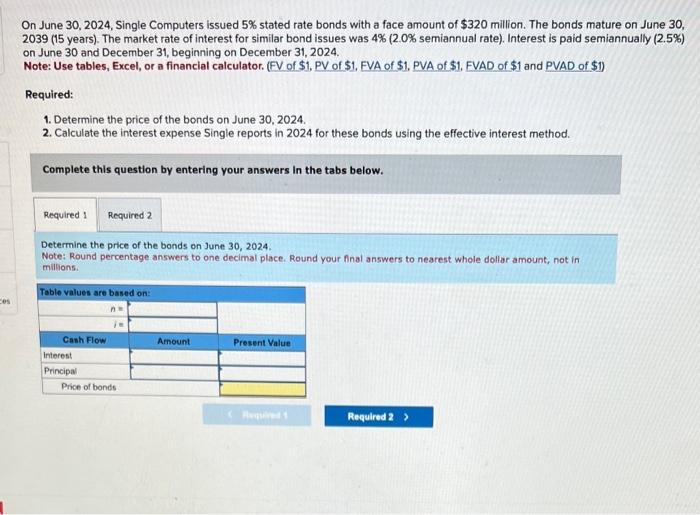

Denzel needs a new car. At the dealership, he finds the car that he likes. The dealership gives him two payment options: 1. Pay $25,000 today for the car. 2. Pay $2,000 at the end of each quarter for three years. Required: 1-a. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. l-b. Which option gives him the lower cost? Complete this question by entering your answers in the tabs below. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1,FVA of $1, and PVA of \$1) A student just graduated from State University with a bachelor's degree in history. During four years at the university, $7,750 in student loans were accumulated. The student asks for your help in determining the amount of the quarterly loan payment. The loan must be paid back in five years and that the annual interest rate is 8%. Payments begin in three months. Required: Determine the quarterly loan payment. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of \$1, PV of \$1, FVA of \$1. PVA of \$1. FVAD of \$1 and PVAD of \$1) in September 30,2024 , a company leased a warehouse. Terms of the lease require 20 annual lease payments of $63,000 with the ist payment due immediately. Accounting standards require the company to record a lease liability when recording this type of lease. ssume a 9% interest rate. What amount should be recorded for the lease liability on September 30,2024 , before the first payment is ade? lote: Use tables, Excel, or a financial calculator. Round your final answer to nearest whole dollar amount. (FV of S1, PV of S1, EVA 1\$1. PVA of \$1. FVAD of \$1 and PVAD of \$11 On December 31, 2024, a company issued 6% stated rate bonds with a face amount of $119 million. The bonds mature on December 31, 2054. Interest is payable annually on each December 31, beginning in 2025. Determine the price of the bonds on December 31, 2024, assuming that the market rate of interest for similar bonds was 7%. Note: Use tables, Excel, or a financial calculator. Enter your answers in whole dollars and not in millions. (FV of S1, PV of S1, FVA of \$1. PVA of \$1. FVAD of \$1 and PVAD of \$1) On June 30,2024 , Single Computers issued 5% stated rate bonds with a face amount of $320 million. The bonds mature on June 30 , 2039 (15 years). The market rate of interest for similar bond issues was 4% ( 2.0% semiannual rate). Interest is paid semiannually (2.5\%) on June 30 and December 31, beginning on December 31, 2024. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1. FVAD of \$1 and PVAD of \$1) Required: 1. Determine the price of the bonds on June 30,2024. 2. Calculate the interest expense Single reports in 2024 for these bonds using the effective interest method. Complete this question by entering your answers in the tabs below. Determine the price of the bonds on June 30, 2024. Note: Round percentage answers to one decimal place. Round your fnal answers to nearest whole dollar amount, not in millions