Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Department G had 1,800 units 25% completed at the beginning of the period, 13,000 units were completed during the period, 1,500 units were 20%

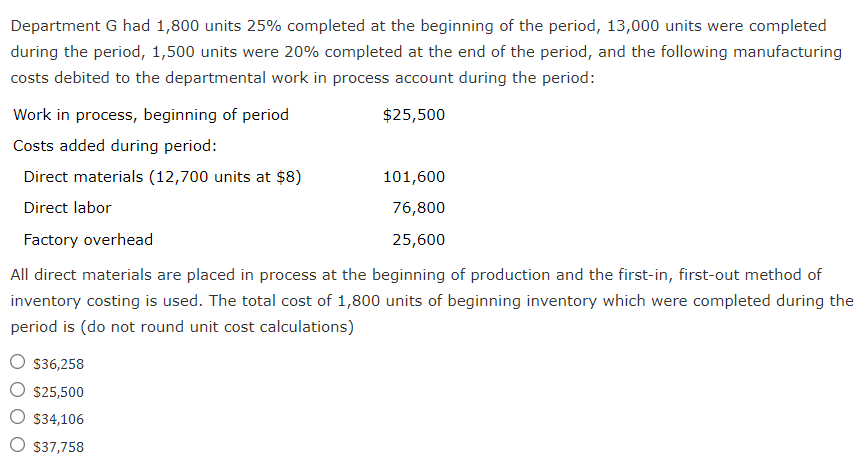

Department G had 1,800 units 25% completed at the beginning of the period, 13,000 units were completed during the period, 1,500 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $25,500 Costs added during period: Direct materials (12,700 units at $8) 101,600 Direct labor 76,800 Factory overhead 25,600 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of 1,800 units of beginning inventory which were completed during the period is (do not round unit cost calculations) $36,258 $25,500 O $34,106 O S37,758

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution Equivalent Unit oF matenial 12700 Morve Equivalent Unit o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started