Answered step by step

Verified Expert Solution

Question

1 Approved Answer

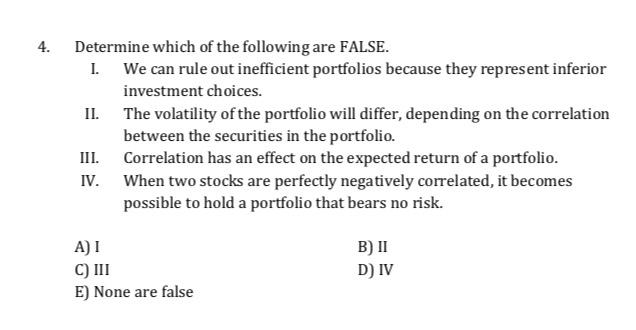

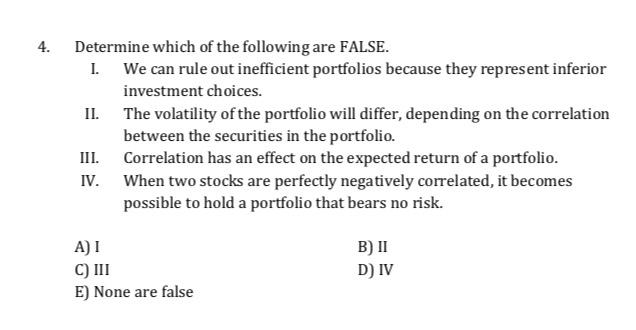

Derivatives Markets 4. Determine which of the following are FALSE. 1. We can rule out inefficient portfolios because they represent inferior investment choices. II. The

Derivatives Markets

4. Determine which of the following are FALSE. 1. We can rule out inefficient portfolios because they represent inferior investment choices. II. The volatility of the portfolio will differ, depending on the correlation between the securities in the portfolio. III. Correlation has an effect on the expected return of a portfolio. IV. When two stocks are perfectly negatively correlated, it becomes possible to hold a portfolio that bears no risk. AI C) III E) None are false B) II D) IV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started