Answered step by step

Verified Expert Solution

Question

1 Approved Answer

departments: Public Company Audits and Private Company Audits. The Tax Division is composed of two cost-center departments also: Individual Tax and Business Tax. (department) level.

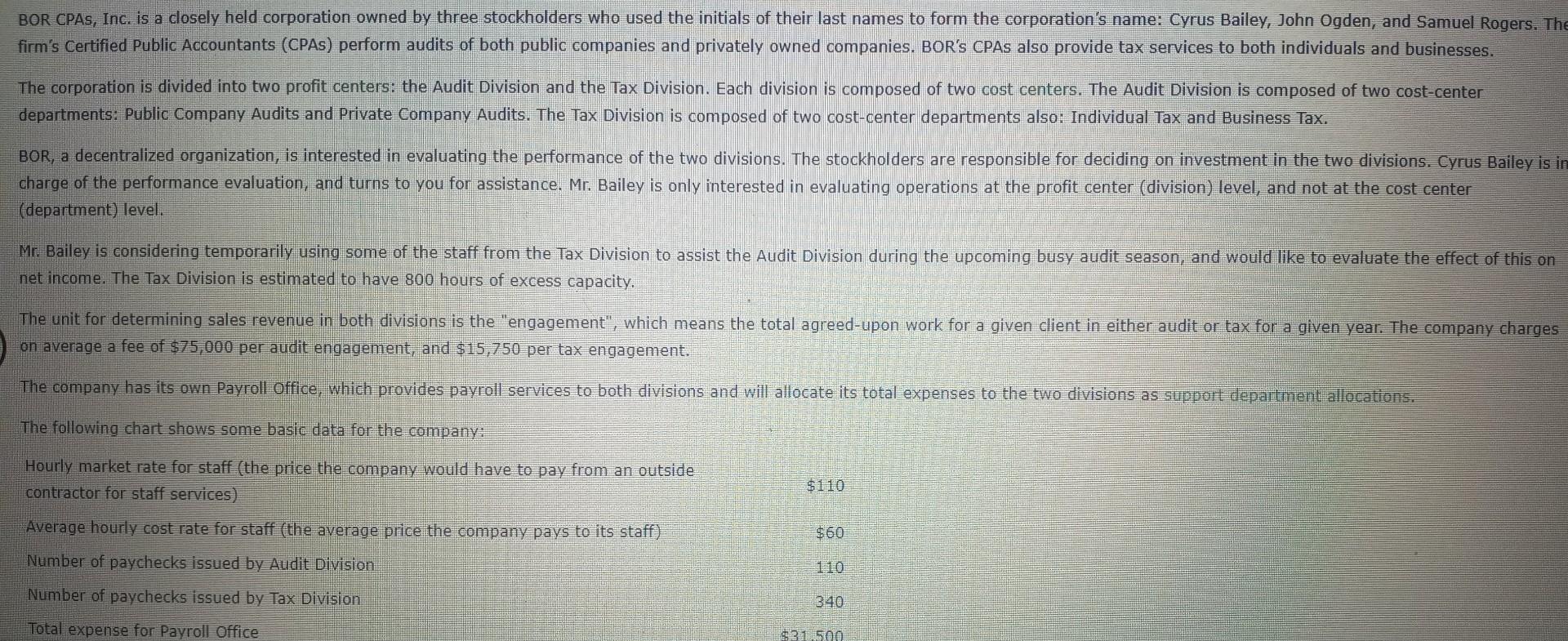

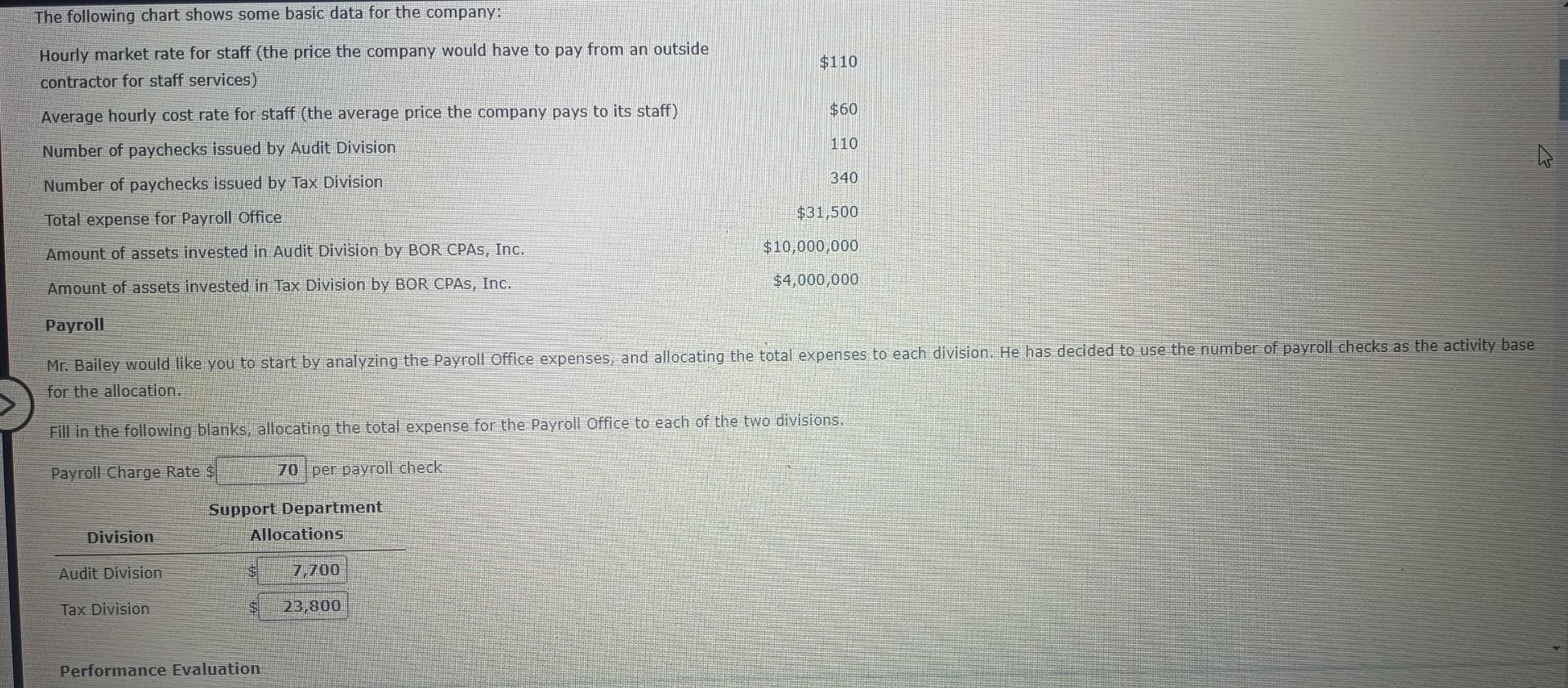

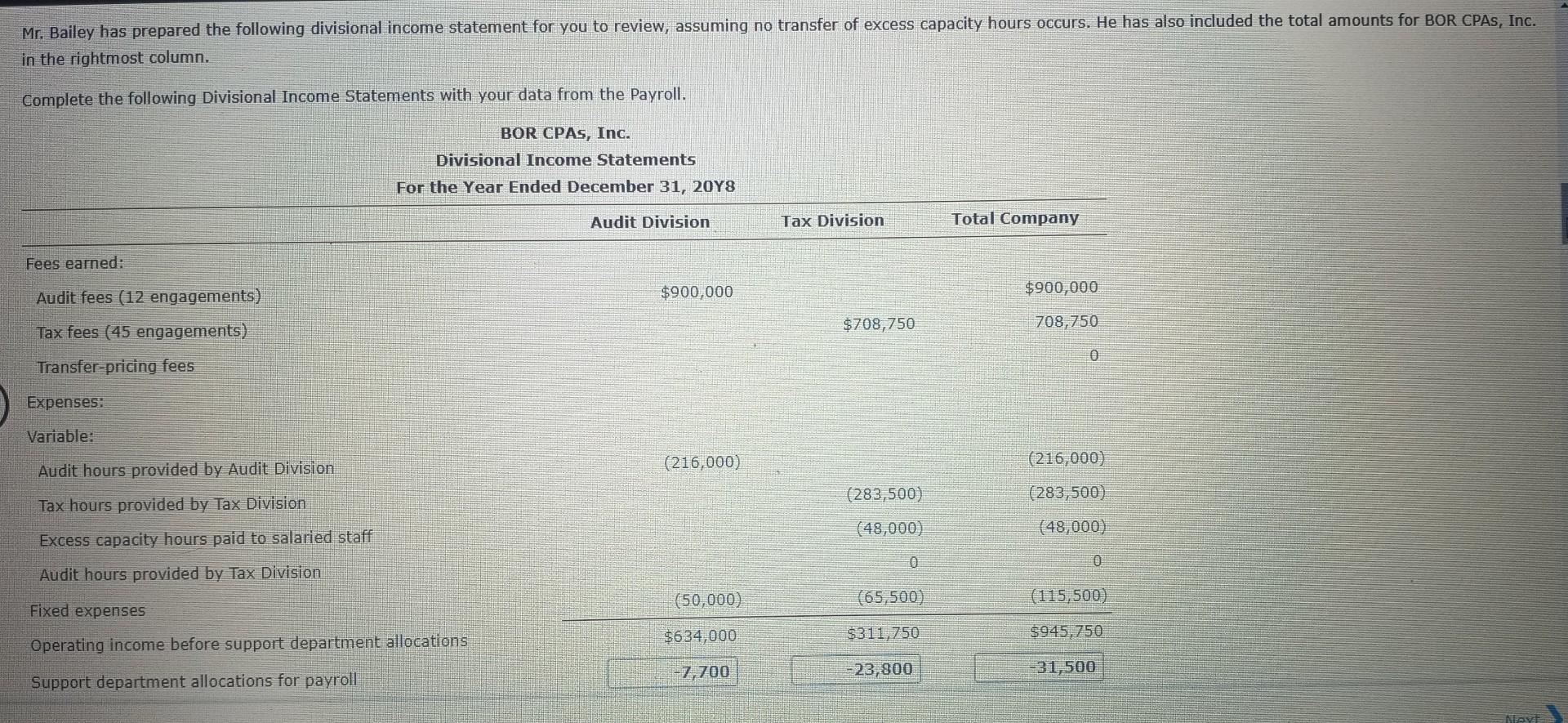

