Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS

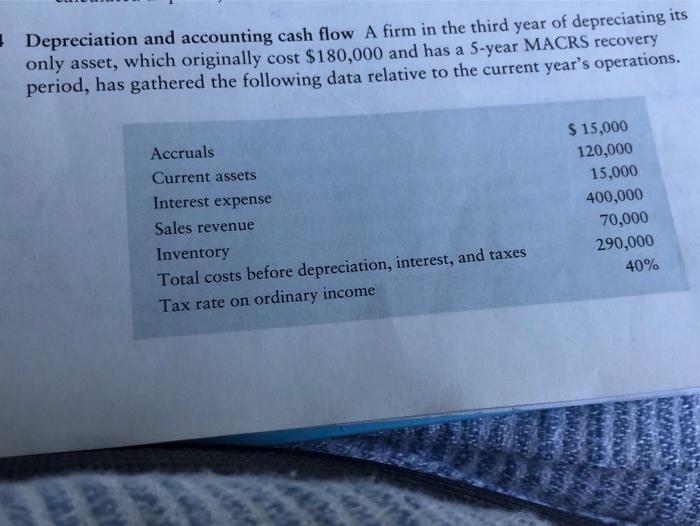

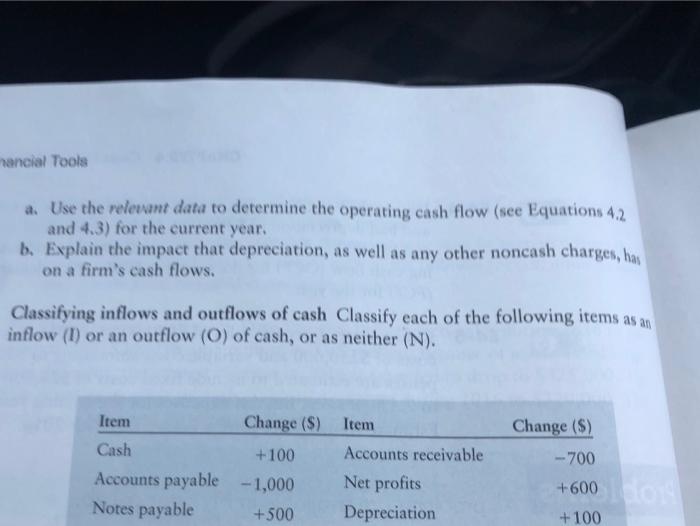

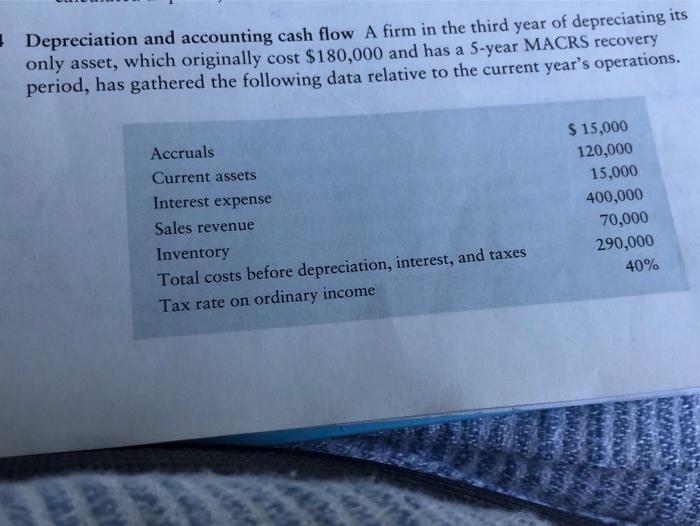

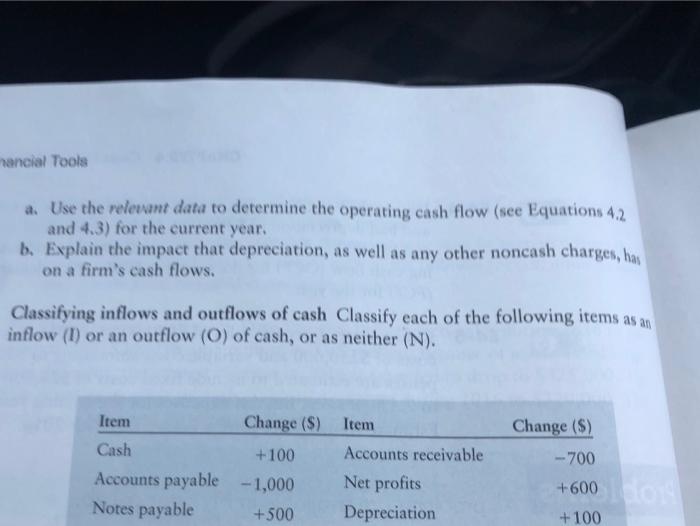

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS recovery period, has gathered the following data relative to the current year's operations. Accruals Current assets Interest expense Sales revenue Inventory $ 15,000 120,000 15,000 400,000 70,000 290,000 40% Total costs before depreciation, interest, and taxes Tax rate on ordinary income BAS nancial Tools a. Use the relevant data to determine the operating cash flow (see Equations 4.2 and 4.3) for the current year, b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. Classifying inflows and outflows of cash Classify each of the following items as an inflow (I) or an outflow (O) of cash, or as neither (N). Item Change ($) Item Change ($) Cash +100 Accounts payable - 1,000 Notes payable +500 - 700 Accounts receivable Net profits Depreciation +600 do +100

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS recovery period, has gathered the following data relative to the current year's operations. Accruals Current assets Interest expense Sales revenue Inventory $ 15,000 120,000 15,000 400,000 70,000 290,000 40% Total costs before depreciation, interest, and taxes Tax rate on ordinary income BAS nancial Tools a. Use the relevant data to determine the operating cash flow (see Equations 4.2 and 4.3) for the current year, b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. Classifying inflows and outflows of cash Classify each of the following items as an inflow (I) or an outflow (O) of cash, or as neither (N). Item Change ($) Item Change ($) Cash +100 Accounts payable - 1,000 Notes payable +500 - 700 Accounts receivable Net profits Depreciation +600 do +100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started