Question

Depreciation is the decrease or loss in value of an item due to age, wear, or market conditions. We usually consider depreciation on expensive

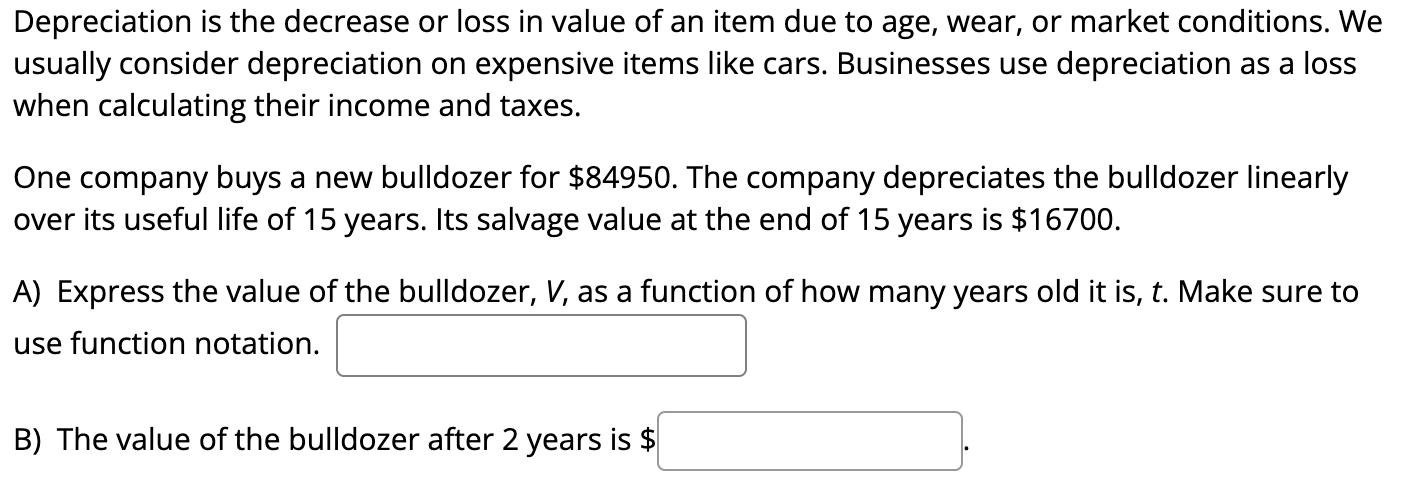

Depreciation is the decrease or loss in value of an item due to age, wear, or market conditions. We usually consider depreciation on expensive items like cars. Businesses use depreciation as a loss when calculating their income and taxes. One company buys a new bulldozer for $84950. The company depreciates the bulldozer linearly over its useful life of 15 years. Its salvage value at the end of 15 years is $16700. A) Express the value of the bulldozer, V, as a function of how many years old it is, t. Make sure to use function notation. B) The value of the bulldozer after 2 years is $

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Let Vt represent the value of the bulldozer at time t where t is the number of years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Statement Analysis

Authors: K. R. Subramanyam, John Wild

11th edition

78110963, 978-0078110962

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App