Answered step by step

Verified Expert Solution

Question

1 Approved Answer

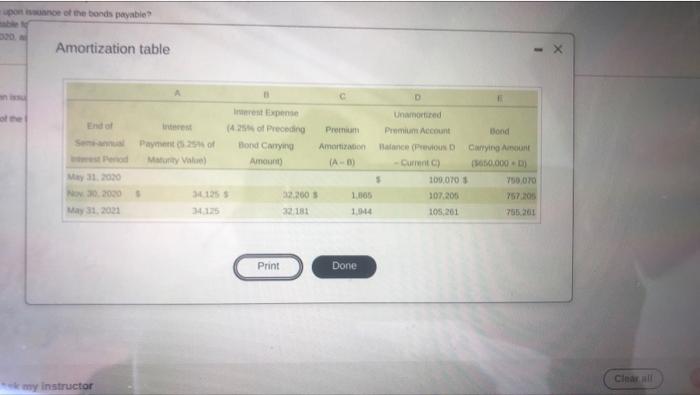

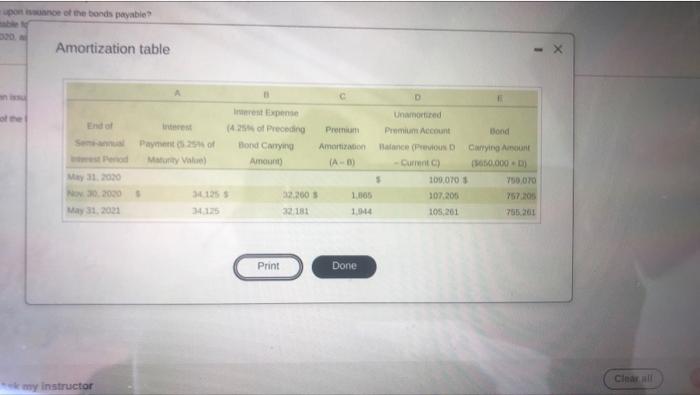

DES2000 The 2000 1000 portance of the bonds payable Amortization table Premium rest Expense (4.25 of Preceding Bond Carvind Amount) Sam Pay25 My Vale Amor

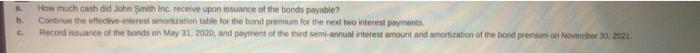

DES2000 The 2000 1000 portance of the bonds payable Amortization table Premium rest Expense (4.25 of Preceding Bond Carvind Amount) Sam Pay25 My Vale Amor (A- Unamored Primium Account Bond Balance (Previous Carrying An -Cut) 10,000) 1000705 750.070 307.205 757205 105,261 76520 May 31, 2020 NO 2000 May 31 2031 1.005 30125 34 125 32.2005 32181 1.14 Print Done Cina my instructor How much cash did John Smith Inc. receive upon issuance of the bonds payable? Continue the effective interest montiration table for the bond premium for the next two interest payments. Record issuance of the bonds on May 31, 2020, and payment of the third semi-annual interest amount and amortization of the bond premium on November 30, 2021 DES2000 The 2000 1000 portance of the bonds payable Amortization table Premium rest Expense (4.25 of Preceding Bond Carvind Amount) Sam Pay25 My Vale Amor (A- Unamored Primium Account Bond Balance (Previous Carrying An -Cut) 10,000) 1000705 750.070 307.205 757205 105,261 76520 May 31, 2020 NO 2000 May 31 2031 1.005 30125 34 125 32.2005 32181 1.14 Print Done Cina my instructor How much cash did John Smith Inc. receive upon issuance of the bonds payable? Continue the effective interest montiration table for the bond premium for the next two interest payments. Record issuance of the bonds on May 31, 2020, and payment of the third semi-annual interest amount and amortization of the bond premium on November 30, 2021

DES2000 The 2000 1000 portance of the bonds payable Amortization table Premium rest Expense (4.25 of Preceding Bond Carvind Amount) Sam Pay25 My Vale Amor (A- Unamored Primium Account Bond Balance (Previous Carrying An -Cut) 10,000) 1000705 750.070 307.205 757205 105,261 76520 May 31, 2020 NO 2000 May 31 2031 1.005 30125 34 125 32.2005 32181 1.14 Print Done Cina my instructor How much cash did John Smith Inc. receive upon issuance of the bonds payable? Continue the effective interest montiration table for the bond premium for the next two interest payments. Record issuance of the bonds on May 31, 2020, and payment of the third semi-annual interest amount and amortization of the bond premium on November 30, 2021 DES2000 The 2000 1000 portance of the bonds payable Amortization table Premium rest Expense (4.25 of Preceding Bond Carvind Amount) Sam Pay25 My Vale Amor (A- Unamored Primium Account Bond Balance (Previous Carrying An -Cut) 10,000) 1000705 750.070 307.205 757205 105,261 76520 May 31, 2020 NO 2000 May 31 2031 1.005 30125 34 125 32.2005 32181 1.14 Print Done Cina my instructor How much cash did John Smith Inc. receive upon issuance of the bonds payable? Continue the effective interest montiration table for the bond premium for the next two interest payments. Record issuance of the bonds on May 31, 2020, and payment of the third semi-annual interest amount and amortization of the bond premium on November 30, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started