Depreciation expense from intragroup asset revaluation -

I have the following question and just wondering about the adjusted depreciation expense. I've attempted what the end consolidated journal entry will be to account for the depreciation difference that occured because of the revaluation of the plant equipment but making sure it's correct. Here is the question and my calculations and journal entries for the question thus far. I haven't included the revaluation entries as I'm just focussing on the depreciation adjustment. Also the parent company Eno Manufacturing owns 70% of the company with the revalued asset (Island Engineering). Whether or not this plays a factor in the calculations and journal entries I'm not sure.

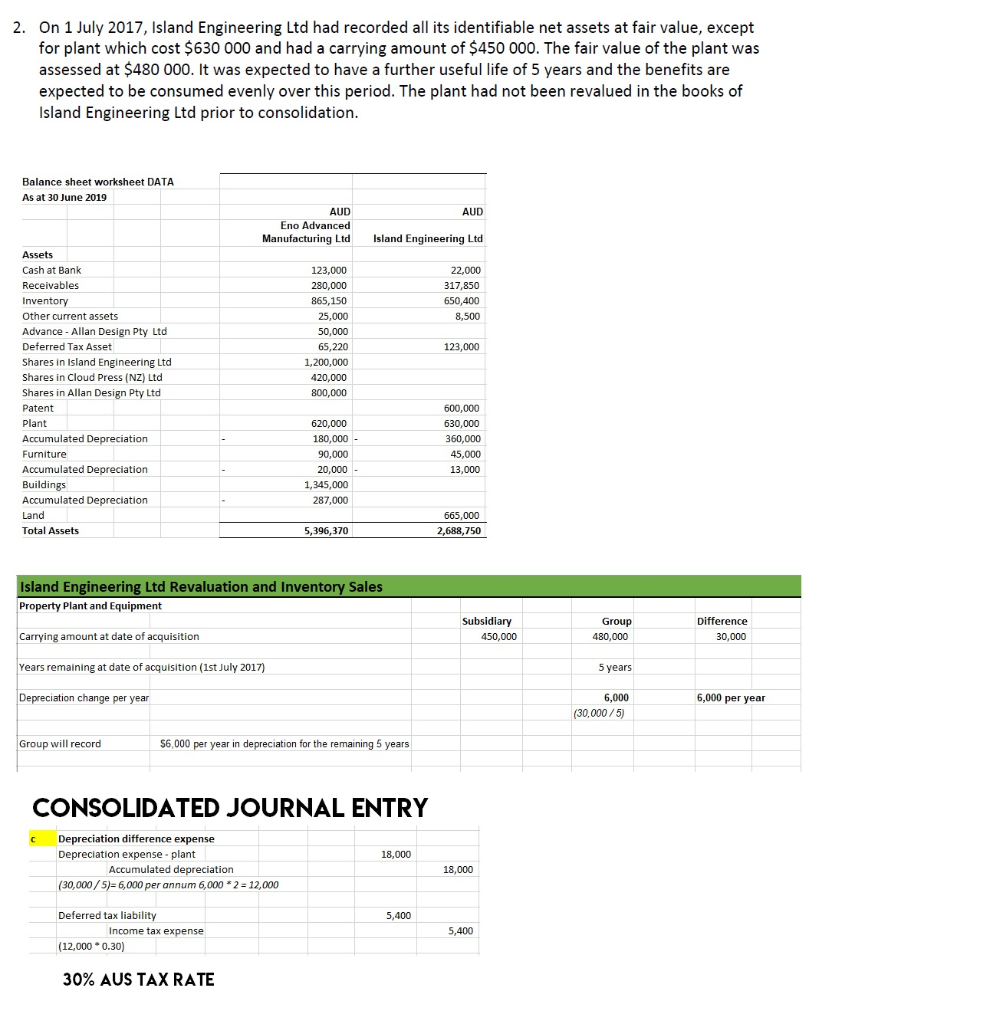

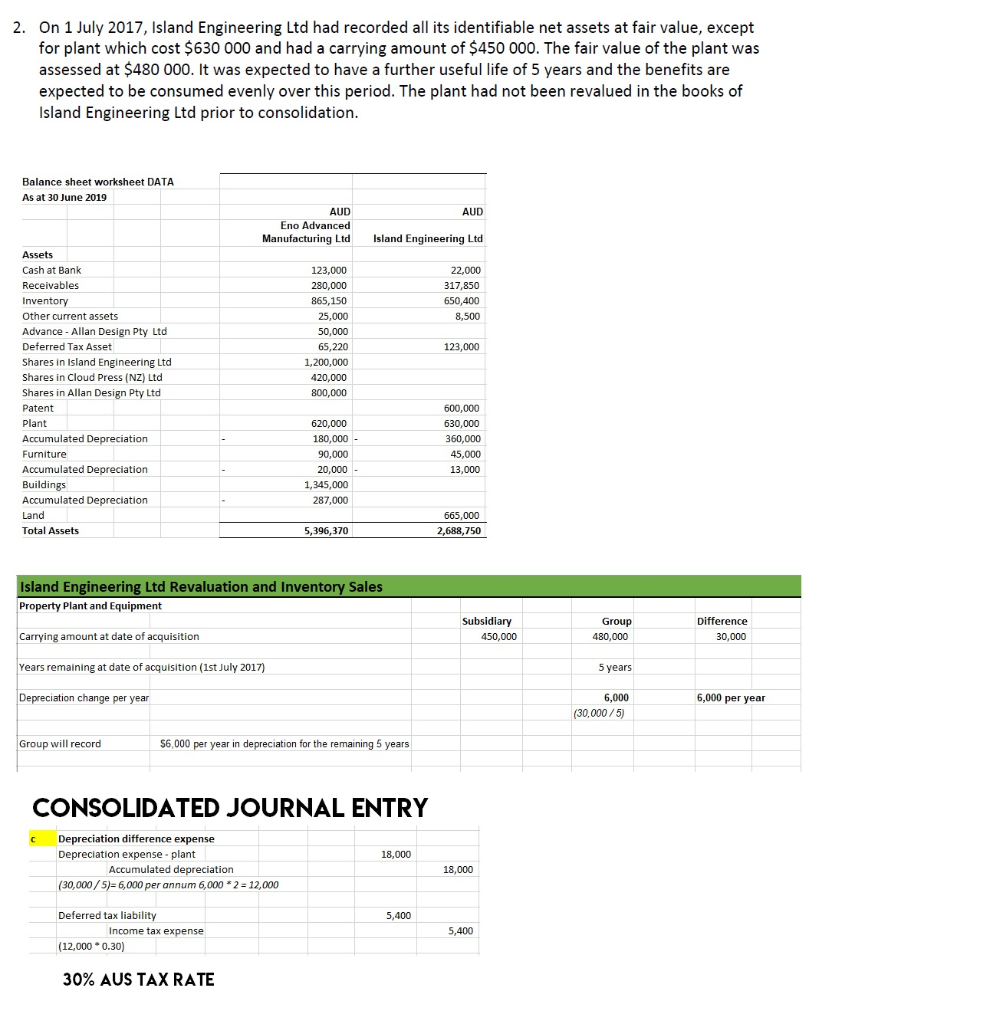

2. On 1 July 2017, Island Engineering Ltd had recorded all its identifiable net assets at fair value, except for plant which cost $630 000 and had a carrying amount of $450 000. The fair value of the plant was assessed at $480 000. It was expected to have a further useful life of 5 years and the benefits are expected to be consumed evenly over this period. The plant had not been revalued in the books of Island Engineering Ltd prior to consolidation. Balance sheet worksheet DATA As at 30 June 2019 AUD AUD Eno Advanced Manufacturing Ltd Island Engineering Ltd 22,000 317,850 650,400 8,500 Assets Cash at Bank Receivables Inventory Other current assets Advance - Allan Design Pty Ltd Deferred Tax Asset Share Shares in Island Engineering Ltd Shares in Cloud Press (NZ) Ltd Shares in Allan Design Pty Ltd Patent Plant Accumulated Depreciation Furniture Accumulated Depreciation Buildings Accumulated Depreciation Land Total Assets 123,000 280,000 865,150 25,000 50,000 65,220 1,200,000 420,000 800,000 123,000 620,000 180,000 90,000 20,000 1,345,000 287,000 600,000 630,000 360,000 45,000 13,000 - 665,000 2,688,750 5,396,370 Island Engineering Ltd Revaluation and Inventory Sales Property Plant and Equipment Subsidiary 450,000 Group 480,000 Carrying amount at date of acquisition Difference 30,000 Years remaining at date of acquisition (1st