Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation Calculations - - Double - Declining Balance On January 1 , 2 0 2 2 , Betelle Company bought some manufacturing equipment for $

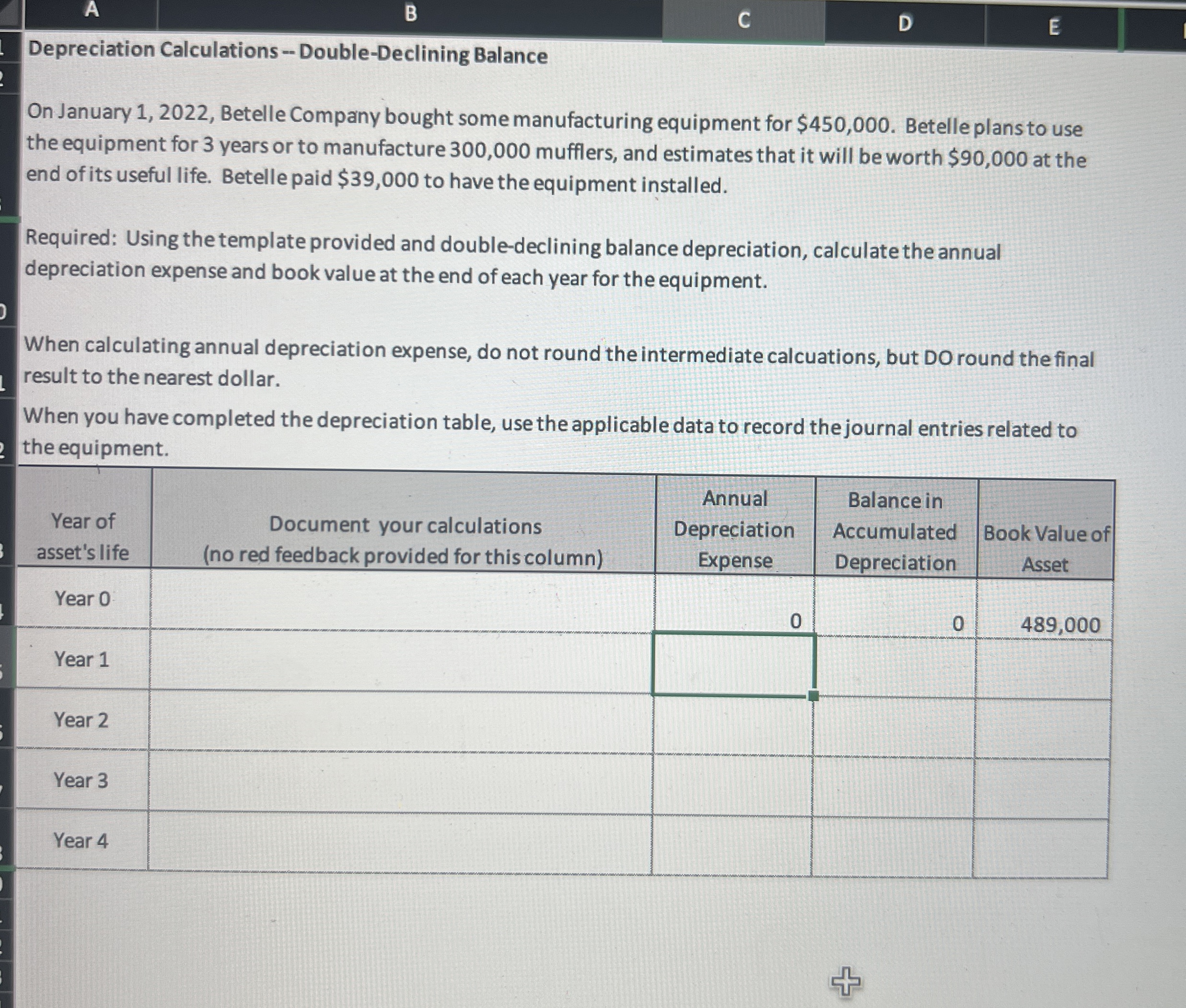

Depreciation Calculations DoubleDeclining Balance

On January Betelle Company bought some manufacturing equipment for $ Betelle plansto use

the equipment for years or to manufacture mufflers, and estimates that it will be worth $ at the

end of its useful life. Betelle paid $ to have the equipment installed.

Required: Using the template provided and doubledeclining balance depreciation, calculate the annual

depreciation expense and book value at the end of each year for the equipment.

When calculating annual depreciation expense, do not round the intermediate calcuations, but DO round the final

result to the nearest dollar.

When you have completed the depreciation table, use the applicable data to record the journal entries related to

the equipment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started