Answered step by step

Verified Expert Solution

Question

1 Approved Answer

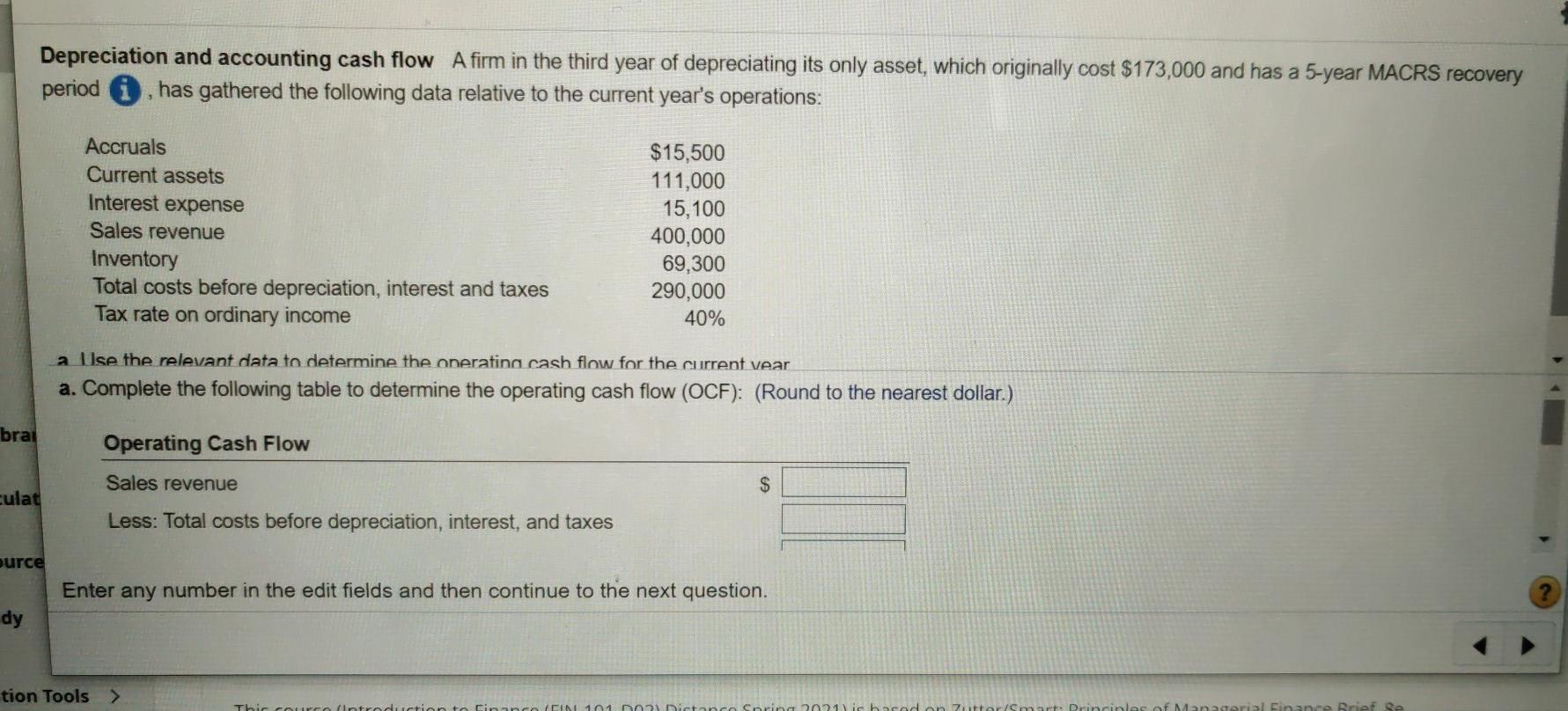

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $173,000 and has a 5-year MACRS