July 2017) 5 years Depreciation change per year 6,000 per year 6,000 (30,000/5) Group will record $6,000 per year in depreciation for the remaining 5 years CONSOLIDATED JOURNAL ENTRY 18,000 Depreciation difference expense Depreciation expense plant Accumulated depreciation (30,000/5)= 6,000 per annum 6,000*2 = 12,000 18,000 5,400 Deferred tax liability Income tax expense (12,000 0.30) 5,400 30% AUS TAX RATE 2. On 1 July 2017, Island Engineering Ltd had recorded all its identifiable net assets at fair value, except for plant which cost $630 000 and had a carrying amount of $450 000. The fair value of the plant was assessed at $480 000. It was expected to have a further useful life of 5 years and the benefits are expected to be consumed evenly over this period. The plant had not been revalued in the books of Island Engineering Ltd prior to consolidation. Balance sheet worksheet DATA As at 30 June 2019 AUD AUD Eno Advanced Manufacturing Ltd Island Engineering Ltd 22,000 317,850 650,400 8,500 Assets Cash at Bank Receivables Inventory Other current assets Advance - Allan Design Pty Ltd Deferred Tax Asset Share Shares in Island Engineering Ltd Shares in Cloud Press (NZ) Ltd Shares in Allan Design Pty Ltd Patent Plant Accumulated Depreciation Furniture Accumulated Depreciation Buildings Accumulated Depreciation Land Total Assets 123,000 280,000 865,150 25,000 50,000 65,220 1,200,000 420,000 800,000 123,000 620,000 180,000 90,000 20,000 1,345,000 287,000 600,000 630,000 360,000 45,000 13,000 - 665,000 2,688,750 5,396,370 Island Engineering Ltd Revaluation and Inventory Sales Property Plant and Equipment Subsidiary 450,000 Group 480,000 Carrying amount at date of acquisition Difference 30,000 Years remaining at date of acquisition (1st July 2017) 5 years Depreciation change per year 6,000 per year 6,000 (30,000/5) Group will record $6,000 per year in depreciation for the remaining 5 years CONSOLIDATED JOURNAL ENTRY 18,000 Depreciation difference expense Depreciation expense plant Accumulated depreciation (30,000/5)= 6,000 per annum 6,000*2 = 12,000 18,000 5,400 Deferred tax liability Income tax expense (12,000 0.30) 5,400 30% AUS TAX RATE