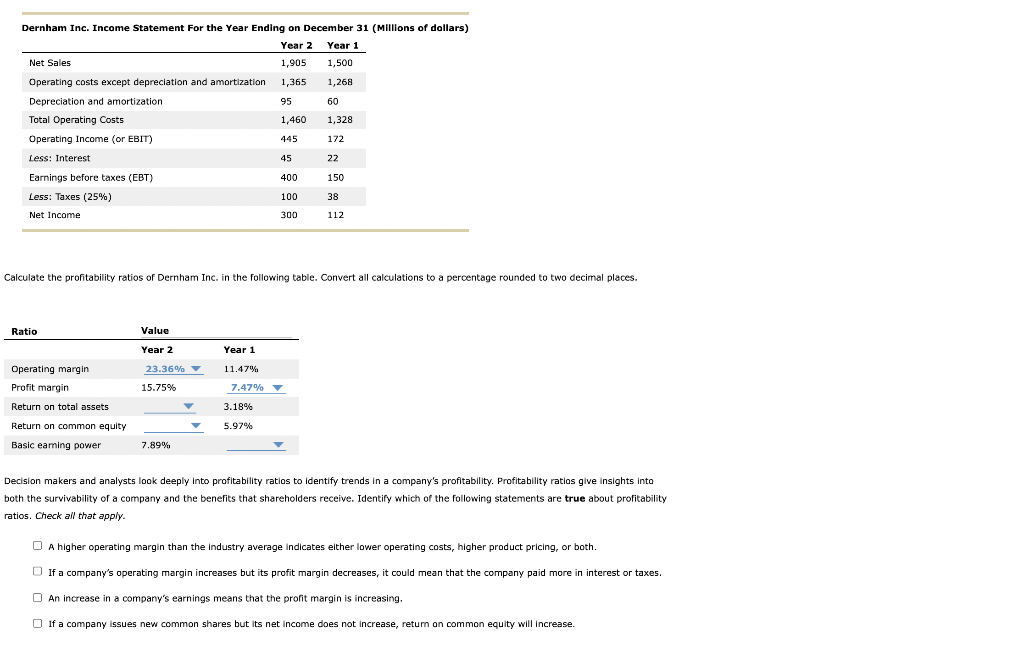

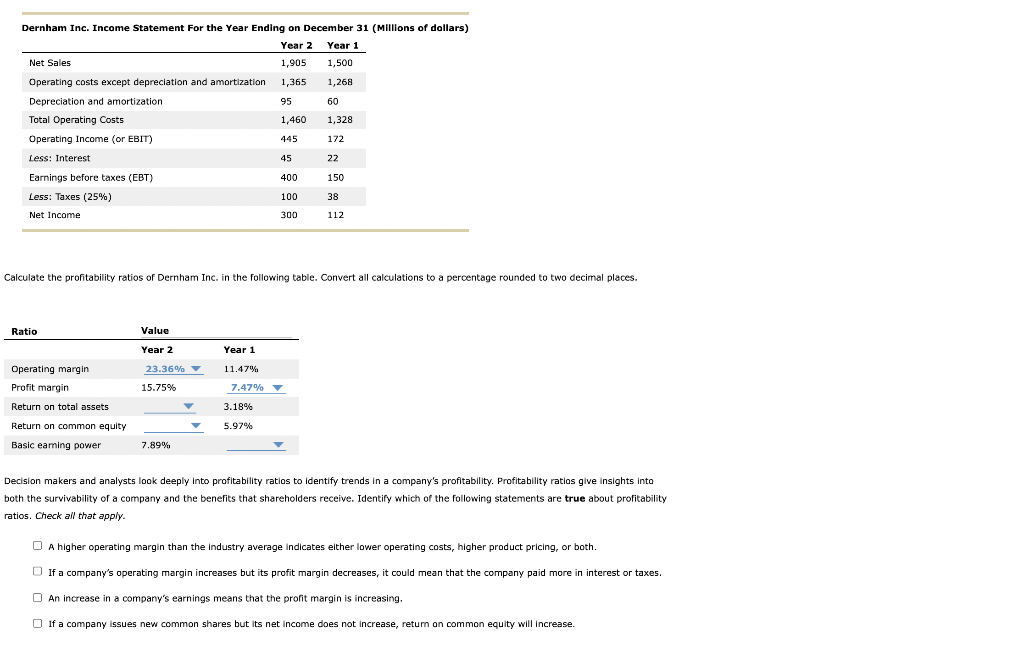

Dernham Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 1.905 1,500 Operating costs except depreciation and amortization 1,365 1,268 95 60 Depreciation and amortization Total Operating Costs Operating Income (or EBIT) 1,460 1,328 445 172 Less: Interest 45 22 400 150 Earnings before taxes (EBT) Less: Taxes (25%) ( Net Income 100 38 300 112 Calculate the profitability ratios of Dernham Inc. in the following table. Convert all calculations to a percentage rounded to two decimal places. Ratio Value Year 2 Year 1 23.36% 11.47% 15.75% 7.47% Operating margin Profit margin Return on total assets Return on common equity Basic eaming power 3.18% 5.97% 7.89% Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratlos give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. O A higher operating margin than the industry average indicates either lower operating costs, higher product pricing, or both. If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. O An increase in a company's earnings means that the profit margin is increasing, If a company issues new common shares but its net income does not increase, return on common equity will increase. Dernham Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 1.905 1,500 Operating costs except depreciation and amortization 1,365 1,268 95 60 Depreciation and amortization Total Operating Costs Operating Income (or EBIT) 1,460 1,328 445 172 Less: Interest 45 22 400 150 Earnings before taxes (EBT) Less: Taxes (25%) ( Net Income 100 38 300 112 Calculate the profitability ratios of Dernham Inc. in the following table. Convert all calculations to a percentage rounded to two decimal places. Ratio Value Year 2 Year 1 23.36% 11.47% 15.75% 7.47% Operating margin Profit margin Return on total assets Return on common equity Basic eaming power 3.18% 5.97% 7.89% Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratlos give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. O A higher operating margin than the industry average indicates either lower operating costs, higher product pricing, or both. If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. O An increase in a company's earnings means that the profit margin is increasing, If a company issues new common shares but its net income does not increase, return on common equity will increase