Question

Derivation of BlackScholesMerton Option Pricing Formula from Binomial Tree Suppose that a binomial tree with n time steps used to value a European call option

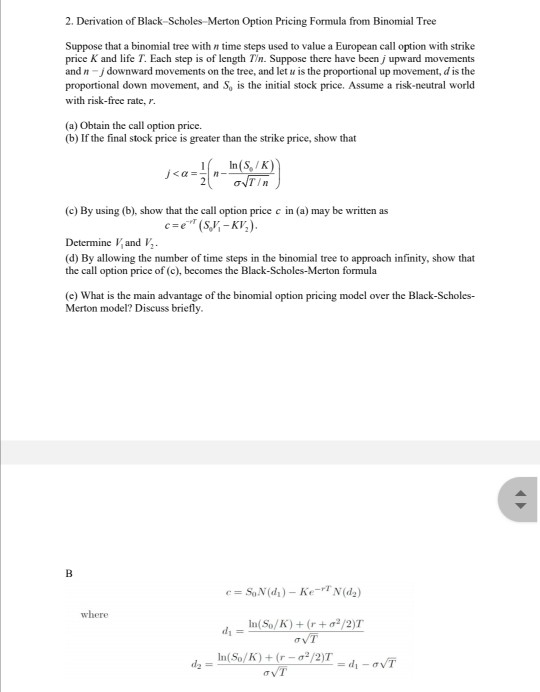

Derivation of BlackScholesMerton Option Pricing Formula from Binomial Tree Suppose that a binomial tree with n time steps used to value a European call option with strike price K and life T. Each step is of length T. Suppose there have been j upward movements and n j downward movements on the tree, and let u is the proportional up movement, d is the proportional down movement, and 0 S is the initial stock price. Assume a risk-neutral world with risk-free rate, r. (a) Obtain the call option price. (b) If the final stock price is greater than the strike price, show that

2. Derivation of Black-Scholes-Merton Option Pricing Formula from Binomial Tree Suppose that a binomial tree with n time steps used to value a European call option with strike price K and life T. Each step is of length Tin. Suppose there have been j upward movements and n-j downward movements on the tree, and let u is the proportional up movement, dis the proportional down movement, and S, is the initial stock price. Assume a risk-neutral world with risk-free rate, r. (a) Obtain the call option price. (b) If the final stock price is greater than the strike price, show that In(S/K) Tin (c) By using (b), show that the call option price c in (a) may be written as cre" (SJ-KV). Determine V and V. (d) By allowing the number of time steps in the binomial tree to approach infinity, show that the call option price of (c), becomes the Black-Scholes-Merton formula (c) What is the main advantage of the binomial option pricing model over the Black-Scholes- Merton model? Discuss briefly. B c=SoN(d) - Ke-(d) where In(So/K) + (r + 02/2)T di = NT In(S./K) + (r - 02/2)T OVT = d.-OVTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started