Answered step by step

Verified Expert Solution

Question

1 Approved Answer

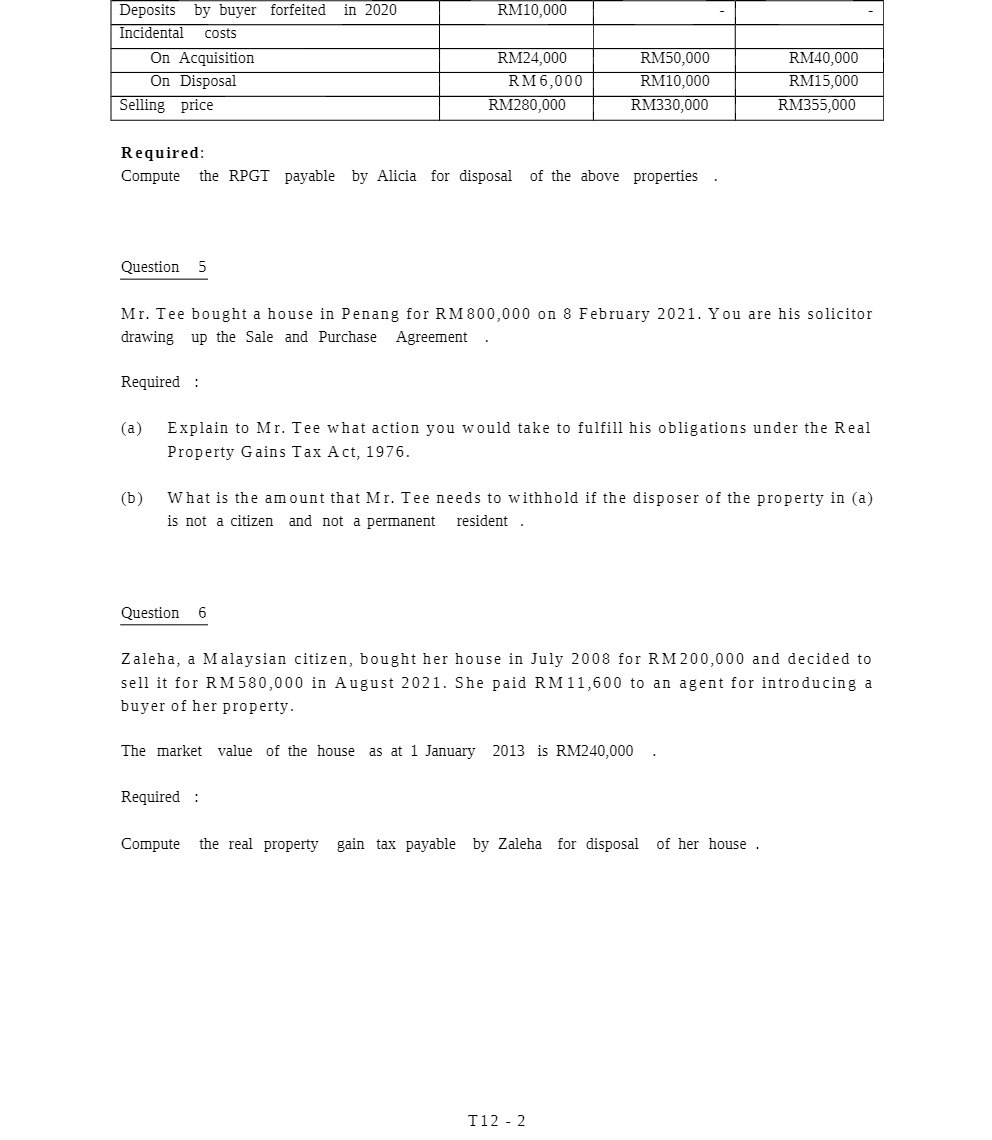

Deposits by buyer forfeited in 2020 Incidental costs On Acquisition On Disposal Selling price Required: RM10,000 RM24,000 RM50,000 RM40,000 RM 6,000 RM10,000 RM15,000 RM280,000

Deposits by buyer forfeited in 2020 Incidental costs On Acquisition On Disposal Selling price Required: RM10,000 RM24,000 RM50,000 RM40,000 RM 6,000 RM10,000 RM15,000 RM280,000 RM330,000 RM355,000 Compute the RPGT payable by Alicia for disposal of the above properties Question 5 Mr. Tee bought a house in Penang for RM 800,000 on 8 February 2021. You are his solicitor drawing up the Sale and Purchase Agreement. Required: (a) Explain to Mr. Tee what action you would take to fulfill his obligations under the Real Property Gains Tax Act, 1976. (b) What is the amount that Mr. Tee needs to withhold if the disposer of the property in (a) is not a citizen and not a permanent resident. Question 6 Zaleha, a Malaysian citizen, bought her house in July 2008 for RM 200,000 and decided to sell it for RM 580,000 in August 2021. She paid RM 11,600 to an agent for introducing a buyer of her property. The market value of the house as at 1 January 2013 is RM240,000. Required: Compute the real property gain tax payable by Zaleha for disposal of her house. T12-2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 4 Compute the RPGT payable by Alicia for the disposal of the above properties To compute the Real Property Gains Tax RPGT payable by Alicia for the disposal of the properties we need to deter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started