Answered step by step

Verified Expert Solution

Question

1 Approved Answer

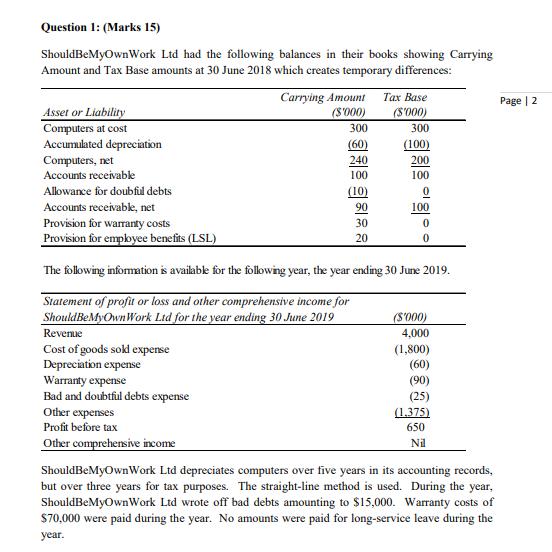

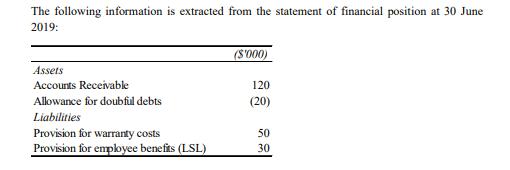

Question 1: (Marks 15) Should Be MyOwn Work Ltd had the following balances in their books showing Carrying Amount and Tax Base amounts at

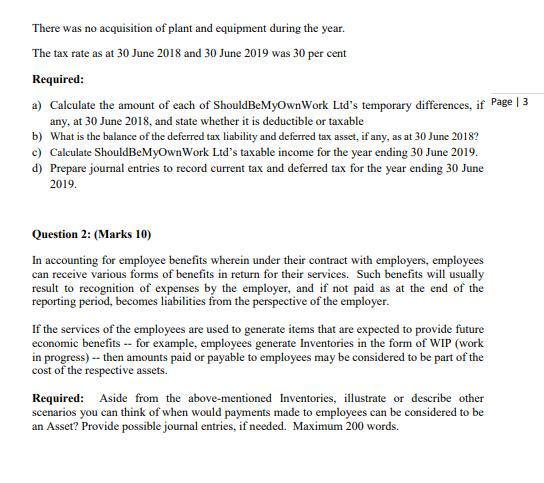

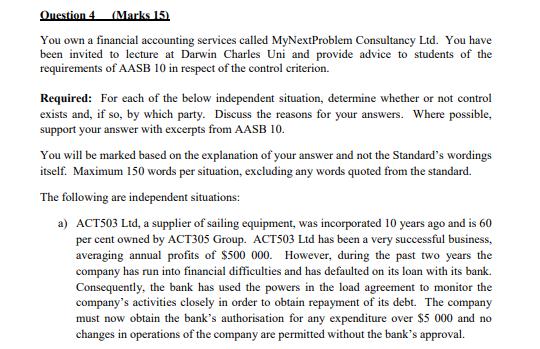

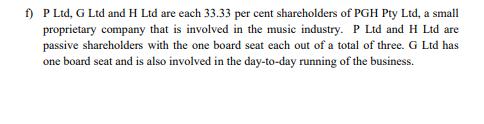

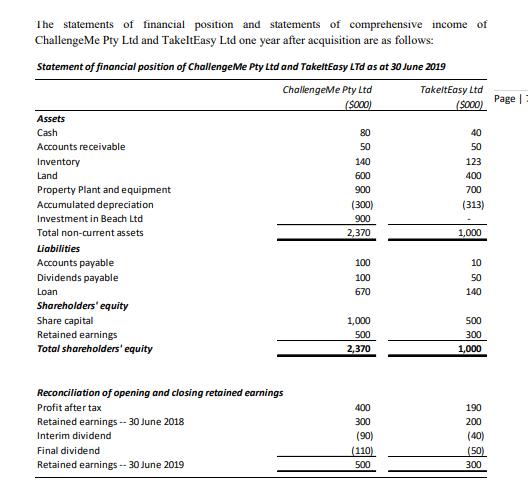

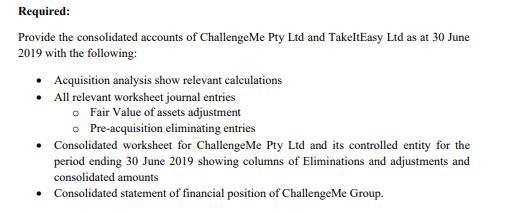

Question 1: (Marks 15) Should Be MyOwn Work Ltd had the following balances in their books showing Carrying Amount and Tax Base amounts at 30 June 2018 which creates temporary differences: Asset or Liability Computers at cost Accumulated depreciation Computers, net Accounts receivable Allowance for doubful debts Cost of goods sold expense Depreciation expense Warranty expense Bad and doubtful debts expense Carrying Amount ($'000) Other expenses Profit before tax Other comprehensive income 300 (60) 240 100 (10) 90 30 20 Tax Base ($'000) Accounts receivable, net Provision for warranty costs Provision for employee benefits (LSL) The following information is available for the following year, the year ending 30 June 2019. Statement of profit or loss and other comprehensive income for Should Be My Own Work Ltd for the year ending 30 June 2019 Revenue 300 (100) 200 100 0 100 0 ($'000) 4,000 (1,800) (60) (90) (25) (1,375) 650 Nil Should Be MyOwn Work Ltd depreciates computers over five years in its accounting records, but over three years for tax purposes. The straight-line method is used. During the year, ShouldBeMyOwn Work Ltd wrote off bad debts amounting to $15,000. Warranty costs of $70,000 were paid during the year. No amounts were paid for long-service leave during the year. Page | 2 The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts Receivable Allowance for doubful debts Liabilities Provision for warranty costs Provision for employee benefits (LSL) ($'000) 120 (20) 50 30 There was no acquisition of plant and equipment during the year. The tax rate as at 30 June 2018 and 30 June 2019 was 30 per cent Required: a) Calculate the amount of each of ShouldBeMyOwn Work Ltd's temporary differences, if Page | 3 any, at 30 June 2018, and state whether it is deductible or taxable b) What is the balance of the deferred tax liability and deferred tax asset, if any, as at 30 June 2018? c) Calculate Should Be MyOwn Work Ltd's taxable income for the year ending 30 June 2019. d) Prepare journal entries to record current tax and deferred tax for the year ending 30 June 2019. Question 2: (Marks 10) In accounting for employee benefits wherein under their contract with employers, employees can receive various forms of benefits in return for their services. Such benefits will usually result to recognition of expenses by the employer, and if not paid as at the end of the reporting period, becomes liabilities from the perspective of the employer. If the services of the employees are used to generate items that are expected to provide future economic benefits --for example, employees generate Inventories in the form of WIP (work in progress) -- then amounts paid or payable to employees may be considered to be part of the cost of the respective assets. Required: Aside from the above-mentioned Inventories, illustrate or describe other scenarios you can think of when would payments made to employees can be considered to be an Asset? Provide possible journal entries, if needed. Maximum 200 words. Question 3: (Marks 10) Required State whether the following assets may be revalued, support your answer with a brief explanation to your reason. (maximum 100 words in each scenario). Prepare journal entries for any revaluations permitted by accounting standards. Assume that each item listed below represents a separate class of assets a) NT News OnTheGo Ltd has developed a masthead for its newspaper to the point where it is a very valuable asset. Although the masthead is not currently recognised, management believes it could be sold for at least $3 million. b) John Wiley & Sons Australasia Ltd purchased a publishing title two years ago for $1.2 million when another publisher went into liquidation. The book has been very successful and management believes that it could probably sell $1.5 million if ever they put it on the market. c) Booze Your Juice Ltd acquired a franchise for an ice-cream stand at a beach at a cost of $100 000. There is great demand for this type of franchise as evidenced by recent sales of equivalent franchises at other beaches. The current market price of such a franchise is $200 000. d) DJB Ltd has deferred development costs of $520 000 and the estimated recoverable amount of development project is $860 000. Page | 4 Question 4 (Marks 15) You own a financial accounting services called MyNextProblem Consultancy Ltd. You have been invited to lecture at Darwin Charles Uni and provide advice to students of the requirements of AASB 10 in respect of the control criterion. Required: For each of the below independent situation, determine whether or not control exists and, if so, by which party. Discuss the reasons for your answers. Where possible. support your answer with excerpts from AASB 10. You will be marked based on the explanation of your answer and not the Standard's wordings itself. Maximum 150 words per situation, excluding any words quoted from the standard. The following