Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Derek earns an annual salary of Rs 780,000 inclusive of the end of year bonus payable in December. He enjoys the benefit of a

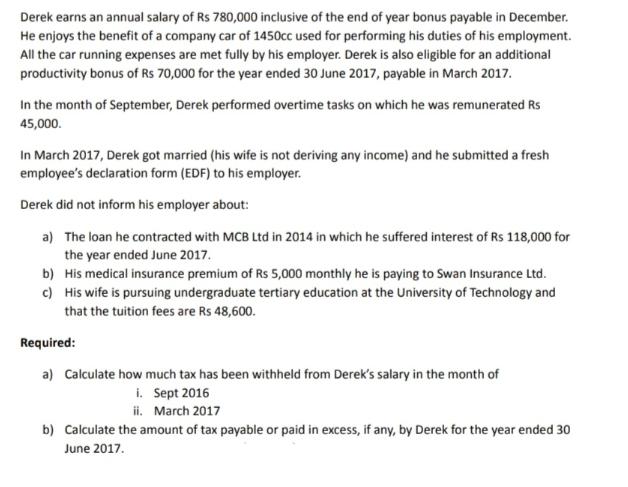

Derek earns an annual salary of Rs 780,000 inclusive of the end of year bonus payable in December. He enjoys the benefit of a company car of 1450cc used for performing his duties of his employment. All the car running expenses are met fully by his employer. Derek is also eligible for an additional productivity bonus of Rs 70,000 for the year ended 30 June 2017, payable in March 2017. In the month of September, Derek performed overtime tasks on which he was remunerated Rs 45,000. In March 2017, Derek got married (his wife is not deriving any income) and he submitted a fresh employee's declaration form (EDF) to his employer. Derek did not inform his employer about: a) The loan he contracted with MCB Ltd in 2014 in which he suffered interest of Rs 118,000 for the year ended June 2017. b) His medical insurance premium of Rs 5,000 monthly he is paying to Swan Insurance Ltd. c) His wife is pursuing undergraduate tertiary education at the University of Technology and that the tuition fees are Rs 48,600. Required: a) Calculate how much tax has been withheld from Derek's salary in the month of i. Sept 2016 ii. March 2017 b) Calculate the amount of tax payable or paid in excess, if any, by Derek for the year ended 30 June 2017.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started