Question

Depreciation The Company adopts the double declining method of depreciation. All assets were purchased on January 1, 2018 for $500,000,000.00. The useful life for all

Depreciation The Company adopts the double declining method of depreciation. All assets were purchased on January 1, 2018 for $500,000,000.00. The useful life for all the assets is 10 years. The salvage value of all the assets is $5,000,000.

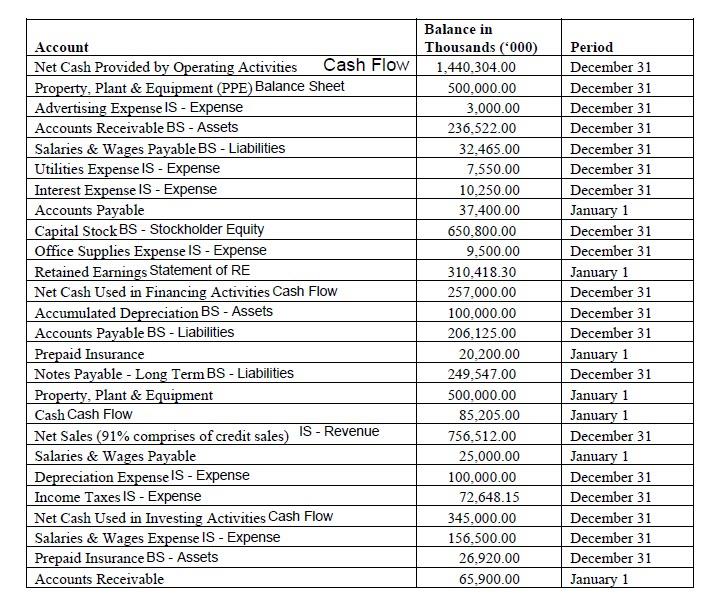

2018 Account Balances With the immediate termination of the Companys Chief Accountant, the Company is yet to locate the records for its 2018 financial statements. The Company was however able to locate information for most of the account balances for 2018 (below), and has suggested you use the data below to the extent it is applicable to your scope of work.

Q. Prepare the Income Statement, Balance Sheet, Cash Flow Statement and Statement of Retained Earnings for the Year Ended December 2018. Deliverables must be in Excel format, including all built-in formulas for calculations.