are independent situations: a) ACT503 Ltd, a supplier of sailing equipment, was incorporated 10 years ago and is 60 per cent owned by ACT305 Group. ACT503 Ltd has been a very successful business, averaging annual profits of $500 000. However, during the past two years the company has run into financial difficulties and has defaulted on its loan with its bank. Consequently, the bank has used the powers in the load agreement to monitor the company's activities closely in order to obtain repayment of its debt. The company must now obtain the bank's authorisation for any expenditure over $5 000 and no changes in operations of the company are permitted without the bank's approval. b) Gyk Pty Ltd is a family-run book publisher that has purposely refrained from using high-technology equipment over the past five years as the directors (the G family) considered it to be a "fad' and a waste of the company's resources. As a result, the company's antiquated equipment has failed to produce quality material and has been very inefficient compared with GyK's competitors. During the current year, the company's bankers took possession of the company's assets, converted all the debt Page | 5 into equity and two directors of the bank were appointed to GyK's board, which now totals four people. The bank is undecided whether it should sell the company's assets, which have little recoverable value, or reject further equity into the company, purchase more advanced equipment and attempt to trade on and sell the business as a going concern. c) ACT502 Ltd is a 30 per cent shareholder of Investment Co. Pty Ltd. The other shareholders have smaller shareholdings (approximately 8 to 12 per cent) and are always too busy to attend annual general meetings. ACT502 has two non-executive seats on the board and the remaining three are held by other shareholders - one chief executive officer who is a shareholder and two non-executives -who do make an attempt to attend board meetings d) S Ltd is owned 50 per cent by BI Ltd and 50 per cent by B2 Ltd (the founding shareholders). Each has two seats on the board, with no party having a casting vote, although B1 Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. B2 Ltd has agreed that it will pay a management fee to B1 Ltd, equivalent to 50 per cent of the results for the year, in the event of a loss. BI Ltd is a holder of 10 options, which are exercisable at any time at a 10 per cent discount to the fair value of the shares as at the exercise date. e) Boost Juice Ltd is a 51 per cent shareholder in Chatime Tea Ltd and currently has two out of five board seats. Trampoline Ltd holds the remaining 49 per cent shares and currently has the other three seats. Boost Juice Ltd is a passive shareholder as it is happy with the way Trampoline Ltd has been running the company. f) P Ltd, G Ltd and H Ltd are each 33.33 per cent shareholders of PGH Pty Ltd, a small proprietary company that is involved in the music industry. P Ltd and H Ltd are passive shareholders with the one board seat each out of a total of three. G Ltd has one board seat and is also involved in the day-to-day running of the business. Question 5 (Marks 50) ChallengeMe Pty Ltd acquired 100 per cent of the issued capital of TakeltEasy Ltd on 30 June 2018 for $900 000, when the statement of financial position of TakeltEasy Ltd was as follows: Statement of financial position TakeltEasy Ltd as at 30 June 2018 $('000) Assets Accounts receivable Inventory Land Property, plant and equip Accumulated depreciation 70 100 400 700 (270) 1,000 Liabilities Loan Shareholders' equity Share Capital Retained Earnings $('000) 300 500 200 1,000 Additional Information: Tax rate is 30 per cent As at the date of acquisition, all assets of TakeltEasy Ltd were at fair value, other than the property, plant and equipment, which had a fair value of $530 000. TakeltEasy Ltd adopts the cost model for measuring its property, plant and equipment. The property, plant and equipment is expected to have a remaining useful life of 10 years, and no residual value. One year following acquisition it was considered that TakeltEasy Ltd's goodwill had a recoverable amount of $60 000. TakeltEasy Ltd declared a dividend of $40 000 on 10 July 2018, with the dividends being paid from pre-acquisition retained earnings. Page | 6 The statements of financial position and statements of comprehensive income of ChallengeMe Pty Ltd and TakeltEasy Ltd one year after acquisition are as follows: Statement of financial position of ChallengeMe Pty Ltd and TakeltEasy LTd as at 30 June 2019 ChallengeMe Pty Ltd TakeltEasy Ltd ($000) ($000) Assets Cash Accounts receivable Inventory Land Property Plant and equipment Accumulated depreciation Investment in Beach Ltd Total non-current assets Liabilities Accounts payable Dividends payable Loan Shareholders' equity Share capital Retained earnings Total shareholders' equity Reconciliation of opening and closing retained earnings Profit after tax Retained earnings-- 30 June 2018 Interim dividend Final dividend Retained earnings --30 June 2019 80 50 140 600 900 (300) 900 2,370 100 100 670 1,000 500 2,370 400 300 (90) (110) 500 40 50 123 400 700 (313) 1,000 10 50 140 500 300 1,000 190 200 (40) (50) 300 Page | Required: Provide the consolidated accounts of ChallengeMe Pty Ltd and TakeItEasy Ltd as at 30 June 2019 with the following: Acquisition analysis show relevant calculations All relevant worksheet journal entries o