Answered step by step

Verified Expert Solution

Question

1 Approved Answer

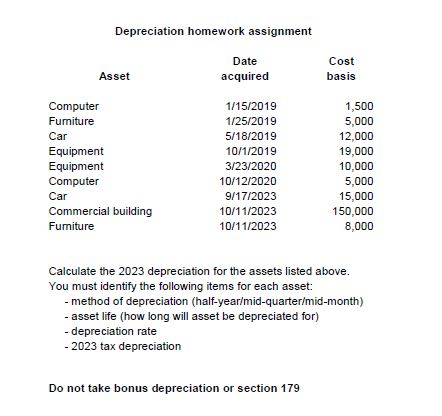

Depreciation homework assignment Asset Date acquired Cost basis Computer 1/15/2019 1,500 Furniture 1/25/2019 5,000 Car 5/18/2019 12,000 Equipment 10/1/2019 19,000 Equipment 3/23/2020 10,000 Computer

Depreciation homework assignment Asset Date acquired Cost basis Computer 1/15/2019 1,500 Furniture 1/25/2019 5,000 Car 5/18/2019 12,000 Equipment 10/1/2019 19,000 Equipment 3/23/2020 10,000 Computer 10/12/2020 5,000 Car 9/17/2023 15,000 Commercial building 10/11/2023 150,000 Furniture 10/11/2023 8,000 Calculate the 2023 depreciation for the assets listed above. You must identify the following items for each asset: - method of depreciation (half-year/mid-quarter/mid-month) -asset life (how long will asset be depreciated for) - depreciation rate -2023 tax depreciation Do not take bonus depreciation or section 179

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To work out the 2023 deterioration for every resource recorded above we want to decide the technique for devaluation resource life deterioration rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started