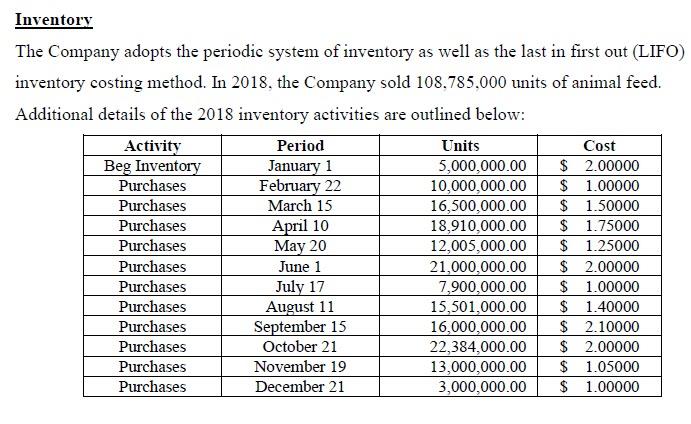

Inventory The Company adopts the periodic system of inventory as well as the last in first out (LIFO) inventory costing method. In 2018, the Company sold 108.785.000 units of animal feed. Additional details of the 2018 inventory activities are outlined below: Activity Period Units Cost Beg Inventory January 1 5,000,000.00 $ 2.00000 Purchases February 22 10,000,000.00 $ 1.00000 Purchases March 15 16,500,000.00 $ 1.50000 Purchases April 10 18,910,000.00 $ 1.75000 Purchases May 20 12,005,000.00 $ 1.25000 Purchases June 1 21,000,000.00 $ 2.00000 Purchases July 17 7,900,000.00 $ 1.00000 Purchases August 11 15,501,000.00 $ 1.40000 Purchases September 15 16,000,000.00 $ 2.10000 Purchases October 21 22,384,000.00 $ 2.00000 Purchases November 19 13,000,000.00 $ 1.05000 Purchases December 21 3,000,000.00 $ 1.00000 Account Net Cash Provided by Operating Activities Cash Flow Property, Plant & Equipment (PPE) Balance Sheet Advertising Expense IS - Expense Accounts Receivable BS - Assets Salaries & Wages Payable BS - Liabilities Utilities Expense IS - Expense Interest Expense IS - Expense Accounts Payable Capital Stock BS - Stockholder Equity Office Supplies Expense IS - Expense Retained Earnings Statement of RE Net Cash Used in Financing Activities Cash Flow Accumulated Depreciation BS - Assets Accounts Payable BS - Liabilities Prepaid Insurance Notes Payable - Long Term BS - Liabilities Property, Plant & Equipment Cash Cash Flow Net Sales (91% comprises of credit sales) IS - Revenue Salaries & Wages Payable Depreciation Expense IS - Expense Income Taxes IS - Expense Net Cash Used in Investing Activities Cash Flow Salaries & Wages Expense IS - Expense Prepaid Insurance BS - Assets Accounts Receivable Balance in Thousands ('000) 1,440,304.00 500,000.00 3.000.00 236.522.00 32.465.00 7.550.00 10.250.00 37,400.00 650.800.00 9.500.00 310.418.30 257,000.00 100,000.00 206,125.00 20.200.00 249,547.00 500,000.00 85,205.00 756.512.00 25,000.00 100,000.00 72.648.15 345,000.00 156,500.00 26.920.00 65.900.00 Period December 31 December 31 December 31 December 31 December 31 December 31 December 31 January 1 December 31 December 31 January 1 December 31 December 31 December 31 January 1 December 31 January 1 January 1 December 31 January 1 December 31 December 31 December 31 December 31 December 31 January 1 Inventory The Company adopts the periodic system of inventory as well as the last in first out (LIFO) inventory costing method. In 2018, the Company sold 108.785.000 units of animal feed. Additional details of the 2018 inventory activities are outlined below: Activity Period Units Cost Beg Inventory January 1 5,000,000.00 $ 2.00000 Purchases February 22 10,000,000.00 $ 1.00000 Purchases March 15 16,500,000.00 $ 1.50000 Purchases April 10 18,910,000.00 $ 1.75000 Purchases May 20 12,005,000.00 $ 1.25000 Purchases June 1 21,000,000.00 $ 2.00000 Purchases July 17 7,900,000.00 $ 1.00000 Purchases August 11 15,501,000.00 $ 1.40000 Purchases September 15 16,000,000.00 $ 2.10000 Purchases October 21 22,384,000.00 $ 2.00000 Purchases November 19 13,000,000.00 $ 1.05000 Purchases December 21 3,000,000.00 $ 1.00000 Account Net Cash Provided by Operating Activities Cash Flow Property, Plant & Equipment (PPE) Balance Sheet Advertising Expense IS - Expense Accounts Receivable BS - Assets Salaries & Wages Payable BS - Liabilities Utilities Expense IS - Expense Interest Expense IS - Expense Accounts Payable Capital Stock BS - Stockholder Equity Office Supplies Expense IS - Expense Retained Earnings Statement of RE Net Cash Used in Financing Activities Cash Flow Accumulated Depreciation BS - Assets Accounts Payable BS - Liabilities Prepaid Insurance Notes Payable - Long Term BS - Liabilities Property, Plant & Equipment Cash Cash Flow Net Sales (91% comprises of credit sales) IS - Revenue Salaries & Wages Payable Depreciation Expense IS - Expense Income Taxes IS - Expense Net Cash Used in Investing Activities Cash Flow Salaries & Wages Expense IS - Expense Prepaid Insurance BS - Assets Accounts Receivable Balance in Thousands ('000) 1,440,304.00 500,000.00 3.000.00 236.522.00 32.465.00 7.550.00 10.250.00 37,400.00 650.800.00 9.500.00 310.418.30 257,000.00 100,000.00 206,125.00 20.200.00 249,547.00 500,000.00 85,205.00 756.512.00 25,000.00 100,000.00 72.648.15 345,000.00 156,500.00 26.920.00 65.900.00 Period December 31 December 31 December 31 December 31 December 31 December 31 December 31 January 1 December 31 December 31 January 1 December 31 December 31 December 31 January 1 December 31 January 1 January 1 December 31 January 1 December 31 December 31 December 31 December 31 December 31 January 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started