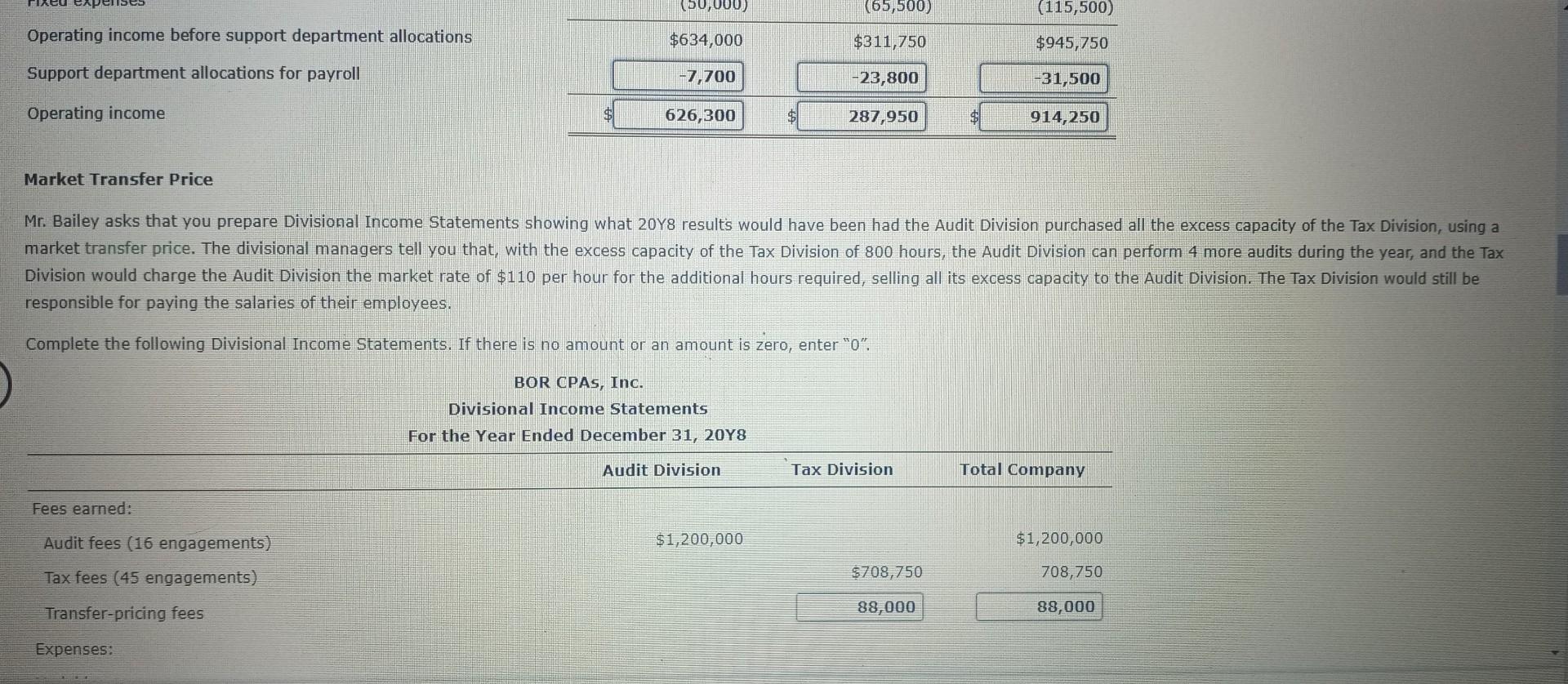

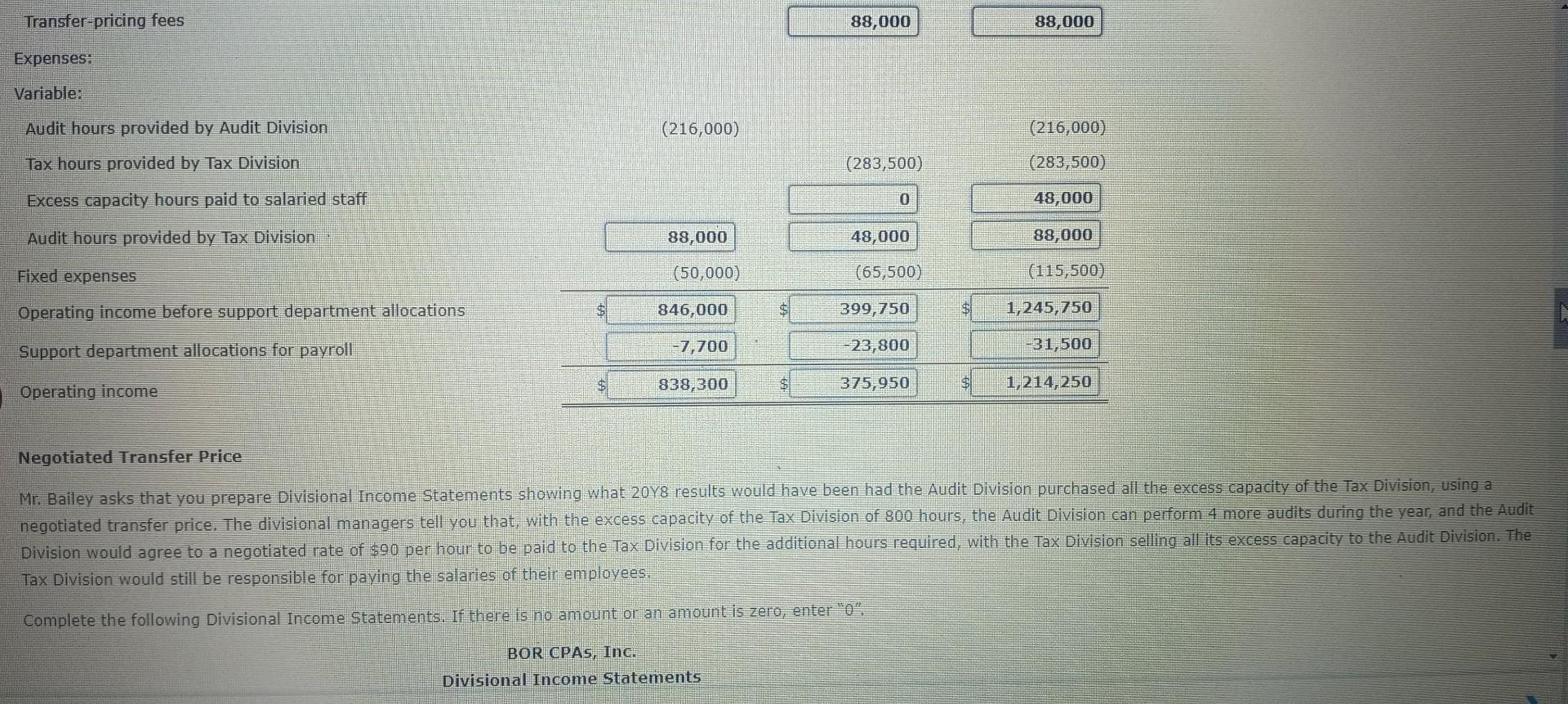

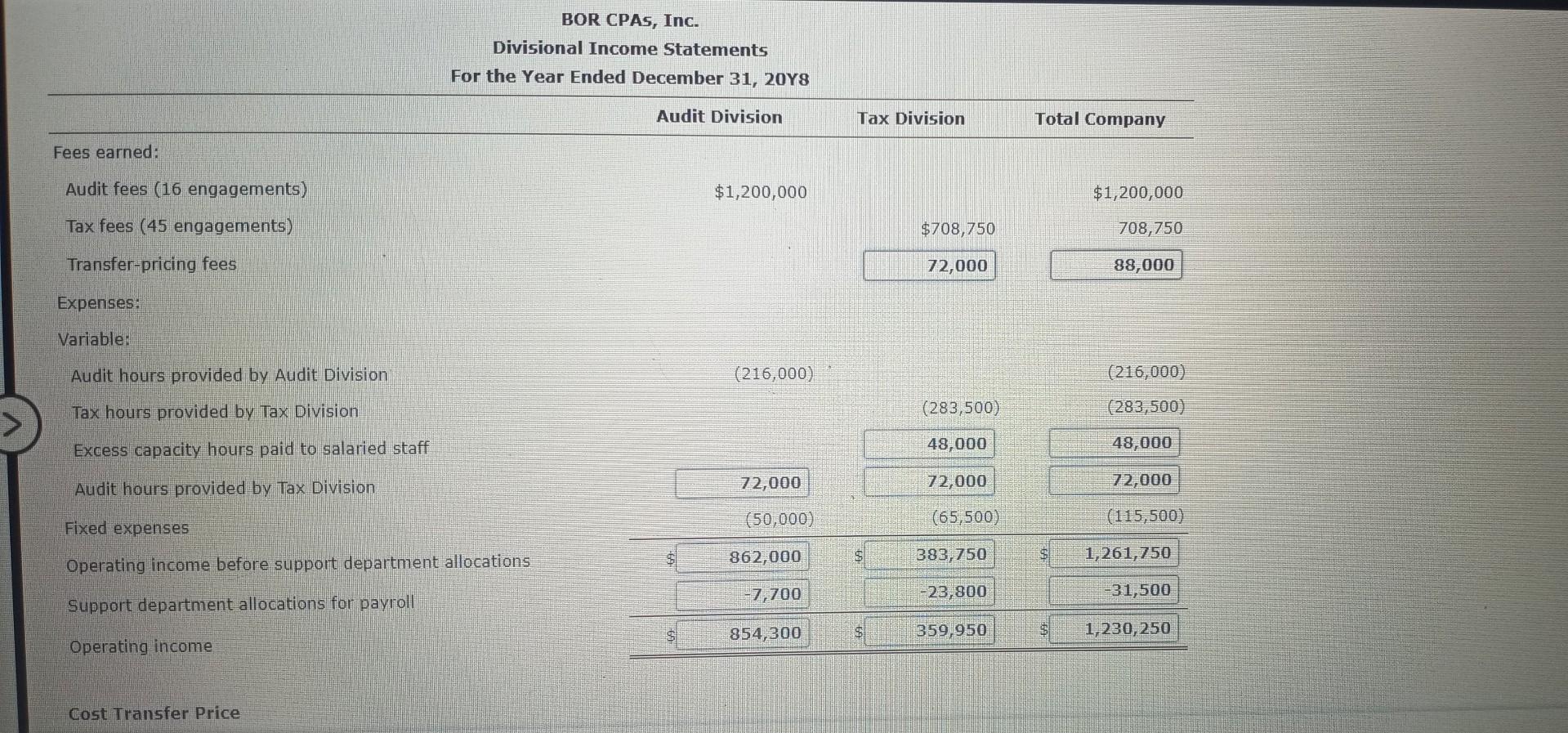

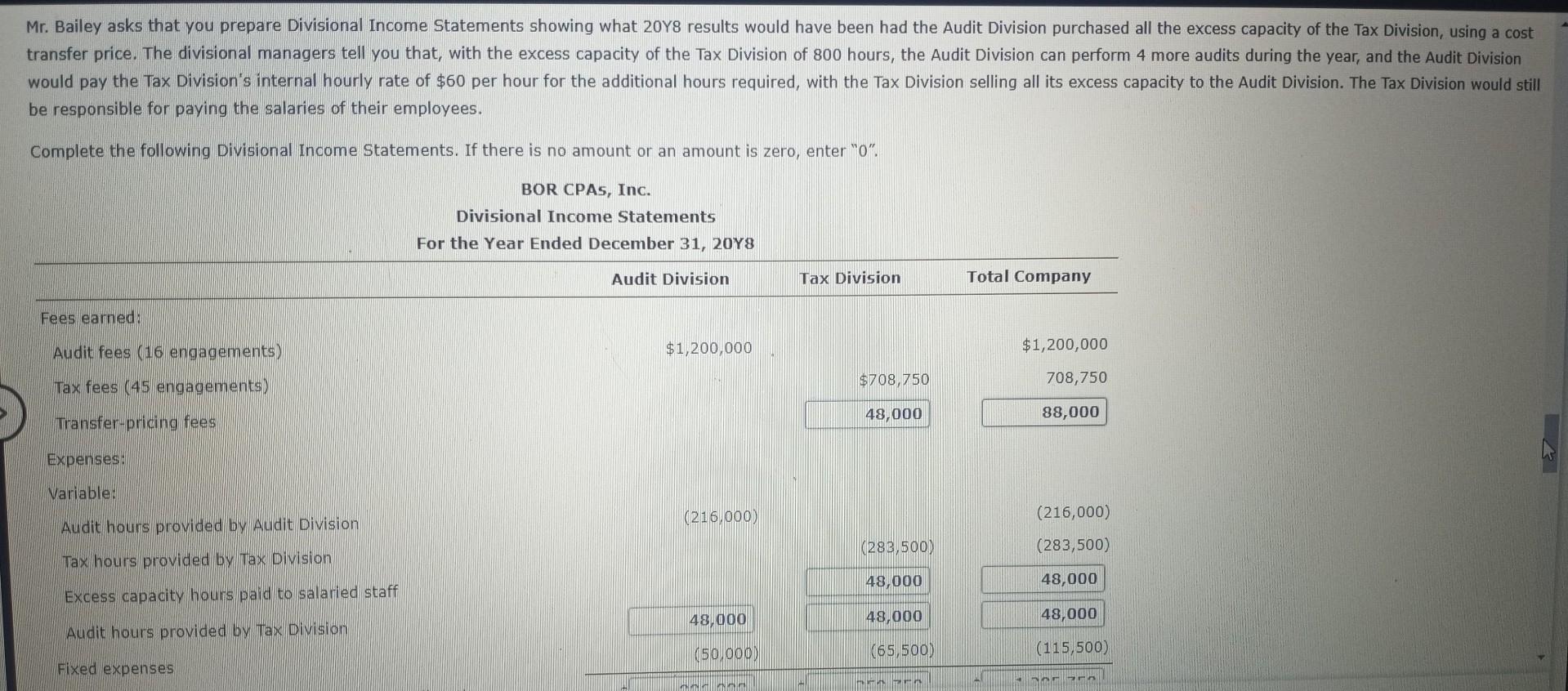

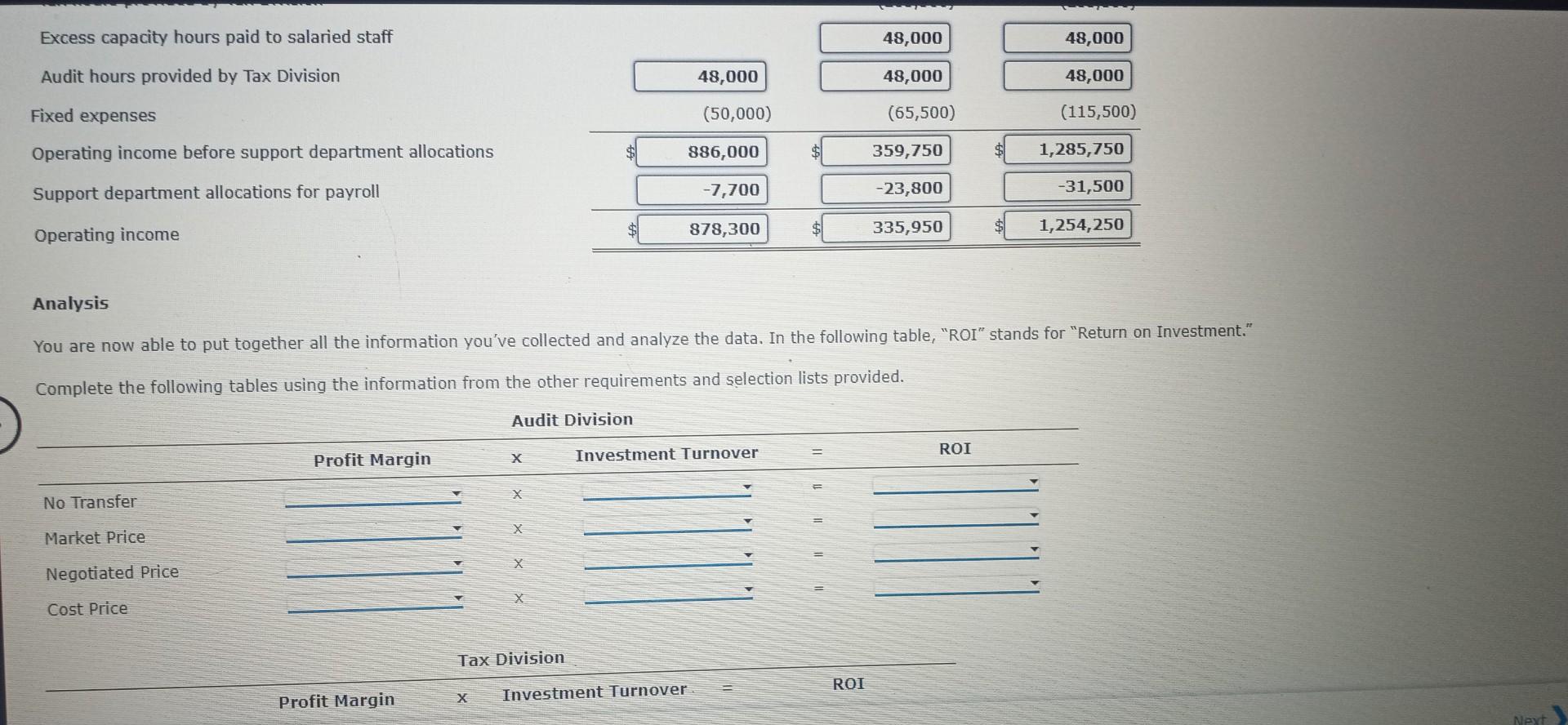

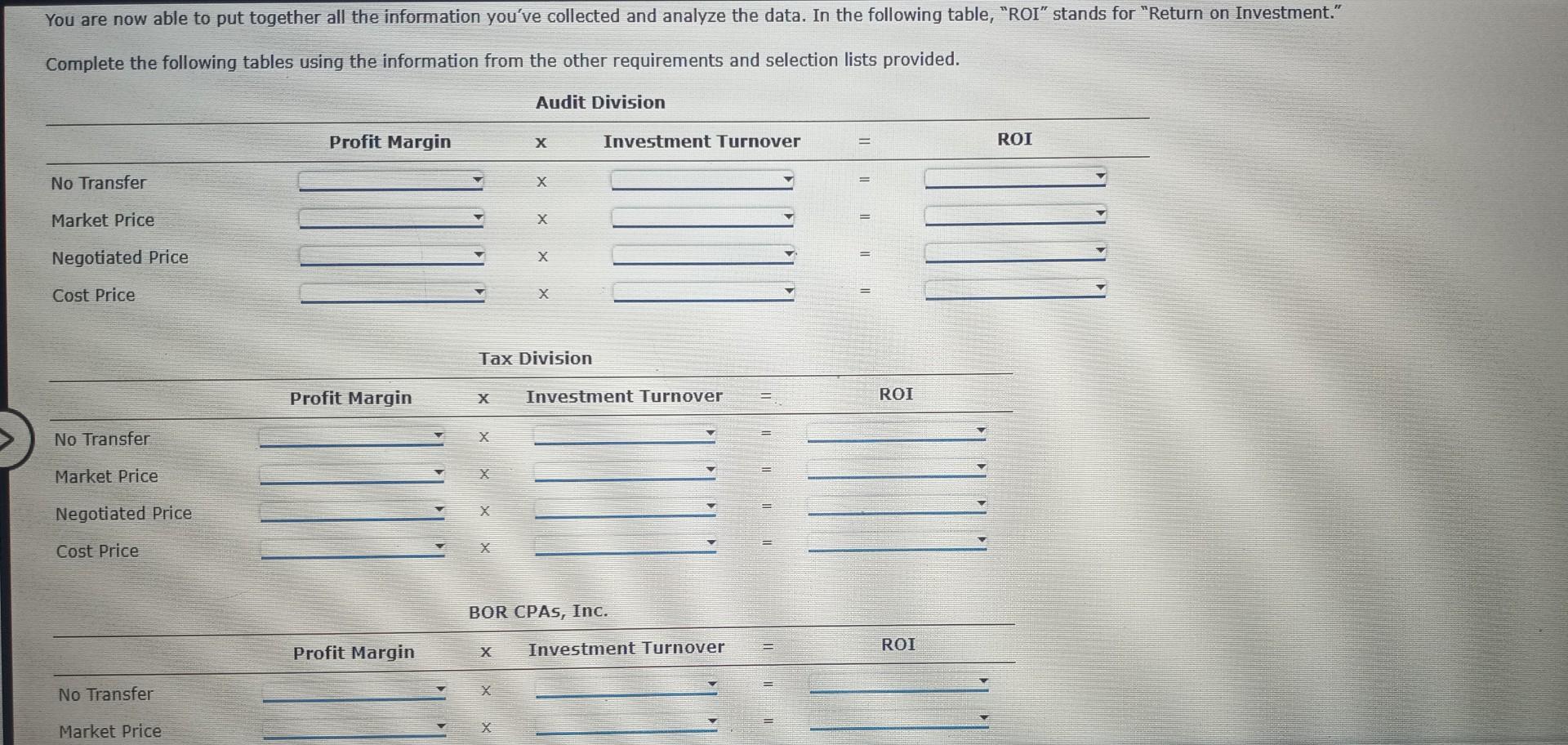

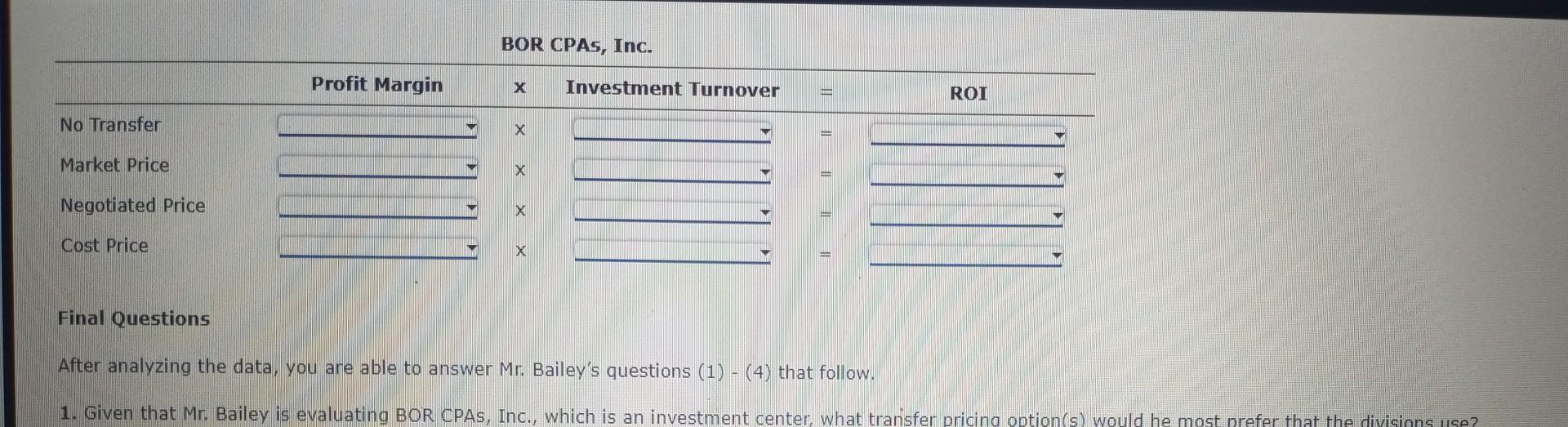

departments: Public Company Audits and Private Company Audits. The Tax