Answered step by step

Verified Expert Solution

Question

1 Approved Answer

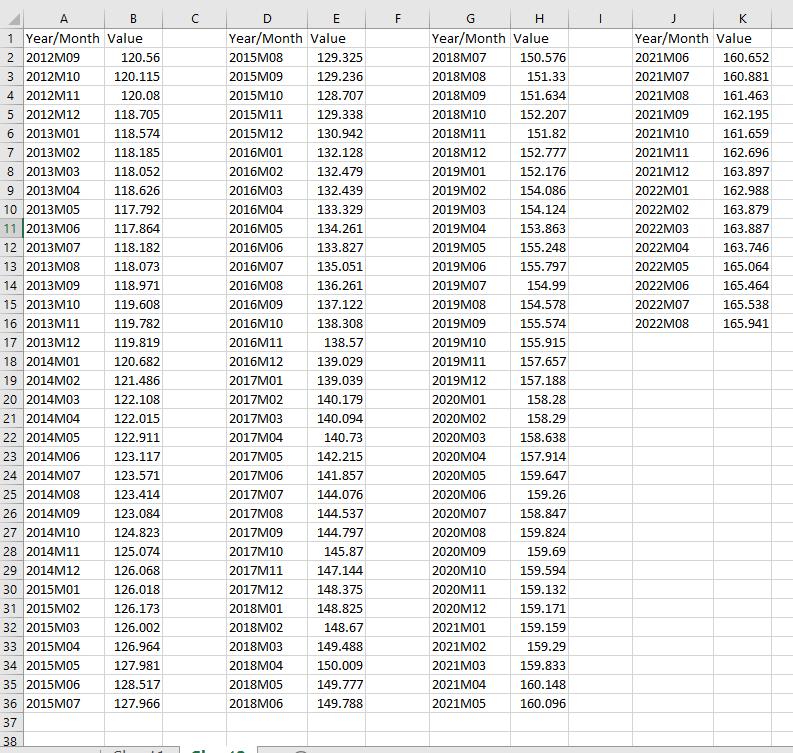

Derive the first stocks monthly VaR at a 98% confidence level and interpret your results in dollars. Assume the investment for this stock is $1,000,000.

Derive the first stock’s monthly VaR at a 98% confidence level and interpret your results in dollars. Assume the investment for this stock is $1,000,000. To save time,

you do not need to derive the VaRs for the second and third stock.

(The columns continue from the bottom of the previous to the top of the next)

A B 1 Year/Month Value 2 2012M09 3 2012M10 4 2012M11 5 2012M12 6 2013M01 7 2013M02 8 2013M03 9 2013M04 10 2013M05 11 2013M06 12 2013M07 13 2013M08 14 2013M09 15 2013M10 16 2013M11 17 2013M12 18 2014M01 19 2014M02 20 2014M03 21 2014M04 22 2014M05 23 2014M06 24 2014M07 25 2014M08 26 2014M09 27 2014M10 28 2014M11 29 2014M12 30 2015M01 31 2015M02 32 2015M03 33 2015M04 34 2015M05 35 2015M06 36 2015M07 m m 678 37 38 120.56 120.115 120.08 118.705 118.574 118.185 118.052 118.626 117.792 117.864 118.182 118.073 118.971 119.608 119.782 119.819 120.682 121.486 122.108 122.015 122.911 123.117 123.571 123.414 123.084 124.823 125.074 126.068 126.018 126.173 126.002 126.964 127.981 128.517 127.966 al E Year/Month Value 2015M08 2015M09 2015M10 2015M11 2015M12 2016M01 2016M02 2016M03 2016M04 2016M05 2016M06 2016M07 2016M08 2016M09 2016M10 2016M11 2016M12 2017M01 2017M02 2017M03 2017M04 2017M05 2017M06 2017M07 2017M08 2017M09 2017M10 2017M11 2017M12 2018M01 2018M02 2018M03 2018M04 2018M05 2018M06 129.325 129.236 128.707 129.338 130.942 132.128 132.479 132.439 133.329 134.261 133.827 135.051 136.261 137.122 138.308 138.57 139.029 139.039 140.179 140.094 140.73 142.215 141.857 144.076 144.537 144.797 145.87 147.144 148.375 148.825 148.67 149.488 150.009 149.777 149.788 F LL G H Year/Month Value 2018M07 2018M08 2018M09 2018M10 2018M11 2018M12 2019M01 2019M02 2019M03 2019M04 2019M05 2019M06 2019M07 2019M08 2019M09 2019M10 2019M11 2019M12 2020M01 2020M02 2020M03 2020M04 2020M05 2020M06 2020M07 2020M08 2020M09 2020M10 2020M11 2020M12 2021M01 2021M02 2021M03 2021M04 2021M05 150.576 151.33 151.634 152.207 151.82 152.777 152.176 154.086 154.124 153.863 155.248 155.797 154.99 154.578 155.574 155.915 157.657 157.188 158.28 158.29 158.638 157.914 159.647 159.26 158.847 159.824 159.69 159.594 159.132 159.171 159.159 159.29 159.833 160.148 160.096 J Year/Month Value 2021M06 2021M07 2021M08 2021M09 2021M10 2021M11 2021M12 2022M01 2022M02 2022M03 2022M04 2022M05 2022M06 2022M07 2022M08 160.652 160.881 161.463 162.195 161.659 162.696 163.897 162.988 163.879 163.887 163.746 165.064 165.464 165.538 165.941

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the first stocks monthly VaR at a 98 confidence level we need to perform the following ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started