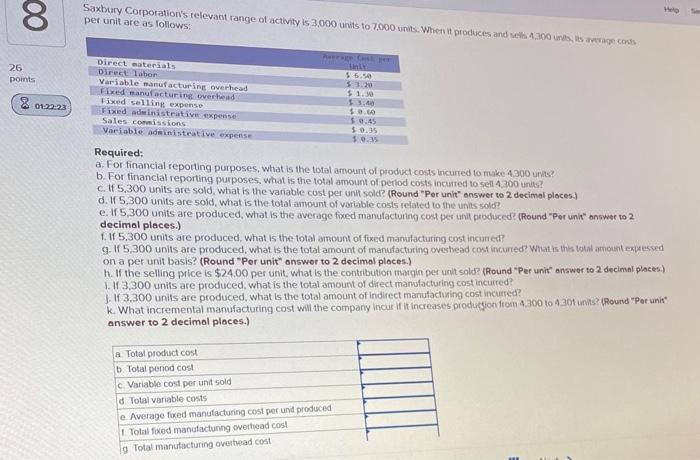

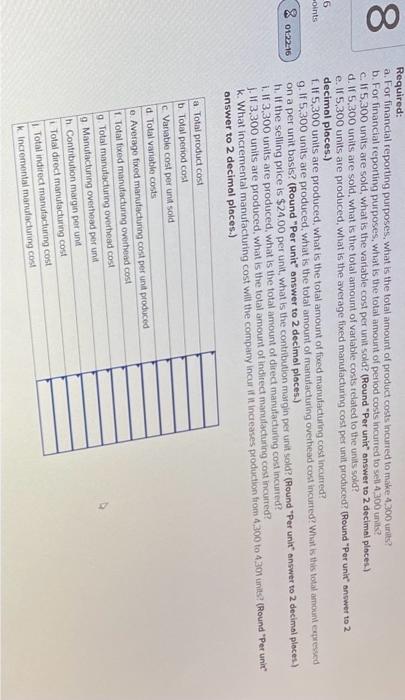

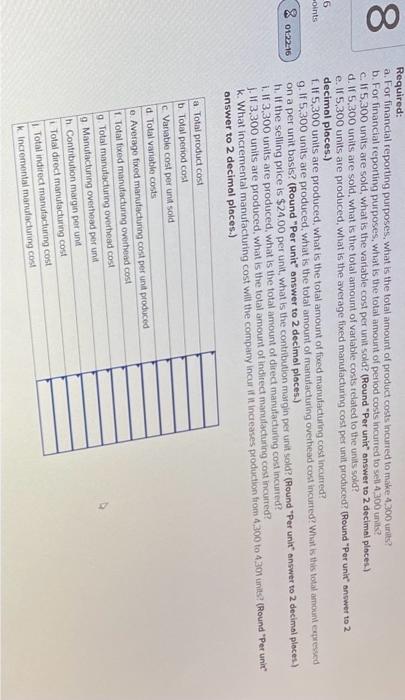

der unit are as follows: Required: a. For financial repotting purposes, what is the total amount of product costs incurred to make 4,300 urats? b. For financial reporting purposes, what is the total amount of perfod costs incurred to sell 4,300 units? c. If 5,300 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places) d. If 5,300 units are 5old, What is the total amount of variable costs related to the units sold? e. If 5,300 units are produced, what is the average fixed manufacturing cost pes unit produced? (Round "Per unit" answer to 2 decimal places.) f. If 5,300 units are produced, what is the total amount of foxed manulacturing cost incuried? g. If 5,300 units are produced, what is the total amount of manufacturing oveshead cost incured? What is this totat amount expessed on a per unit basis? (Round "Per unit" onswer to 2 decimal places.) h. If the selling price is $24.00 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places) I. If 3,300 units are produced, what is the total amount of direct manufacturing cost incurred? J. If 3,300 units are produced, what is the total amount of indirect manutacturing cost incurred? k. What incremental manufacturing cost will the company incur if it increases producjon from 4,300 to 4 3ath units? (Round "Per unis" answer to 2 decimal places.) a. For financtal reporting purposes, what is the total amount of product costs incumed lo make 4,300 urits? b. For financial reponting purposes, what is the tolal amount of period costs incurred to seti 4,300 anils? c. If 5.300 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places) d. If 5,300 units are sold, what is the total amount of variable costs telated to the units sold? e. If 5,300 units are produced, what is the avetage fixed manufacturing cost per unil produced? (Round "Por unit" answer to 2 decimal places.) f. If 5,300 units are produced, what is the total amount of fored manutacturing cost incurred? 9. If 5,300 units ate produced, what is the total amount of manufacluting overhead cost incumed? What ks this total arnouni equressed on a per unit basks? (Round "Per unit" onswer to 2 decimal places.) h. If the selling price is $24.00 per unk, what is the contribution maigin per unit sold? (Round "Per unit' answer to 2 decimol pleces.) 1. If 3,300 units are produced. What is the total amount of direct manutacturing cost incuared? J. If 3,300 units are produced. What is the total amount of indirect manulacturing cost incurred? onswer to 2 decimal places.) der unit are as follows: Required: a. For financial repotting purposes, what is the total amount of product costs incurred to make 4,300 urats? b. For financial reporting purposes, what is the total amount of perfod costs incurred to sell 4,300 units? c. If 5,300 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places) d. If 5,300 units are 5old, What is the total amount of variable costs related to the units sold? e. If 5,300 units are produced, what is the average fixed manufacturing cost pes unit produced? (Round "Per unit" answer to 2 decimal places.) f. If 5,300 units are produced, what is the total amount of foxed manulacturing cost incuried? g. If 5,300 units are produced, what is the total amount of manufacturing oveshead cost incured? What is this totat amount expessed on a per unit basis? (Round "Per unit" onswer to 2 decimal places.) h. If the selling price is $24.00 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places) I. If 3,300 units are produced, what is the total amount of direct manufacturing cost incurred? J. If 3,300 units are produced, what is the total amount of indirect manutacturing cost incurred? k. What incremental manufacturing cost will the company incur if it increases producjon from 4,300 to 4 3ath units? (Round "Per unis" answer to 2 decimal places.) a. For financtal reporting purposes, what is the total amount of product costs incumed lo make 4,300 urits? b. For financial reponting purposes, what is the tolal amount of period costs incurred to seti 4,300 anils? c. If 5.300 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places) d. If 5,300 units are sold, what is the total amount of variable costs telated to the units sold? e. If 5,300 units are produced, what is the avetage fixed manufacturing cost per unil produced? (Round "Por unit" answer to 2 decimal places.) f. If 5,300 units are produced, what is the total amount of fored manutacturing cost incurred? 9. If 5,300 units ate produced, what is the total amount of manufacluting overhead cost incumed? What ks this total arnouni equressed on a per unit basks? (Round "Per unit" onswer to 2 decimal places.) h. If the selling price is $24.00 per unk, what is the contribution maigin per unit sold? (Round "Per unit' answer to 2 decimol pleces.) 1. If 3,300 units are produced. What is the total amount of direct manutacturing cost incuared? J. If 3,300 units are produced. What is the total amount of indirect manulacturing cost incurred? onswer to 2 decimal places.)