Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lucy and Richard Kupau are a married and have one dependent child, Miu who is 5 years old. The Kupaus live in Texas where there

Lucy and Richard Kupau are a married and have one dependent child, Miu who is 5 years old. The Kupaus live in Texas where there is no state income tax and all are U.S. citizens.

Financial Information

- Richard Salary as a marketing executive $395,000 (Medicare withheld at 1.45%)

- Lucys Salary as a merchandising consultant $222,000 (Medicare withheld at 1.45%)

- Unemployment Compensation $8,000

- Interest Income from corporate bonds $16,000

- Interest Income from Wells Fargo CDs $5,250

- Interest Income from State of Texas Bonds $5,500

- Scholarship for Lucy (educational expenses = $6,325) $7,500 (Lucy went back to school)

- Inheritance from Grandmother $550,000

- Gift from uncle $175,000

- Annuity Payments (investment=$30K, payout=120K) $36,000

- Long-term capital gains $32,000

- Dividends from Microsoft (Qualifying) $18,350

- Roth IRA contribution for Richard $5,000

- Roth IRA contribution for Lucy $5,000

- Mortgage Interest Principal ($1,500,000 ) $72,000 (Mortgage origination 2018)

- Charitable Contributions to St. Ludmilas Church $42,200

- Non cash charitable contribution to Cancer Society $4,500

- Un-reimbursed payments to medical doctors $67,500 (Richard is fighting cancer)

- Payments for non-prescriptions drugs (aspirin, allergy) $3,250

- Investment interest expense $62,250

- Non-cash contribution of clothing to goodwill $4,000

- Real Estate Taxes residence $18,250

- Federal Income tax withholding $150,000

Questions

- What is the Kupaus gross income for 2019

- What is the Kupaus adjusted gross income for 2019

- What is the Kupaus itemized deductions for 2019

- What is the Kupaus taxable income for 2019

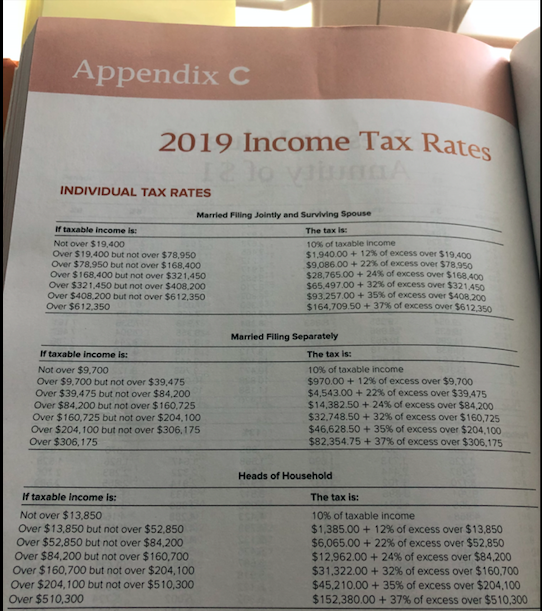

- What is the Kupaus tax liability for 2019

- What is the Kupaus refund or tax due for 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started