Fair Value of assets adjustment o Pre-acquisition eliminating entries Consolidated worksheet for ChallengeMe Pty Ltd and its controlled entity for the period ending 30 June 2019 showing columns of Eliminations and adjustments and consolidated amounts. Consolidated statement of financial position of ChallengeMe Group. Question 1: (Marks 15) Should Be MyOwn Work Ltd had the following balances in their books showing Carrying Amount and Tax Base amounts at 30 June 2018 which creates temporary differences: Asset or Liability Computers at cost Accumulated depreciation Computers, net Accounts receivable Allowance for doubful debts Cost of goods sold expense Depreciation expense Warranty expense Bad and doubtful debts expense Carrying Amount ($'000) Other expenses Profit before tax Other comprehensive income 300 (60) 240 100 (10) 90 30 20 Tax Base ($'000) Accounts receivable, net Provision for warranty costs Provision for employee benefits (LSL) The following information is available for the following year, the year ending 30 June 2019. Statement of profit or loss and other comprehensive income for Should Be My Own Work Ltd for the year ending 30 June 2019 Revenue 300 (100) 200 100 0 100 0 ($'000) 4,000 (1,800) (60) (90) (25) (1,375) 650 Nil Should Be MyOwn Work Ltd depreciates computers over five years in its accounting records, but over three years for tax purposes. The straight-line method is used. During the year, ShouldBeMyOwn Work Ltd wrote off bad debts amounting to $15,000. Warranty costs of $70,000 were paid during the year. No amounts were paid for long-service leave during the year. Page | 2 The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts Receivable Allowance for doubful debts Liabilities Provision for warranty costs Provision for employee benefits (LSL) ($'000) 120 (20) 50 30 There was no acquisition of plant and equipment during the year. The tax rate as at 30 June 2018 and 30 June 2019 was 30 per cent Required: a) Calculate the amount of each of ShouldBeMyOwn Work Ltd's temporary differences, if Page | 3 any, at 30 June 2018, and state whether it is deductible or taxable b) What is the balance of the deferred tax liability and deferred tax asset, if any, as at 30 June 2018? c) Calculate Should Be MyOwn Work Ltd's taxable income for the year ending 30 June 2019. d) Prepare journal entries to record current tax and deferred tax for the year ending 30 June 2019. Question 2: (Marks 10) In accounting for employee benefits wherein under their contract with employers, employees can receive various forms of benefits in return for their services. Such benefits will usually result to recognition of expenses by the employer, and if not paid as at the end of the reporting period, becomes liabilities from the perspective of the employer. If the services of the employees are used to generate items that are expected to provide future economic benefits --for example, employees generate Inventories in the form of WIP (work in progress) -- then amounts paid or payable to employees may be considered to be part of the cost of the respective assets. Required: Aside from the above-mentioned Inventories, illustrate or describe other scenarios you can think of when would payments made to employees can be considered to be an Asset? Provide possible journal entries, if needed. Maximum 200 words. Question 3: (Marks 10) Required State whether the following assets may be revalued, support your answer with a brief explanation to your reason. (maximum 100 words in each scenario). Prepare journal entries for any revaluations permitted by accounting standards. Assume that each item listed below represents a separate class of assets a) NT News OnTheGo Ltd has developed a masthead for its newspaper to the point where it is a very valuable asset. Although the masthead is not currently recognised, management believes it could be sold for at least $3 million. b) John Wiley & Sons Australasia Ltd purchased a publishing title two years ago for $1.2 million when another publisher went into liquidation. The book has been very successful and management believes that it could probably sell $1.5 million if ever they put it on the market. c) Booze Your Juice Ltd acquired a franchise for an ice-cream stand at a beach at a cost of $100 000. There is great demand for this type of franchise as evidenced by recent sales of equivalent franchises at other beaches. The current market price of such a franchise is $200 000. d) DJB Ltd has deferred development costs of $520 000 and the estimated recoverable amount of development project is $860 000. Page | 4 Question 4 (Marks 15) You own a financial accounting services called MyNextProblem Consultancy Ltd. You have been invited to lecture at Darwin Charles Uni and provide advice to students of the requirements of AASB 10 in respect of the control criterion. Required: For each of the below independent situation, determine whether or not control exists and, if so, by which party. Discuss the reasons for your answers. Where possible. support your answer with excerpts from AASB 10. You will be marked based on the explanation of your answer and not the Standard's wordings itself. Maximum 150 words per situation, excluding any words quoted from the standard. The following are independent situations: a) ACT503 Ltd, a supplier of sailing equipment, was incorporated 10 years ago and is 60 per cent owned by ACT305 Group. ACT503 Ltd has been a very successful