Question

Derivatives can be valued using risk neutral valuation. The spreadsheet Risk Neutral Valuation.xlsx simulates 10,000 values of stock price (assuming log normal distribution) at expiration

Derivatives can be valued using risk neutral valuation. The spreadsheet Risk Neutral Valuation.xlsx simulates 10,000 values of stock price (assuming log normal distribution) at expiration of derivative. Each stock price results in a derivative payoff. These derivative payoffs are discounted and averaged to get derivative value. The formula in cells in column C is set to price a European call with strike price of $50 but can be changed to price any other derivative. Value a derivative under the following assumptions: The current stock price (to be specified in cell G1 of the spreadsheet) is 20 + the number of the first letter of your last name + the number of the second letter of your last name. Assume A = 1, B = 2, and so on until Z = 26. For example, current stock price is 39 if your name is Jane Doe.

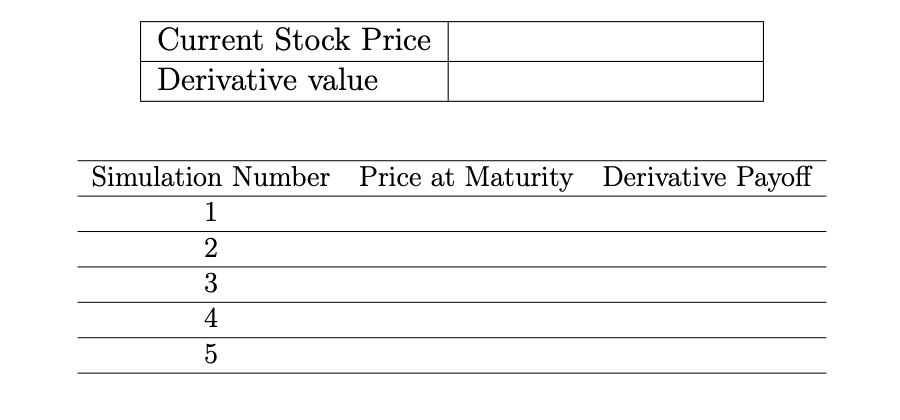

Change the formula in cells in column C to value a derivative which will expire after six months. Its payoff will equal the absolute difference between the stock price at that time and todays stock price, up to a maximum of $5. For example, if the stock price today is $50 and the stock price at expiration is $47.2, you will get $2.8. If the stock price at expiration is $53.6, you will get $3.6. If the stock price at expiration is $30 or $90, you will get $5. The risk-free rate is 5% per annum compounded continuously and the stock volatility is 20% per annum. Provide the stock price and the calculated derivative value. Also provide an image of the first few (about 5) lines of the spreadsheet or provide values in a table as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started