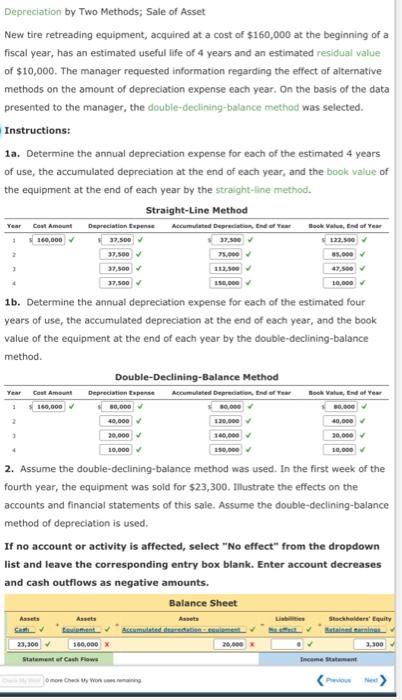

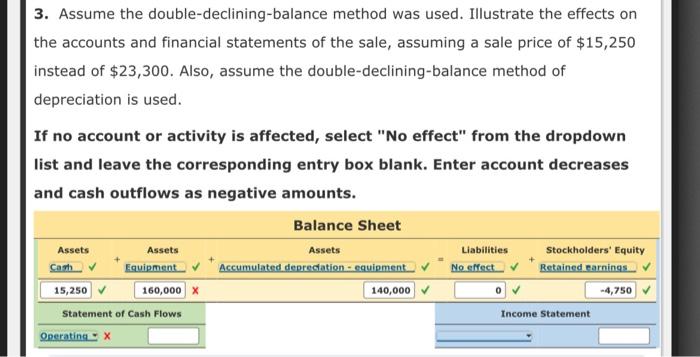

Depreciation by Two Methods; Sale of Asset New tire retreading equipment, acquired at a cost of $160,000 at the beginning of a fiscal year, has an estimated useful life of 4 years and an estimated residual value of $10,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. On the basis of the data presented to the manager, the double-declining-balance method was selected. Instructions: 1a. Determine the annual depreciation expense for each of the estimated 4 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the straight-fine method. 1b. Determine the annual depreciation expense for each of the estimated four years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the double-declining-balance method. 2. Assume the double-declining-balance method was used. In the first week of the fourth year, the equipment was sold for $23,300. Illustrate the effects on the accounts and financial statements of this sale. Assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding entry box blank. Enter account decreases and cash outflows as negative amounts. 3. Assume the double-declining-balance method was used. Illustrate the effects on the accounts and financial statements of the sale, assuming a sale price of $15,250 instead of $23,300. Also, assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding entry box blank. Enter account decreases and cash outflows as negative amounts. Depreciation by Two Methods; Sale of Asset New tire retreading equipment, acquired at a cost of $160,000 at the beginning of a fiscal year, has an estimated useful life of 4 years and an estimated residual value of $10,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. On the basis of the data presented to the manager, the double-declining-balance method was selected. Instructions: 1a. Determine the annual depreciation expense for each of the estimated 4 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the straight-fine method. 1b. Determine the annual depreciation expense for each of the estimated four years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the double-declining-balance method. 2. Assume the double-declining-balance method was used. In the first week of the fourth year, the equipment was sold for $23,300. Illustrate the effects on the accounts and financial statements of this sale. Assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding entry box blank. Enter account decreases and cash outflows as negative amounts. 3. Assume the double-declining-balance method was used. Illustrate the effects on the accounts and financial statements of the sale, assuming a sale price of $15,250 instead of $23,300. Also, assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding entry box blank. Enter account decreases and cash outflows as negative amounts