Division is composed of two cost-center departments also: Individual Tax and Business Tax. (department) level. net income. The Tax Division is estimated to have 800 hours of excess capacity. on average a fee of $75,000 per audit engagement, and \$15,750 per tax engagement. The following chart shows some basic data for the company: Hourly market rate for staff (the price the company would have to pay from an outside contractor for staff services) Average hourly cost rate for staff (the average price the company pays to its staff) Number of paychecks issued by Audit Division ___ 110 Number of paychecks issued by Tax Division for the allocation. Fill in the following blanks, allocating the total expense for the Payroll Office to each of the two divisions. Payroll Charge Rate $70 per payroll check Performance Evaluation in the rightmost column. responsible for paying the salaries of their employees. Complete the following Divisional Income Statements. If there is no amount or an amount is zero, enter " 0 ". Negotiated Transfer Price Tax Division would still be responsible for paying the salaries of their employees, BOR CPAs, Inc. Divisional Income Statements For the Year Ended December 31, 20 Y8 Cost Transfer Price be responsible for paying the salaries of their employees. Complete the following Divisional Income Statements. If there is no amount or an amount is zero, enter " 0 ". You are now able to put together all the information you've collected and analyze the data. In the following table, "ROI" stands for "Return on Investment." Complete the following tables using the information from the other requirements and selection lists provided. You are now able to put together all the information you've collected and analyze the data. In the following table, "ROI" stands for "Return on Investment." Complete the following tables using the information from the other requirements and selection lists provided. After analyzing the data, you are able to answer Mr. Bailey's questions (1) - (4) that follow. 1. Given that Mr. Bailey is evaluating BOR CPAs, Inc., which is an investment center, what transfer pricing option(s) would he most prefer that the divicions uce

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started