Answered step by step

Verified Expert Solution

Question

1 Approved Answer

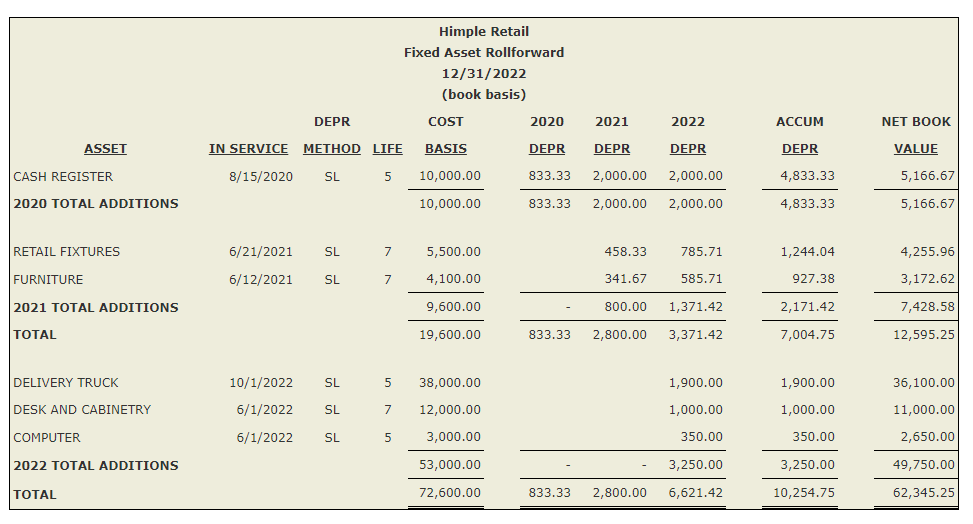

Depreciation and section 179 expense deduction for Schedule C Form: begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} hline & & & & begin{tabular}{r} Himple ixed Asset 12/31 (book

Depreciation and section 179 expense deduction for Schedule C Form:

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & & & & \begin{tabular}{r} Himple \\ ixed Asset \\ 12/31 \\ (book \end{tabular} & \begin{tabular}{l} il \\ orward \\ 2 \end{tabular} & & & & \\ \hline & & DEPR & & cosT & 2020 & 2021 & 2022 & ACCUM & NET BOOK \\ \hline ASSET & IN SERVICE & METHOD & LIFE & BASIS & DEPR & DEPR & DEPR & DEPR & VALUE \\ \hline CASH REGISTER & 8/15/2020 & SL & 5 & 10,000.00 & 833.33 & 2,000.00 & 2,000.00 & 4,833.33 & 5,166.67 \\ \hline 2020 TOTAL ADDITIONS & & & & 10,000.00 & 833.33 & 2,000.00 & 2,000.00 & 4,833.33 & 5,166.67 \\ \hline RETAIL FIXTURES & 6/21/2021 & SL & 7 & 5,500.00 & & 458.33 & 785.71 & 1,244.04 & 4,255.96 \\ \hline FURNITURE & 6/12/2021 & SL & 7 & 4,100.00 & & 341.67 & 585.71 & 927.38 & 3,172.62 \\ \hline 2021 TOTAL ADDITIONS & & & & 9,600.00 & - & 800.00 & 1,371.42 & 2,171.42 & 7,428.58 \\ \hline TOTAL & & & & 19,600.00 & 833.33 & 2,800.00 & 3,371.42 & 7,004.75 & 12,595.25 \\ \hline DELIVERY TRUCK & 10/1/2022 & SL & 5 & 38,000.00 & & & 1,900.00 & 1,900.00 & 36,100.00 \\ \hline DESK AND CABINETRY & 6/1/2022 & SL & 7 & 12,000.00 & & & 1,000.00 & 1,000.00 & 11,000.00 \\ \hline COMPUTER & 6/1/2022 & SL & 5 & 3,000.00 & & & 350.00 & 350.00 & 2,650.00 \\ \hline 2022 TOTAL ADDITIONS & & & & 53,000.00 & - & - & 3,250.00 & 3,250.00 & 49,750.00 \\ \hline TOTAL & & & & 72,600.00 & 833.33 & 2,800.00 & 6,621.42 & 10,254.75 & 62,345.25 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & & & & \begin{tabular}{r} Himple \\ ixed Asset \\ 12/31 \\ (book \end{tabular} & \begin{tabular}{l} il \\ orward \\ 2 \end{tabular} & & & & \\ \hline & & DEPR & & cosT & 2020 & 2021 & 2022 & ACCUM & NET BOOK \\ \hline ASSET & IN SERVICE & METHOD & LIFE & BASIS & DEPR & DEPR & DEPR & DEPR & VALUE \\ \hline CASH REGISTER & 8/15/2020 & SL & 5 & 10,000.00 & 833.33 & 2,000.00 & 2,000.00 & 4,833.33 & 5,166.67 \\ \hline 2020 TOTAL ADDITIONS & & & & 10,000.00 & 833.33 & 2,000.00 & 2,000.00 & 4,833.33 & 5,166.67 \\ \hline RETAIL FIXTURES & 6/21/2021 & SL & 7 & 5,500.00 & & 458.33 & 785.71 & 1,244.04 & 4,255.96 \\ \hline FURNITURE & 6/12/2021 & SL & 7 & 4,100.00 & & 341.67 & 585.71 & 927.38 & 3,172.62 \\ \hline 2021 TOTAL ADDITIONS & & & & 9,600.00 & - & 800.00 & 1,371.42 & 2,171.42 & 7,428.58 \\ \hline TOTAL & & & & 19,600.00 & 833.33 & 2,800.00 & 3,371.42 & 7,004.75 & 12,595.25 \\ \hline DELIVERY TRUCK & 10/1/2022 & SL & 5 & 38,000.00 & & & 1,900.00 & 1,900.00 & 36,100.00 \\ \hline DESK AND CABINETRY & 6/1/2022 & SL & 7 & 12,000.00 & & & 1,000.00 & 1,000.00 & 11,000.00 \\ \hline COMPUTER & 6/1/2022 & SL & 5 & 3,000.00 & & & 350.00 & 350.00 & 2,650.00 \\ \hline 2022 TOTAL ADDITIONS & & & & 53,000.00 & - & - & 3,250.00 & 3,250.00 & 49,750.00 \\ \hline TOTAL & & & & 72,600.00 & 833.33 & 2,800.00 & 6,621.42 & 10,254.75 & 62,345.25 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started