Answered step by step

Verified Expert Solution

Question

1 Approved Answer

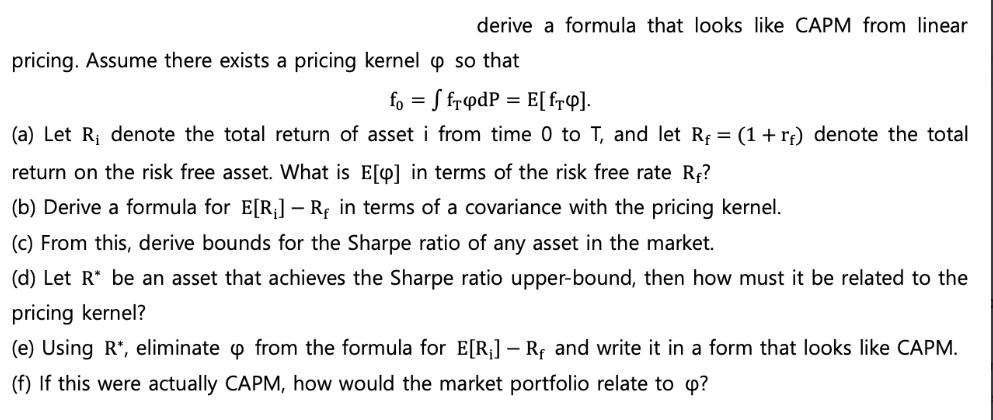

derive a formula that looks like CAPM from linear pricing. Assume there exists a pricing kernel op so that fo=ffrodP = E[f4]. (a) Let

derive a formula that looks like CAPM from linear pricing. Assume there exists a pricing kernel op so that fo=ffrodP = E[f4]. (a) Let R denote the total return of asset i from time 0 to T, and let R = (1 + r) denote the total return on the risk free asset. What is E[p] in terms of the risk free rate R? (b) Derive a formula for E[R] - R, in terms of a covariance with the pricing kernel. (c) From this, derive bounds for the Sharpe ratio of any asset in the market. (d) Let R* be an asset that achieves the Sharpe ratio upper-bound, then how must it be related to the pricing kernel? (e) Using R*, eliminate p from the formula for E[R] - Rf and write it in a form that looks like CAPM. (f) If this were actually CAPM, how would the market portfolio relate to q?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Assuming that the pricing kernel is op we have EopRi EopERiop Since op is assumed to be the pricin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started