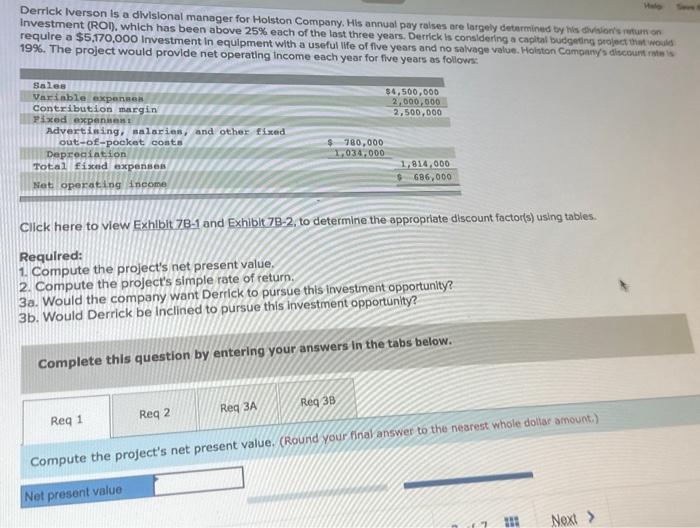

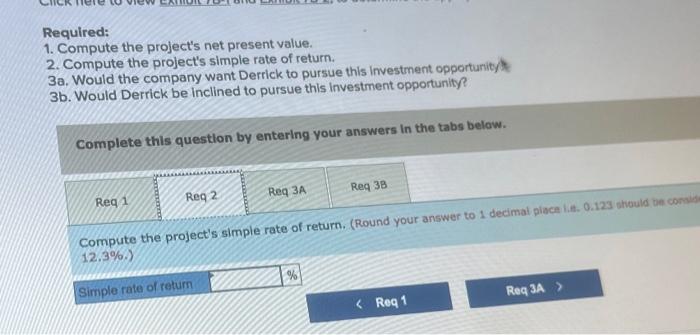

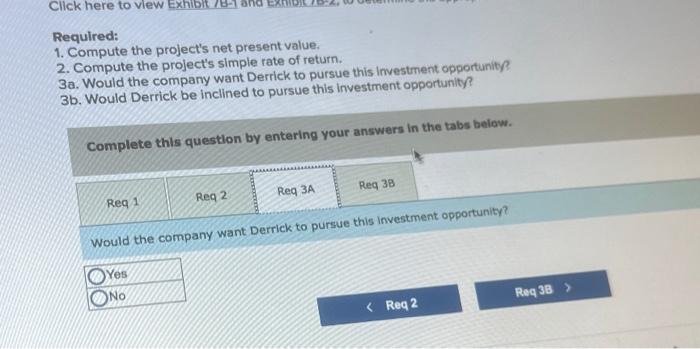

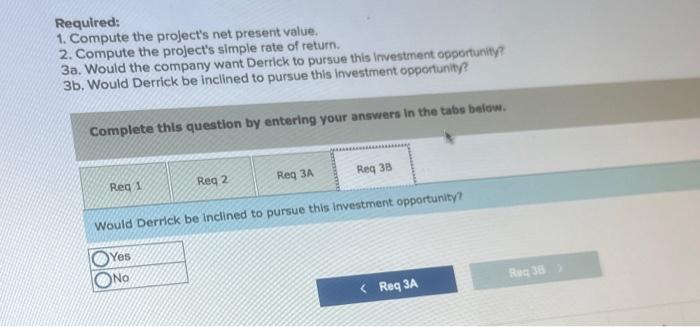

Derrick Jverson is a divisional manager for Holston Company. His annual pay ralses are largely detarmined by his divisionis ritum on investment (ROI), which has been above 25% each of the last three years, Derrick is considering a caplal budgeting project that woulh require a $5,170,000 Investment in equipment with a useful life of flve years and no solvage value. Holston Campari/s discount rats is 19\%. The project would provide net operating income each year for five years as follows: Click here to view Exhiblt 781 and Exhiblt 782, to determine the appropriate discount factor(s) using tables Reculred: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Compute the project's net present value. (Round your finalanswer to the nearest whole doltar arnount.) Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunityk 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Compute the project's simple rate of return. (Round your answer to 1 decimal piace iat. 0.123 should be cons) 13 3% Requlred: 1. Compute the project's net present value. 2. Compute the prolect's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Would the company want Derrick to pursue this investment opportunity? Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Would Derrick be inclined to pursue this investment opportunity? Derrick Jverson is a divisional manager for Holston Company. His annual pay ralses are largely detarmined by his divisionis ritum on investment (ROI), which has been above 25% each of the last three years, Derrick is considering a caplal budgeting project that woulh require a $5,170,000 Investment in equipment with a useful life of flve years and no solvage value. Holston Campari/s discount rats is 19\%. The project would provide net operating income each year for five years as follows: Click here to view Exhiblt 781 and Exhiblt 782, to determine the appropriate discount factor(s) using tables Reculred: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Compute the project's net present value. (Round your finalanswer to the nearest whole doltar arnount.) Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunityk 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Compute the project's simple rate of return. (Round your answer to 1 decimal piace iat. 0.123 should be cons) 13 3% Requlred: 1. Compute the project's net present value. 2. Compute the prolect's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Would the company want Derrick to pursue this investment opportunity? Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3a. Would the company want Derrick to pursue this investment opportunity? 3b. Would Derrick be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Would Derrick be inclined to pursue this investment opportunity