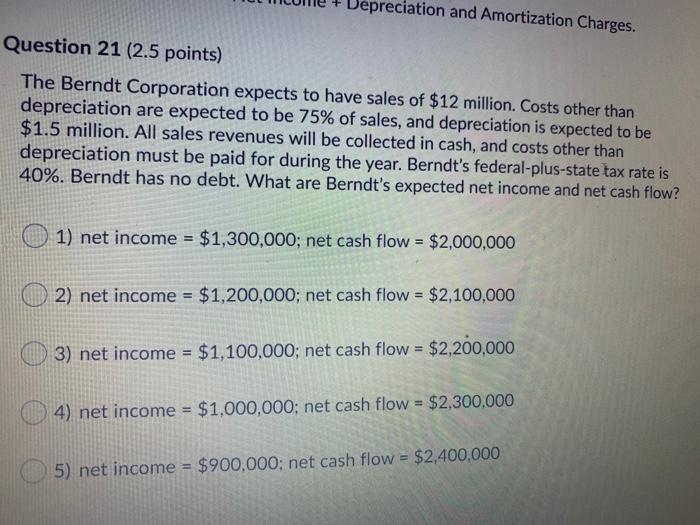

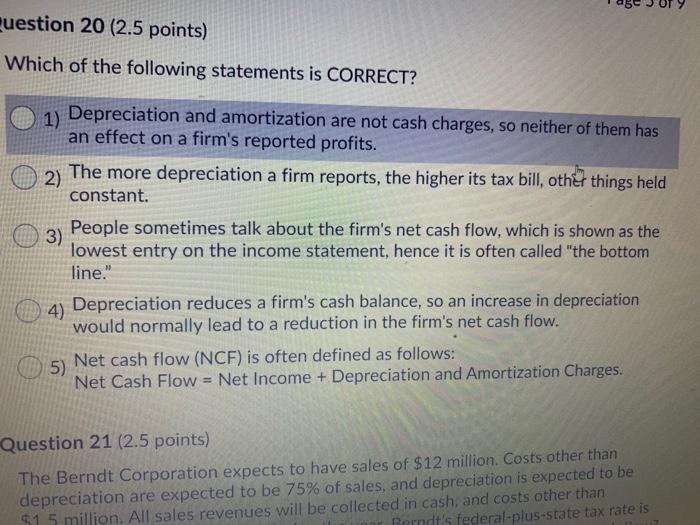

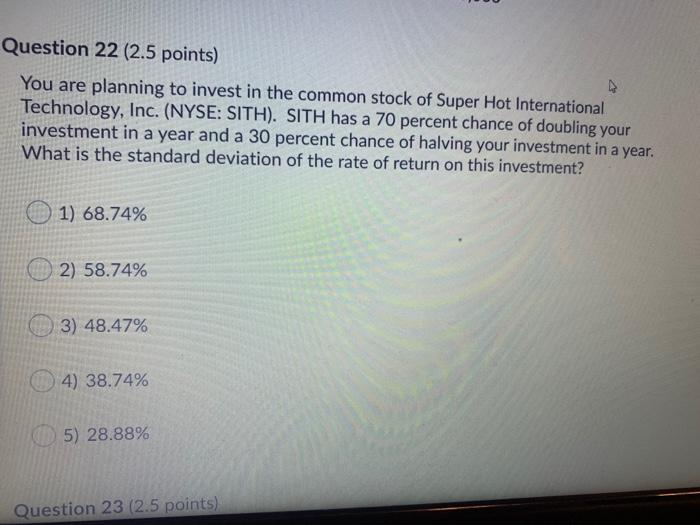

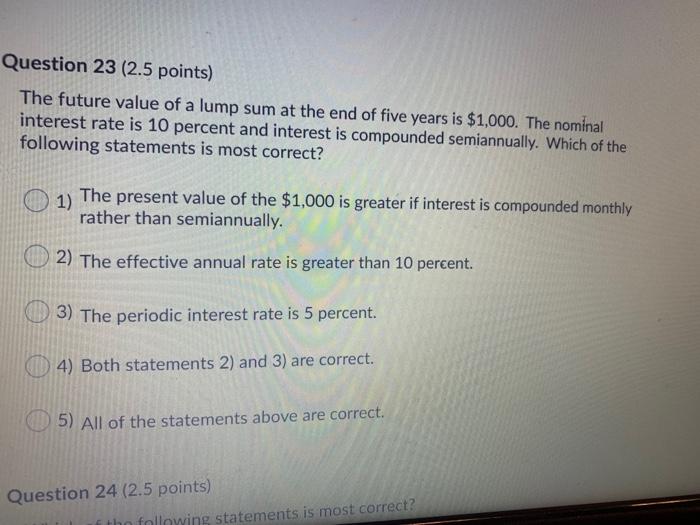

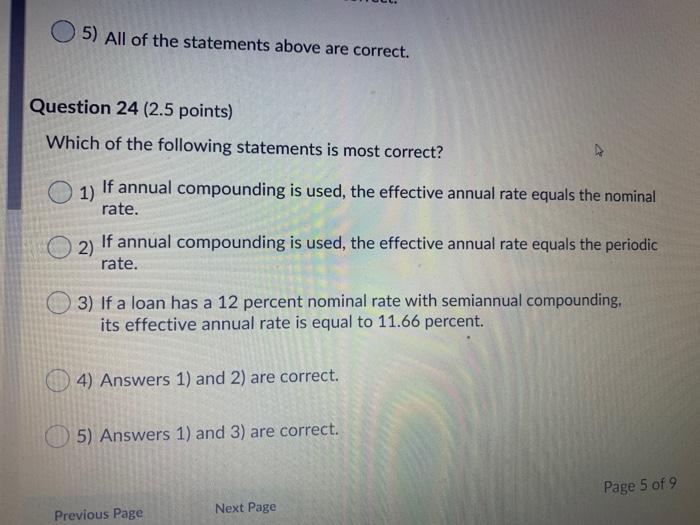

Depreciation and Amortization Charges. Question 21 (2.5 points) The Berndt Corporation expects to have sales of $12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be $1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndt's federal-plus-state tax rate is 40%. Berndt has no debt. What are Berndt's expected net income and net cash flow? 1) net income = $1,300,000; net cash flow = $2,000,000 2) net income = $1,200,000; net cash flow = $2,100,000 3) net income = $1,100,000; net cash flow = $2,200,000 4) net income = $1,000,000; net cash flow = $2,300,000 5) net income = $900,000; net cash flow = $2,400,000 question 20 (2.5 points) Which of the following statements is CORRECT? 1) Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits. 2) The more depreciation a firm reports, the higher its tax bill, other things held constant. People sometimes talk about the firm's net cash flow, which is shown as the 3) lowest entry on the income statement, hence it is often called "the bottom line." Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow. 5) Net cash flow (NCF) is often defined as follows: Net Cash Flow = Net Income + Depreciation and Amortization Charges. 