business, averaging annual profits of $500 000. However, during the past two years the company has run into financial difficulties and has defaulted on its loan with its bank. Consequently, the bank has used the powers in the load agreement to monitor the company's activities closely in order to obtain repayment of its debt. The company must now obtain the bank's authorisation for any expenditure over $5 000 and no changes in operations of the company are permitted without the bank's approval. b) Gyk Pty Ltd is a family-run book publisher that has purposely refrained from using high-technology equipment over the past five years as the directors (the G family) considered it to be a "fad' and a waste of the company's resources. As a result, the company's antiquated equipment has failed to produce quality material and has been very inefficient compared with GyK's competitors. During the current year, the company's bankers took possession of the company's assets, converted all the debt Page | 5 into equity and two directors of the bank were appointed to GyK's board, which now totals four people. The bank is undecided whether it should sell the company's assets, which have little recoverable value, or reject further equity into the company, purchase more advanced equipment and attempt to trade on and sell the business as a going concern. c) ACT502 Ltd is a 30 per cent shareholder of Investment Co. Pty Ltd. The other shareholders have smaller shareholdings (approximately 8 to 12 per cent) and are always too busy to attend annual general meetings. ACT502 has two non-executive seats on the board and the remaining three are held by other shareholders - one chief executive officer who is a shareholder and two non-executives -who do make an attempt to attend board meetings d) S Ltd is owned 50 per cent by BI Ltd and 50 per cent by B2 Ltd (the founding shareholders). Each has two seats on the board, with no party having a casting vote, although B1 Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. B2 Ltd has agreed that it will pay a management fee to B1 Ltd, equivalent to 50 per cent of the results for the year, in the event of a loss. BI Ltd is a holder of 10 options, which are exercisable at any time at a 10 per cent discount to the fair value of the shares as at the exercise date. e) Boost Juice Ltd is a 51 per cent shareholder in Chatime Tea Ltd and currently has two out of five board seats. Trampoline Ltd holds the remaining 49 per cent shares and currently has the other three seats. Boost Juice Ltd is a passive shareholder as it is happy with the way Trampoline Ltd has been running the company. f) P Ltd, G Ltd and H Ltd are each 33.33 per cent shareholders of PGH Pty Ltd, a small proprietary company that is involved in the music industry. P Ltd and H Ltd are passive shareholders with the one board seat each out of a total of three. G Ltd has one board seat and is also involved in the day-to-day running of the business. Question 5 (Marks 50) ChallengeMe Pty Ltd acquired 100 per cent of the issued capital of TakeltEasy Ltd on 30 June 2018 for $900 000, when the statement of financial position of TakeltEasy Ltd was as follows: Statement of financial position TakeltEasy Ltd as at 30 June 2018 $('000) Assets Accounts receivable Inventory Land Property, plant and equip Accumulated depreciation 70 100 400 700 (270) 1,000 Liabilities Loan Shareholders' equity Share Capital Retained Earnings $('000) 300 500 200 1,000 Additional Information: Tax rate is 30 per cent As at the date of acquisition, all assets of TakeltEasy Ltd were at fair value, other than the property, plant and equipment, which had a fair value of $530 000. TakeltEasy Ltd adopts the cost model for measuring its property, plant and equipment. The property, plant and equipment is expected to have a remaining useful life of 10 years, and no residual value. One year following acquisition it was considered that TakeltEasy Ltd's goodwill had a recoverable amount of $60 000. TakeltEasy Ltd declared a dividend of $40 000 on 10 July 2018, with the dividends being paid from pre-acquisition retained earnings. Page | 6 The statements of financial position and statements of comprehensive income of ChallengeMe Pty Ltd and TakeltEasy Ltd one year after acquisition are as follows: Statement of financial position of ChallengeMe Pty Ltd and TakeltEasy LTd as at 30 June 2019 ChallengeMe Pty Ltd TakeltEasy Ltd ($000) ($000) Assets Cash Accounts receivable Inventory Land Property Plant and equipment Accumulated depreciation Investment in Beach Ltd Total non-current assets Liabilities Accounts payable Dividends payable Loan Shareholders' equity Share capital Retained earnings Total shareholders' equity Reconciliation of opening and closing retained earnings Profit after tax Retained earnings-- 30 June 2018 Interim dividend Final dividend Retained earnings --30 June 2019 80 50 140 600 900 (300) 900 2,370 100 100 670 1,000 500 2,370 400 300 (90) (110) 500 40 50 123 400 700 (313) 1,000 10 50 140 500 300 1,000 190 200 (40) (50) 300 Page | Required: Provide the consolidated accounts of ChallengeMe Pty Ltd and TakeItEasy Ltd as at 30 June 2019 with the following: Acquisition analysis show relevant calculations All relevant worksheet journal entries o Fair Value of assets adjustment o Pre-acquisition eliminating entries Consolidated worksheet for ChallengeMe Pty Ltd and its controlled entity for the period ending 30 June 2019 showing columns