Question

Depreciable Cost per Unit: * a-0.0375 b-0.2 c-0.25 d-None of the above Book Value of the year end 2019: * a-$21,250 b-$22,500 c-$24,062.5 d-None of

Depreciable Cost per Unit: *

a-0.0375

b-0.2

c-0.25

d-None of the above

Book Value of the year end 2019: *

a-$21,250

b-$22,500

c-$24,062.5

d-None of the above

Depreciation Expense of the year 2020: *

a-$1,500

b-$4,000

-c$6,000

d-None of the above

Accumulated depreciation of the year 2021: *

a-$3,750

b-$13,750

c-$15,000

d-None of the above

Depreciation Expense of the year 2022: *

a-$750

b-$3,000

c-$4,000

d-None of the above

Book Value at the year end 2022: *

a-$7,000

b-$18,000

c-$20,500

d-None of the above

The depreciation expenses over the years are: *

a-Constant

b-Variable

c-Declining

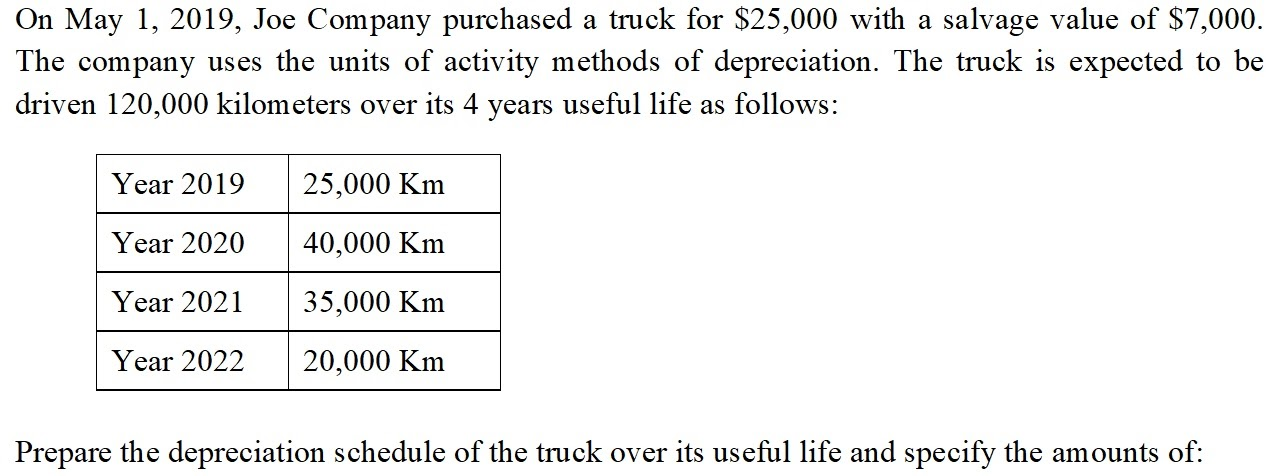

On May 1, 2019, Joe Company purchased a truck for $25,000 with a salvage value of $7,000. The company uses the units of activity methods of depreciation. The truck is expected to be driven 120,000 kilometers over its 4 years useful life as follows: Year 2019 25,000 Km Year 2020 40,000 Km Year 2021 35,000 Km Year 2022 20,000 Km Prepare the depreciation schedule of the truck over its useful life and specify the amounts ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started