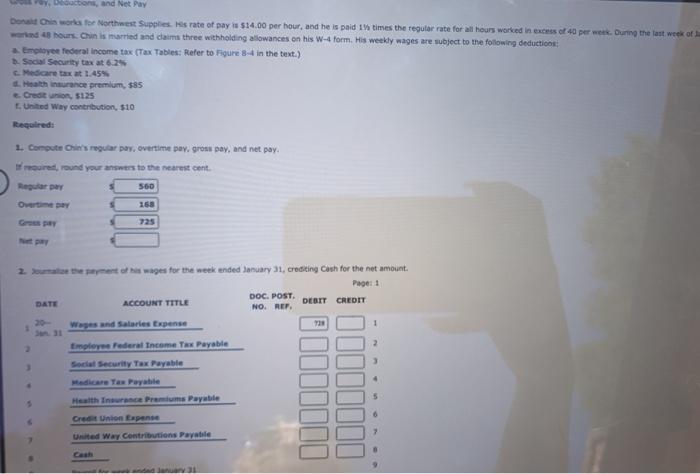

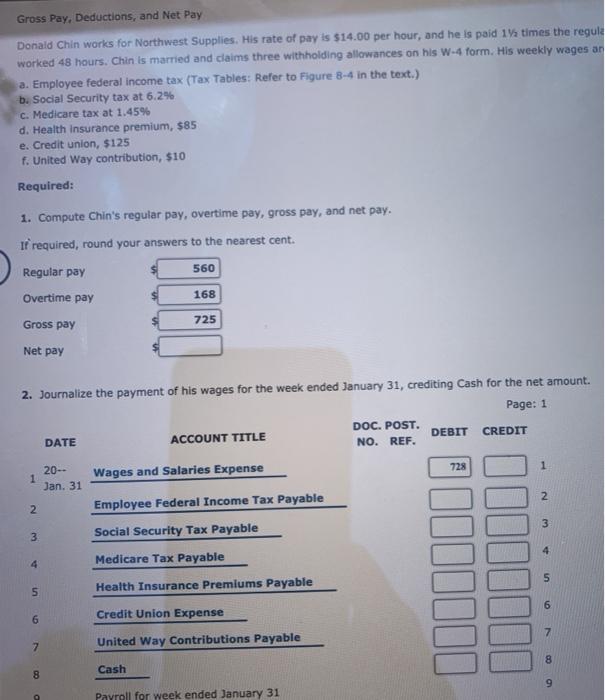

Descons, and Net Pay Dort his works for Northwest Supplies is rate of pay is $14.00 per hour, and he is paid 1 times the regular rate for all hours worked in exces et 40 per week. During the last week of od 48 hours. Chin is married and claims three withholding allowances on his W-4 form. His weekly wages are subject to the following deductions Employee federal income tax (Tax Tables: Refer to Figure 3-4 in the text.) Social Security tax at 6.2 c. Medicare tax at 1.45% Health insurance premium, 585 Credito 5125 United Way contribution, 510 Required: 1. Compute regular pay, overtime pay, gross pay, and net pay. ored, round your answers to the nearest cont. Regular pary 560 725 2. Southayent of his wages for the week ended January 31, Crediting Cash for the net amount. Page 1 DOC. POST DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. Wages and Salaries Expense 730 1 3 3 4 Employee federal Income Tax Payable Social Security Tax Payable Medicare Tax Payabile Health Insurance Premiums Payable Credit Union Espanse United Way Contributions Payable Bill1110 100000 Gross Pay, Deductions, and Net Pay Donald Chin works for Northwest Supplies. His rate of pay is $14.00 per hour, and he is paid 1 times the regula worked 48 hours. Chin is married and claims three withholding allowances on his W-4 form. His weekly wages an a. Employee federal income tax (Tax Tables: Refer to Figure 8-4 in the text.) b. Social Security tax at 6.2% c. Medicare tax at 1.45% d. Health Insurance premium, $85 e. Credit union, $125 f. United Way contribution, $10 Required: 1. Compute Chin's regular pay, overtime pay, gross pay, and net pay. If required, round your answers to the nearest cent. Regular pay 560 Overtime pay 168 Gross pay 725 Net pay 2. Journalize the payment of his wages for the week ended January 31, crediting Cash for the net amount. Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 728 1 1 20- Jan. 31 Wages and Salaries Expense 2 2 Employee Federal Income Tax Payable Social Security Tax Payable 3 3 4 Medicare Tax Payable 5 5 Health Insurance Premiums Payable 6 6 Credit Union Expense 7 United Way Contributions Payable 00 8 Cash Payroll for week ended January 31