of Eliminations and adjustments and consolidated amounts. Consolidated statement of financial position of ChallengeMe Group. Question 1: (Marks 15) Should Be MyOwn Work Ltd had the following balances in their books showing Carrying Amount and Tax Base amounts at 30 June 2018 which creates temporary differences: Asset or Liability Computers at cost Accumulated depreciation Computers, net Accounts receivable Allowance for doubful debts Cost of goods sold expense Depreciation expense Warranty expense Bad and doubtful debts expense Carrying Amount ($'000) Other expenses Profit before tax Other comprehensive income 300 (60) 240 100 (10) 90 30 20 Tax Base ($'000) Accounts receivable, net Provision for warranty costs Provision for employee benefits (LSL) The following information is available for the following year, the year ending 30 June 2019. Statement of profit or loss and other comprehensive income for Should Be My Own Work Ltd for the year ending 30 June 2019 Revenue 300 (100) 200 100 0 100 0 ($'000) 4,000 (1,800) (60) (90) (25) (1,375) 650 Nil Should Be MyOwn Work Ltd depreciates computers over five years in its accounting records, but over three years for tax purposes. The straight-line method is used. During the year, ShouldBeMyOwn Work Ltd wrote off bad debts amounting to $15,000. Warranty costs of $70,000 were paid during the year. No amounts were paid for long-service leave during the year. Page | 2 The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts Receivable Allowance for doubful debts Liabilities Provision for warranty costs Provision for employee benefits (LSL) ($'000) 120 (20) 50 30 There was no acquisition of plant and equipment during the year. The tax rate as at 30 June 2018 and 30 June 2019 was 30 per cent Required: a) Calculate the amount of each of ShouldBeMyOwn Work Ltd's temporary differences, if Page | 3 any, at 30 June 2018, and state whether it is deductible or taxable b) What is the balance of the deferred tax liability and deferred tax asset, if any, as at 30 June 2018? c) Calculate Should Be MyOwn Work Ltd's taxable income for the year ending 30 June 2019. d) Prepare journal entries to record current tax and deferred tax for the year ending 30 June 2019. Question 2: (Marks 10) In accounting for employee benefits wherein under their contract with employers, employees can receive various forms of benefits in return for their services. Such benefits will usually result to recognition of expenses by the employer, and if not paid as at the end of the reporting period, becomes liabilities from the perspective of the employer. If the services of the employees are used to generate items that are expected to provide future economic benefits --for example, employees generate Inventories in the form of WIP (work in progress) -- then amounts paid or payable to employees may be considered to be part of the cost of the respective assets. Required: Aside from the above-mentioned Inventories, illustrate or describe other scenarios you can think of when would payments made to employees can be considered to be an Asset? Provide possible journal entries, if needed. Maximum 200 words. Question 3: (Marks 10) Required State whether the following assets may be revalued, support your answer with a brief explanation to your reason. (maximum 100 words in each scenario). Prepare journal entries for any revaluations permitted by accounting standards. Assume that each item listed below represents a separate class of assets a) NT News OnTheGo Ltd has developed a masthead for its newspaper to the point where it is a very valuable asset. Although the masthead is not currently recognised, management believes it could be sold for at least $3 million. b) John Wiley & Sons Australasia Ltd purchased a publishing title two years ago for $1.2 million when another publisher went into liquidation. The book has been very successful and management believes that it could probably sell $1.5 million if ever they put it on the market. c) Booze Your Juice Ltd acquired a franchise for an ice-cream stand at a beach at a cost of $100 000. There is great demand for this type of franchise as evidenced by recent sales of equivalent franchises at other beaches. The current market price of such a franchise is $200 000. d) DJB Ltd has deferred development costs of $520 000 and the estimated recoverable amount of development project is $860 000. Page | 4 Question 4 (Marks 15) You own a financial accounting services called MyNextProblem Consultancy Ltd. You have been invited to lecture at Darwin Charles Uni and provide advice to students of the requirements of AASB 10 in respect of the control criterion. Required: For each of the below independent situation, determine whether or not control exists and, if so, by which party. Discuss the reasons for your answers. Where possible. support your answer with excerpts from AASB 10. You will be marked based on the explanation of your answer and not the Standard's wordings itself. Maximum 150 words per situation, excluding any words quoted from the standard. The following are independent situations: a) ACT503 Ltd, a supplier of sailing equipment, was incorporated 10 years ago and is 60 per cent owned by ACT305 Group. ACT503 Ltd has been a very successful business, averaging annual profits of $500 000. However, during the past two years the company has run into financial difficulties and has defaulted on its loan with its bank. Consequently, the bank