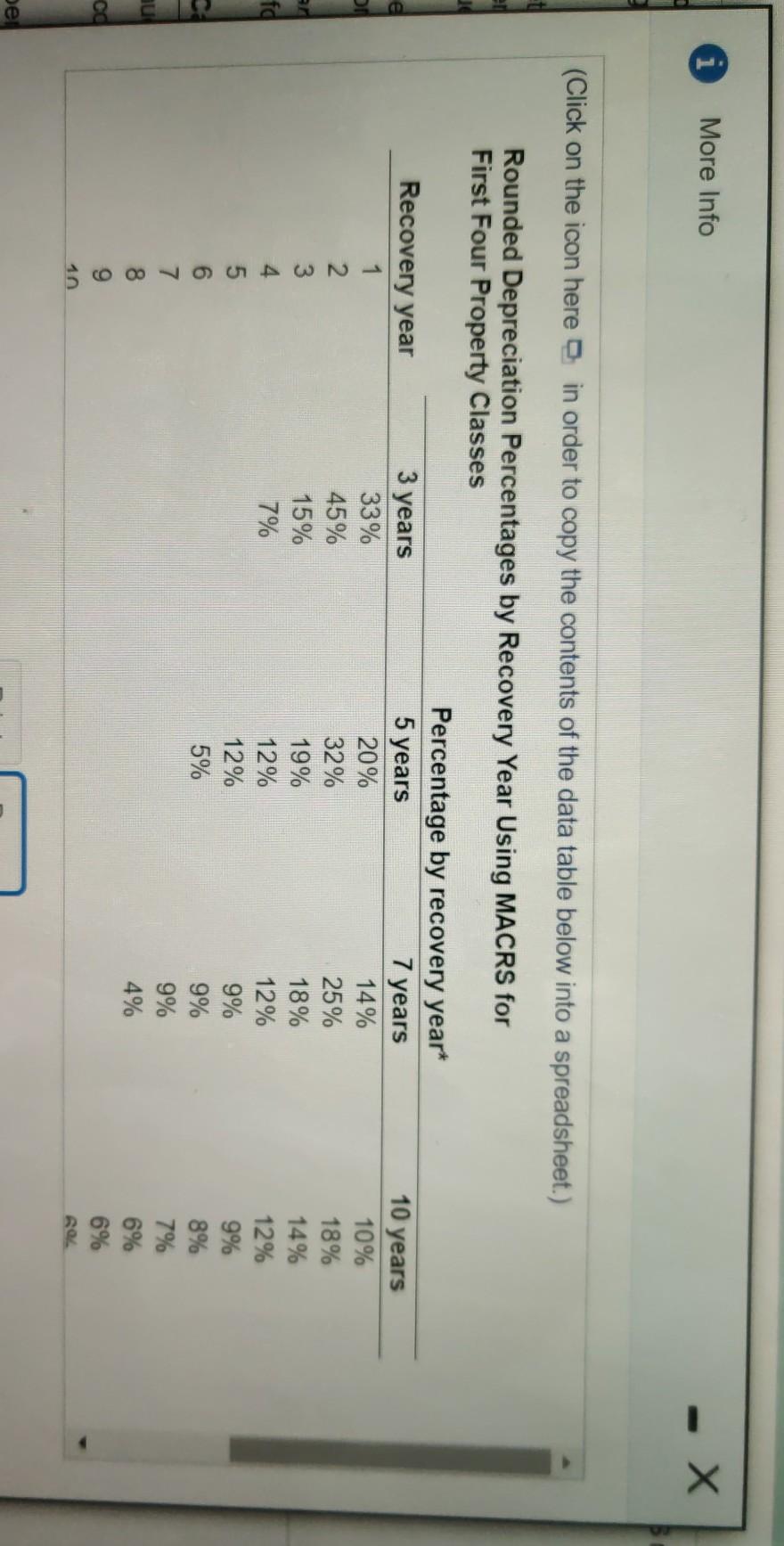

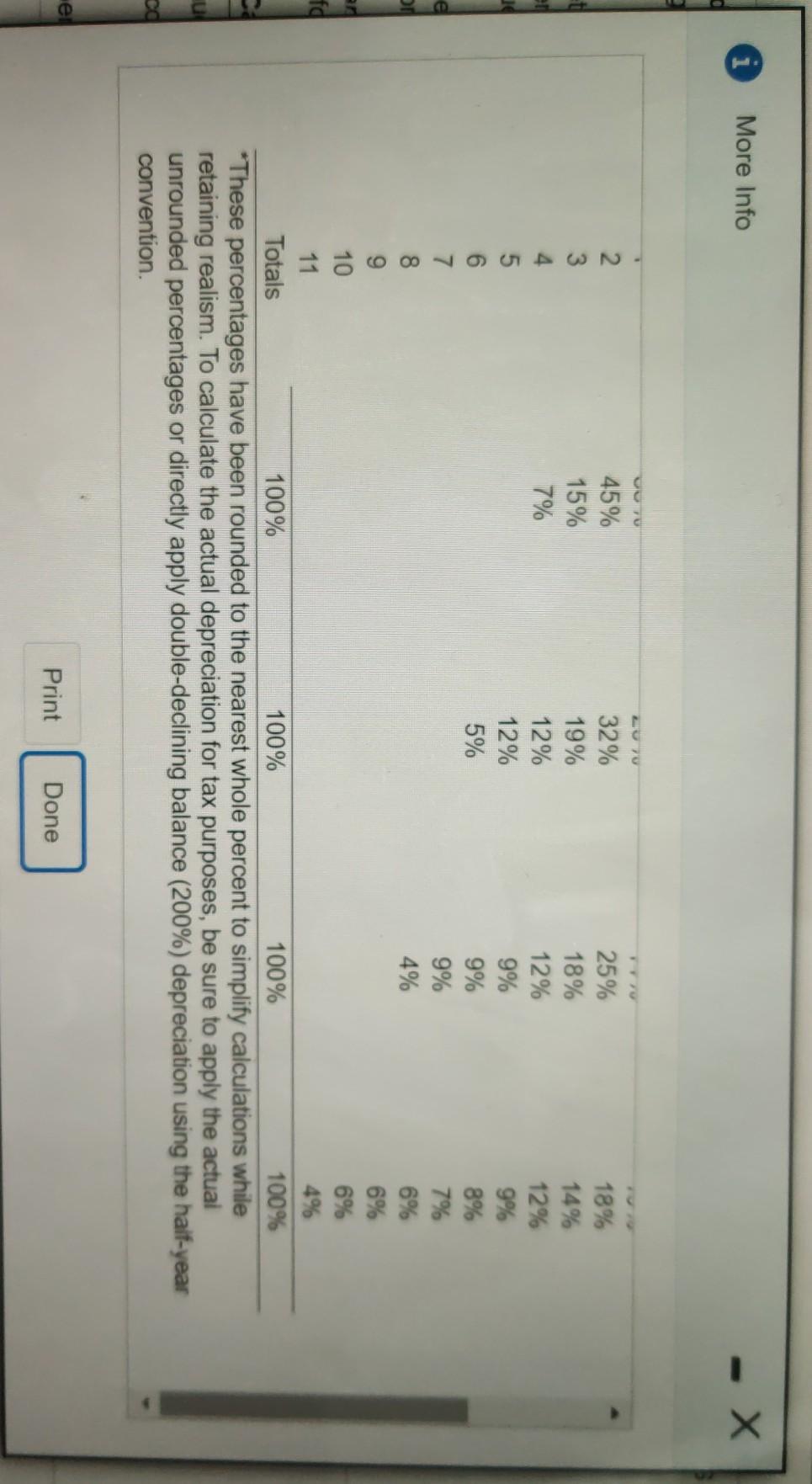

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $173,000 and has a 5-year MACRS recovery period i, has gathered the following data relative to the current year's operations: Accruals Current assets Interest expense Sales revenue Inventory Total costs before depreciation, interest and taxes Tax rate on ordinary income $15,500 111,000 15,100 400,000 69,300 290,000 40% a Ilse the relevant data to determine the operating cash flow for the current vear a. Complete the following table to determine the operating cash flow (OCF): (Round to the nearest dollar.) brai Operating Cash Flow Sales revenue $ culat Less: Total costs before depreciation, interest, and taxes ource Enter any number in the edit fields and then continue to the next question. dy tion Tools > DIN 101 Srin 2021 is hace ane Brief Se More Info - X (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 1 33% 20% 14% 2 45% 32% 25% 3 15% 19% 18% 7% 12% 12% 5 12% 9% 6 5% 9% 7 9% 8 4% 9 fo 10 years 10% 18% 14% 12% 9% 8% 7% 6% 6% us De More Info Ovo 9% 2. 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention fo Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started