Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Describe how taxes that depend positively on real GDP reduce the size of the multiplier and act as an automatic stabilizer for the economy Let's

Describe how taxes that depend positively on real GDP reduce the size of the multiplier and act as an automatic stabilizer for the economy

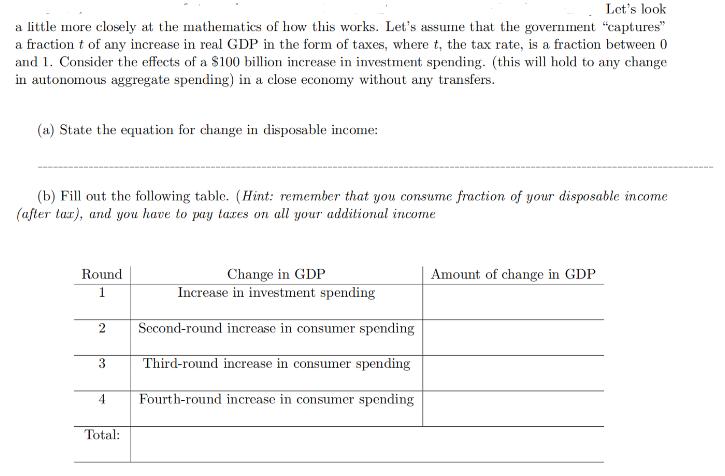

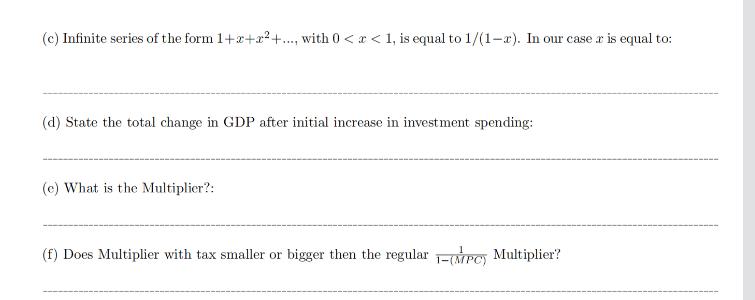

Let's look a little more closely at the mathematics of how this works. Let's assume that the government "captures" a fraction t of any increase in real GDP in the form of taxes, where t, the tax rate, is a fraction between 0 and 1. Consider the effects of a $100 billion increase in investment spending. (this will hold to any change in autonomous aggregate spending) in a close economy without any transfers. (a) State the equation for change in disposable income: (b) Fill out the following table. (Hint: remember that you consume fraction of your disposable income (after tar), and you have to pay taxes on all your additional income Round 1 2 3 4 Total: Change in GDP Increase in investment spending Second-round increase in consumer spending Third-round increase in consumer spending Fourth-round increase in consumer spending Amount of change in GDP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Taxes and the Multiplier Effect Taxes that depend positively on real GDP act as automatic stabilizer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started