has used the powers in the load agreement to monitor the company's activities closely in order to obtain repayment of its debt. The company must now obtain the bank's authorisation for any expenditure over $5 000 and no changes in operations of the company are permitted without the bank's approval. b) Gyk Pty Ltd is a family-run book publisher that has purposely refrained from using high-technology equipment over the past five years as the directors (the G family) considered it to be a "fad' and a waste of the company's resources. As a result, the company's antiquated equipment has failed to produce quality material and has been very inefficient compared with GyK's competitors. During the current year, the company's bankers took possession of the company's assets, converted all the debt Page | 5 into equity and two directors of the bank were appointed to GyK's board, which now totals four people. The bank is undecided whether it should sell the company's assets, which have little recoverable value, or reject further equity into the company, purchase more advanced equipment and attempt to trade on and sell the business as a going concern. c) ACT502 Ltd is a 30 per cent shareholder of Investment Co. Pty Ltd. The other shareholders have smaller shareholdings (approximately 8 to 12 per cent) and are always too busy to attend annual general meetings. ACT502 has two non-executive seats on the board and the remaining three are held by other shareholders - one chief executive officer who is a shareholder and two non-executives -who do make an attempt to attend board meetings d) S Ltd is owned 50 per cent by BI Ltd and 50 per cent by B2 Ltd (the founding shareholders). Each has two seats on the board, with no party having a casting vote, although B1 Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. B2 Ltd has agreed that it will pay a management fee to B1 Ltd, equivalent to 50 per cent of the results for the year, in the event of a loss. BI Ltd is a holder of 10 options, which are exercisable at any time at a 10 per cent discount to the fair value of the shares as at the exercise date. e) Boost Juice Ltd is a 51 per cent shareholder in Chatime Tea Ltd and currently has two out of five board seats. Trampoline Ltd holds the remaining 49 per cent shares and currently has the other three seats. Boost Juice Ltd is a passive shareholder as it is happy with the way Trampoline Ltd has been running the company. f) P Ltd, G Ltd and H Ltd are each 33.33 per cent shareholders of PGH Pty Ltd, a small proprietary company that is involved in the music industry. P Ltd and H Ltd are passive shareholders with the one board seat each out of a total of three. G Ltd has one board seat and is also involved in the day-to-day running of the business. Question 5 (Marks 50) ChallengeMe Pty Ltd acquired 100 per cent of the issued capital of TakeltEasy Ltd on 30 June 2018 for $900 000, when the statement of financial position of TakeltEasy Ltd was as follows: Statement of financial position TakeltEasy Ltd as at 30 June 2018 $('000) Assets Accounts receivable Inventory Land Property, plant and equip Accumulated depreciation 70 100 400 700 (270) 1,000 Liabilities Loan Shareholders' equity Share Capital Retained Earnings $('000) 300 500 200 1,000 Additional Information: Tax rate is 30 per cent As at the date of acquisition, all assets of TakeltEasy Ltd were at fair value, other than the property, plant and equipment, which had a fair value of $530 000. TakeltEasy Ltd adopts the cost model for measuring its property, plant and equipment. The property, plant and equipment is expected to have a remaining useful life of 10 years, and no residual value. One year following acquisition it was considered that TakeltEasy Ltd's goodwill had a recoverable amount of $60 000. TakeltEasy Ltd declared a dividend of $40 000 on 10 July 2018, with the dividends being paid from pre-acquisition retained earnings. Page | 6 The statements of financial position and statements of comprehensive income of ChallengeMe Pty Ltd and TakeltEasy Ltd one year after acquisition are as follows: Statement of financial position of ChallengeMe Pty Ltd and TakeltEasy LTd as at 30 June 2019 ChallengeMe Pty Ltd TakeltEasy Ltd ($000) ($000) Assets Cash Accounts receivable Inventory Land Property Plant and equipment Accumulated depreciation Investment in Beach Ltd Total non-current assets Liabilities Accounts payable Dividends payable Loan Shareholders' equity Share capital Retained earnings Total shareholders' equity Reconciliation of opening and closing retained earnings Profit after tax Retained earnings-- 30 June 2018 Interim dividend Final dividend Retained earnings --30 June 2019 80 50 140 600 900 (300) 900 2,370 100 100 670 1,000 500 2,370 400 300 (90) (110) 500 40 50 123 400 700 (313) 1,000 10 50 140 500 300 1,000 190 200 (40) (50) 300 Page | Required: Provide the consolidated accounts of ChallengeMe Pty Ltd and TakeItEasy Ltd as at 30 June 2019 with the following: Acquisition analysis show relevant calculations All relevant worksheet journal entries o Fair Value of assets adjustment o Pre-acquisition eliminating entries Consolidated worksheet for ChallengeMe Pty Ltd and its controlled entity for the period ending 30 June 2019 showing columns of Eliminations and adjustments and consolidated amounts. Consolidated statement of financial position of ChallengeMe Group. Question 1: (Marks 15) Should Be MyOwn Work Ltd had the following