Answered step by step

Verified Expert Solution

Question

1 Approved Answer

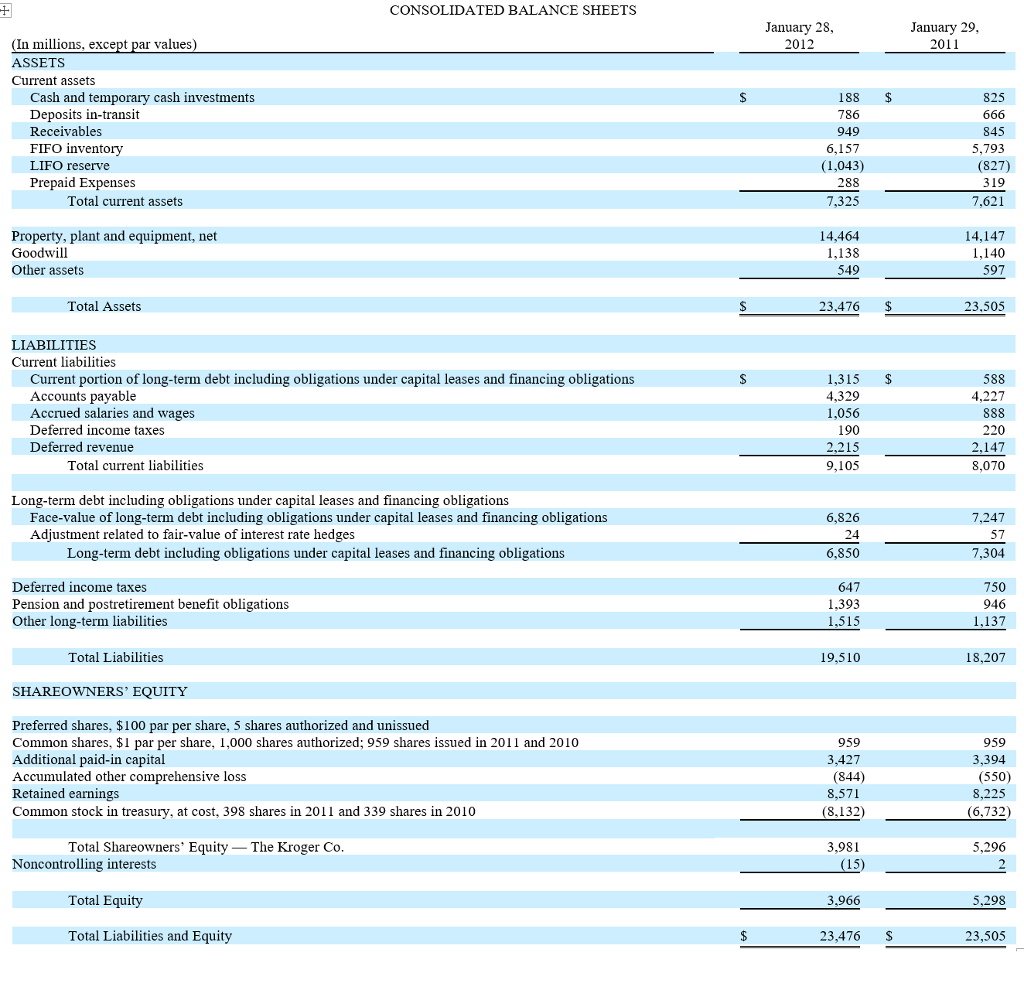

Depreciation: Answer the 3 questions upon reading the consolidated statements of operations of the Kroger CO.: Questions: How did Kroger recognize depreciation expense in fiscal

Depreciation:

Answer the 3 questions upon reading the consolidated statements of operations of the Kroger CO.:

Questions:

How did Kroger recognize depreciation expense in fiscal year 2011? Use T-account to denote the accounting treatment using actual numbers.

What is the estimate of the remaining useful life of Kroger's PP&E in fiscal year 2011?

Has Kroger acquired other companies in the past?

CONSOLIDATED BALANCE SHEETS January 28, 2012 anuary 29, 2011 In millions, except par values) ASSETS Current assets Cash and temporary cash investments Deposits in-transit Receivables FIFO inventory LIFO reserve Prepaid Expenses 786 949 6,157 845 5,793 288 7,325 Total current assets 7,621 Property, plant and equipment, net Goodwill Other assets 14,464 1,138 549 14,147 1,140 597 Total Assets 23,476 $ 23,505 LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases and financing obligations Accounts payable Accrued salaries and wages Deferred income taxes Deferred revenue 1,315$ 4,329 1,056 588 190 220 Total current liabilities 9,105 8,070 Long-term debt including obligations under capital leases and financing obligations Face-value of long-term debt including obligations under capital leases and financing obligations Adiustment related to fair-value of interest rate hedges 6,826 6,850 647 Long-term debt including obligations under capital leases and financing obligations Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities 750 946 1,137 1,393 Total Liabilities 19,510 18,207 SHAREOWNERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 1,000 shares authorized; 959 shares issued in 2011 and 2010 Additional paid-in capital Accumulated other comprehensive loss Retained earnings Common stock in trea 959 3,427 844 959 (550) (6,732) 5,296 at cost, 398 shares in 2011 and 339 shares in 2010 (8,132) Total Shareowners' Equity-The Kroger Co 3,981 Noncontrolling interests Total Equity 3,966 5,298 Total Liabilities and Equity 23,476 S 23,505 CONSOLIDATED BALANCE SHEETS January 28, 2012 anuary 29, 2011 In millions, except par values) ASSETS Current assets Cash and temporary cash investments Deposits in-transit Receivables FIFO inventory LIFO reserve Prepaid Expenses 786 949 6,157 845 5,793 288 7,325 Total current assets 7,621 Property, plant and equipment, net Goodwill Other assets 14,464 1,138 549 14,147 1,140 597 Total Assets 23,476 $ 23,505 LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases and financing obligations Accounts payable Accrued salaries and wages Deferred income taxes Deferred revenue 1,315$ 4,329 1,056 588 190 220 Total current liabilities 9,105 8,070 Long-term debt including obligations under capital leases and financing obligations Face-value of long-term debt including obligations under capital leases and financing obligations Adiustment related to fair-value of interest rate hedges 6,826 6,850 647 Long-term debt including obligations under capital leases and financing obligations Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities 750 946 1,137 1,393 Total Liabilities 19,510 18,207 SHAREOWNERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 1,000 shares authorized; 959 shares issued in 2011 and 2010 Additional paid-in capital Accumulated other comprehensive loss Retained earnings Common stock in trea 959 3,427 844 959 (550) (6,732) 5,296 at cost, 398 shares in 2011 and 339 shares in 2010 (8,132) Total Shareowners' Equity-The Kroger Co 3,981 Noncontrolling interests Total Equity 3,966 5,298 Total Liabilities and Equity 23,476 S 23,505Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started