Question

Describe each section of figure the profit and social value potential. Where does the organization you are completing your Social business plan project fit on

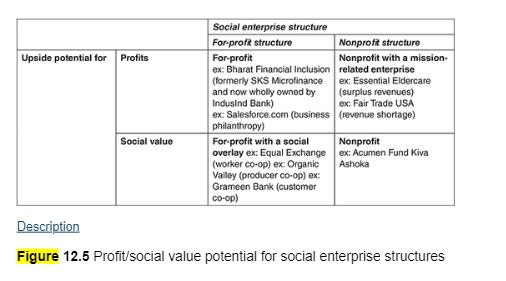

Describe each section of figure the profit and social value potential. Where does the organization you are completing your Social business plan project fit on this matrix? If you were starting a venture with a social dimension, which one would you choose and why?

For-Profit

In the upper-left quadrant is the traditional for-profit model. Advantages of the for-profit model include the relative ease of raising money as equity or debt, and the ease of selling or shutting down (as long as creditors receive their due) (Fruchterman, 2011). Disadvantages for the for-profit model include being required by law to put the interests of the shareholders first, meaning making money for them. Taxes on income and property must also be paid to governments, and for-profit companies cannot accept foundation grants or nontaxable contributions.

An example of a for-profit corporation focused on alleviating poverty is Bharat Financial Inclusion (BFI) Ltd. of India - formerly known as SKS Microfinance of India. BFI distributes small loans that begin at Rs. 2,000 to Rs. 12,000 (about $44-$260) to poor women so they can start and expand simple businesses and increase their incomes (SKS Microfinance, 2011). The microenterprises of these poor women range from raising cows and goats (in order to sell their milk) to opening a village tea stall. A major challenge for social enterprises is scaling up their operations to influence more than just a locale or a region. SKS switched from a nonprofit model to a for-profit model early in its existence in order to access the financial resources that could come from being listed on the Bombay Stock Exchange, as well as on the New York Stock Exchange.

For-Profit With a Social Overlay

The lower-left quadrant of Figure 12.5 represents the hybrid forms that have a for-profit legal structure with upside potential for social value rather than profits (Bromberger, 2011). These are for-profits with a social overlay (Fruchterman, 2011). Some of these structures have existed for decades. These include stakeholder-owned firms in the form of cooperatives. Such cooperatives might be formed by workers as in the case of Equal Exchange - a fair-trade food company based in West Bridgewater, Massachusetts (www.equalexchange.coop). Alternatively, a cooperative might be formed by producers as in the case of Cooperative Regions of Organic Producers Pool (CROPP), better known by its brand name in grocery stores - Organic Valley - based in La Farge, Wisconsin. CROPP is owned by the 1,800 organic family farms that produce the dairy, eggs, and meat it distributes. 'We don't have any need for profits much over 2 percent,' CROPP CEO George Siemon said. 'We'd just pay taxes on it. We'd rather give it to the farmers' (Kelly, 2009, p. 6). Finally, a cooperative can be owned by customers as in the case of Bangladesh's Grameen Bank that is owned by the poor people who are its depositors and customers

Upside potential for Profits Description Social enterprise structure For-profit structure For-profit ex: Bharat Financial Inclusion (formerly SKS Microfinance and now wholly owned by Indusind Bank) Nonprofit structure Nonprofit with a mission- related enterprise ex: Essential Eldercare (surplus revenues) ex: Fair Trade USA ex: Salesforce.com (business (revenue shortage) philanthropy) Social value For-profit with a social overlay ex: Equal Exchange (worker co-op) ex: Organic Valley (producer co-op) ex: Grameen Bank (customer co-op) Nonprofit ex: Acumen Fund Kiva Ashoka Figure 12.5 Profit/social value potential for social enterprise structures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started