Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dep. Variable: Model: Method: Date: Time: No. Observations: Df Residuals: Df Model: Covariance Type: Intercept roe lsales finance Omnibus: Prob (Omnibus): Skew: Kurtosis: lsalary. OLS

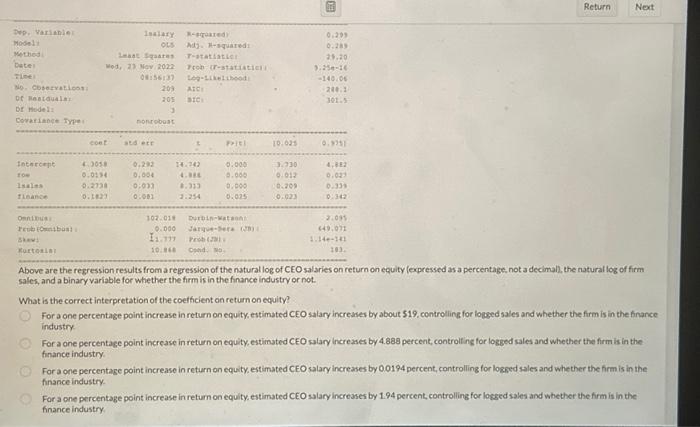

Dep. Variable: Model: Method: Date: Time: No. Observations: Df Residuals: Df Model: Covariance Type: Intercept roe lsales finance Omnibus: Prob (Omnibus): Skew: Kurtosis: lsalary. OLS Least Squares Wed, 23 Nov 2022 08:56:37 coef 4.3058 0.0194 0.2738 0.1827 nonrobust std err 209 205 3 0.292 0.004 0.033 0.081 R-squared: Adj. R-squared: F-statistic: Prob (F-statistic): Log-Likelihood: AIC: BIC: 14.742 4.888 8.313 2.254 P>ltl 0.000 0.000 0.000 0.025 102.018 Durbin-Watson: 0.000 Jarque-Bera (JB): 11.777 Prob (JB): Cond. No. 10.868 [0.025 3.730 0.012 0.209 0.023 0.299 0.289 29.20 9.25e-16 -140.06 288.1 301.5 0.975] 4.882 0.027 0.339 0.342 PACOUE 2.095 649.071 1.14e-141 183. Return Next Above are the regression results from a regression of the natural log of CEO salaries on return on equity (expressed as a percentage, not a decimal), the natural log of firm sales, and a binary variable for whether the firm is in the finance industry or not. What is the correct interpretation of the coefficient on return on equity? For a one percentage point increase in return on equity, estimated CEO salary increases by about $19, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 4.888 percent, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 0.0194 percent, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 1.94 percent, controlling for logged sales and whether the firm is in the finance industry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started