balances in their books showing Carrying Amount and Tax Base amounts at 30 June 2018 which creates temporary differences: Asset or Liability Computers at cost Accumulated depreciation Computers, net Accounts receivable Allowance for doubful debts Cost of goods sold expense Depreciation expense Warranty expense Bad and doubtful debts expense Carrying Amount ($'000) Other expenses Profit before tax Other comprehensive income 300 (60) 240 100 (10) 90 30 20 Tax Base ($'000) Accounts receivable, net Provision for warranty costs Provision for employee benefits (LSL) The following information is available for the following year, the year ending 30 June 2019. Statement of profit or loss and other comprehensive income for Should Be My Own Work Ltd for the year ending 30 June 2019 Revenue 300 (100) 200 100 0 100 0 ($'000) 4,000 (1,800) (60) (90) (25) (1,375) 650 Nil Should Be MyOwn Work Ltd depreciates computers over five years in its accounting records, but over three years for tax purposes. The straight-line method is used. During the year, ShouldBeMyOwn Work Ltd wrote off bad debts amounting to $15,000. Warranty costs of $70,000 were paid during the year. No amounts were paid for long-service leave during the year. Page | 2 The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts Receivable Allowance for doubful debts Liabilities Provision for warranty costs Provision for employee benefits (LSL) ($'000) 120 (20) 50 30 There was no acquisition of plant and equipment during the year. The tax rate as at 30 June 2018 and 30 June 2019 was 30 per cent Required: a) Calculate the amount of each of ShouldBeMyOwn Work Ltd's temporary differences, if Page | 3 any, at 30 June 2018, and state whether it is deductible or taxable b) What is the balance of the deferred tax liability and deferred tax asset, if any, as at 30 June 2018? c) Calculate Should Be MyOwn Work Ltd's taxable income for the year ending 30 June 2019. d) Prepare journal entries to record current tax and deferred tax for the year ending 30 June 2019. Question 2: (Marks 10) In accounting for employee benefits wherein under their contract with employers, employees can receive various forms of benefits in return for their services. Such benefits will usually result to recognition of expenses by the employer, and if not paid as at the end of the reporting period, becomes liabilities from the perspective of the employer. If the services of the employees are used to generate items that are expected to provide future economic benefits --for example, employees generate Inventories in the form of WIP (work in progress) -- then amounts paid or payable to employees may be considered to be part of the cost of the respective assets. Required: Aside from the above-mentioned Inventories, illustrate or describe other scenarios you can think of when would payments made to employees can be considered to be an Asset? Provide possible journal entries, if needed. Maximum 200 words. Question 3: (Marks 10) Required State whether the following assets may be revalued, support your answer with a brief explanation to your reason. (maximum 100 words in each scenario). Prepare journal entries for any revaluations permitted by accounting standards. Assume that each item listed below represents a separate class of assets a) NT News OnTheGo Ltd has developed a masthead for its newspaper to the point where it is a very valuable asset. Although the masthead is not currently recognised, management believes it could be sold for at least $3 million. b) John Wiley & Sons Australasia Ltd purchased a publishing title two years ago for $1.2 million when another publisher went into liquidation. The book has been very successful and management believes that it could probably sell $1.5 million if ever they put it on the market. c) Booze Your Juice Ltd acquired a franchise for an ice-cream stand at a beach at a cost of $100 000. There is great demand for this type of franchise as evidenced by recent sales of equivalent franchises at other beaches. The current market price of such a franchise is $200 000. d) DJB Ltd has deferred development costs of $520 000 and the estimated recoverable amount of development project is $860 000. Page | 4 Question 4 (Marks 15) You own a financial accounting services called MyNextProblem Consultancy Ltd. You have been invited to lecture at Darwin Charles Uni and provide advice to students of the requirements of AASB 10 in respect of the control criterion. Required: For each of the below independent situation, determine whether or not control exists and, if so, by which party. Discuss the reasons for your answers. Where possible. support your answer with excerpts from AASB 10. You will be marked based on the explanation of your answer and not the Standard's wordings itself. Maximum 150 words per situation, excluding any words quoted from the standard. The following are independent situations: a) ACT503 Ltd, a supplier of sailing equipment, was incorporated 10 years ago and is 60 per cent owned by ACT305 Group. ACT503 Ltd has been a very successful business, averaging annual profits of $500 000. However, during the past two years the company has run into financial difficulties and has defaulted on its loan with its bank. Consequently, the bank has used the powers in the load agreement to monitor the company's activities closely in order to obtain repayment of its debt. The company must now obtain the bank's authorisation for any