4) Question 21 (2.5 points) The Berndt Corporation expects to have sales of $12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be $15 million. All sales revenues will be collected in cash, and costs other than Berndt's federal-plus-state tax rate is Question 22 (2.5 points) You are planning to invest in the common stock of Super Hot International Technology, Inc. (NYSE: SITH). SITH has a 70 percent chance of doubling your investment in a year and a 30 percent chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? 1) 68.74% 2) 58.74% 3) 48.47% 4) 38.74% 5) 28.88% Question 23 (2.5 points) Question 23 (2.5 points) The future value of a lump sum at the end of five years is $1,000. The nominal interest rate is 10 percent and interest is compounded semiannually. Which of the following statements is most correct? 1) The present value of the $1,000 is greater if interest is compounded monthly rather than semiannually. 2) The effective annual rate is greater than 10 percent. 3) The periodic interest rate is 5 percent. 4) Both statements 2) and 3) are correct. 5) All of the statements above are correct. Question 24 (2.5 points) following statements is most correct? 5) All of the statements above are correct. Question 24 (2.5 points) Which of the following statements is most correct? 1) If annual compounding is used, the effective annual rate equals the nominal rate. 2) If annual compounding is used, the effective annual rate equals the periodic rate. 3) If a loan has a 12 percent nominal rate with semiannual compounding, its effective annual rate is equal to 11.66 percent. 4) Answers 1) and 2) are correct. 5) Answers 1) and 3) are correct. Page 5 of 9 Previous Page Next Page