expenditure over $5 000 and no changes in operations of the company are permitted without the bank's approval. b) Gyk Pty Ltd is a family-run book publisher that has purposely refrained from using high-technology equipment over the past five years as the directors (the G family) considered it to be a "fad' and a waste of the company's resources. As a result, the company's antiquated equipment has failed to produce quality material and has been very inefficient compared with GyK's competitors. During the current year, the company's bankers took possession of the company's assets, converted all the debt Page | 5 into equity and two directors of the bank were appointed to GyK's board, which now totals four people. The bank is undecided whether it should sell the company's assets, which have little recoverable value, or reject further equity into the company, purchase more advanced equipment and attempt to trade on and sell the business as a going concern. c) ACT502 Ltd is a 30 per cent shareholder of Investment Co. Pty Ltd. The other shareholders have smaller shareholdings (approximately 8 to 12 per cent) and are always too busy to attend annual general meetings. ACT502 has two non-executive seats on the board and the remaining three are held by other shareholders - one chief executive officer who is a shareholder and two non-executives -who do make an attempt to attend board meetings d) S Ltd is owned 50 per cent by BI Ltd and 50 per cent by B2 Ltd (the founding shareholders). Each has two seats on the board, with no party having a casting vote, although B1 Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. B2 Ltd has agreed that it will pay a management fee to B1 Ltd, equivalent to 50 per cent of the results for the year, in the event of a loss. BI Ltd is a holder of 10 options, which are exercisable at any time at a 10 per cent discount to the fair value of the shares as at the exercise date. e) Boost Juice Ltd is a 51 per cent shareholder in Chatime Tea Ltd and currently has two out of five board seats. Trampoline Ltd holds the remaining 49 per cent shares and currently has the other three seats. Boost Juice Ltd is a passive shareholder as it is happy with the way Trampoline Ltd has been running the company. f) P Ltd, G Ltd and H Ltd are each 33.33 per cent shareholders of PGH Pty Ltd, a small proprietary company that is involved in the music industry. P Ltd and H Ltd are passive shareholders with the one board seat each out of a total of three. G Ltd has one board seat and is also involved in the day-to-day running of the business. Question 5 (Marks 50) ChallengeMe Pty Ltd acquired 100 per cent of the issued capital of TakeltEasy Ltd on 30 June 2018 for $900 000, when the statement of financial position of TakeltEasy Ltd was as follows: Statement of financial position TakeltEasy Ltd as at 30 June 2018 $('000) Assets Accounts receivable Inventory Land Property, plant and equip Accumulated depreciation 70 100 400 700 (270) 1,000 Liabilities Loan Shareholders' equity Share Capital Retained Earnings $('000) 300 500 200 1,000 Additional Information: Tax rate is 30 per cent As at the date of acquisition, all assets of TakeltEasy Ltd were at fair value, other than the property, plant and equipment, which had a fair value of $530 000. TakeltEasy Ltd adopts the cost model for measuring its property, plant and equipment. The property, plant and equipment is expected to have a remaining useful life of 10 years, and no residual value. One year following acquisition it was considered that TakeltEasy Ltd's goodwill had a recoverable amount of $60 000. TakeltEasy Ltd declared a dividend of $40 000 on 10 July 2018, with the dividends being paid from pre-acquisition retained earnings. Page | 6 The statements of financial position and statements of comprehensive income of ChallengeMe Pty Ltd and TakeltEasy Ltd one year after acquisition are as follows: Statement of financial position of ChallengeMe Pty Ltd and TakeltEasy LTd as at 30 June 2019 ChallengeMe Pty Ltd TakeltEasy Ltd ($000) ($000) Assets Cash Accounts receivable Inventory Land Property Plant and equipment Accumulated depreciation Investment in Beach Ltd Total non-current assets Liabilities Accounts payable Dividends payable Loan Shareholders' equity Share capital Retained earnings Total shareholders' equity Reconciliation of opening and closing retained earnings Profit after tax Retained earnings-- 30 June 2018 Interim dividend Final dividend Retained earnings --30 June 2019 80 50 140 600 900 (300) 900 2,370 100 100 670 1,000 500 2,370 400 300 (90) (110) 500 40 50 123 400 700 (313) 1,000 10 50 140 500 300 1,000 190 200 (40) (50) 300 Page | Required: Provide the consolidated accounts of ChallengeMe Pty Ltd and TakeItEasy Ltd as at 30 June 2019 with the following: Acquisition analysis show relevant calculations All relevant worksheet journal entries o Fair Value of assets adjustment o Pre-acquisition eliminating entries Consolidated worksheet for ChallengeMe Pty Ltd and its controlled entity for the period ending 30 June 2019 showing columns of Eliminations and adjustments and consolidated amounts. Consolidated statement of financial position of ChallengeMe Group.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Carrying Tax Base Temporary Taxable Amount Difference Deductible Assets or Liability 000 000 Computer at cost 300 300 0 Accumulated depreciation 60 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started