Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Describe how you would handle the following: You are about to start preparing monthly financials. What is your first step? Describe below. A vendor claims

Describe how you would handle the following:

- You are about to start preparing monthly financials.

- What is your first step? Describe below.

A vendor claims they did not receive payment.

Describe your steps to look into the issue below.

- Craft a response to the following scenario:

- You are taking a vacation from the 6th to the 12th and are concerned about hitting the client's financial deadline on the 15th. Draft an email to the client on how to address the situation using the space below:

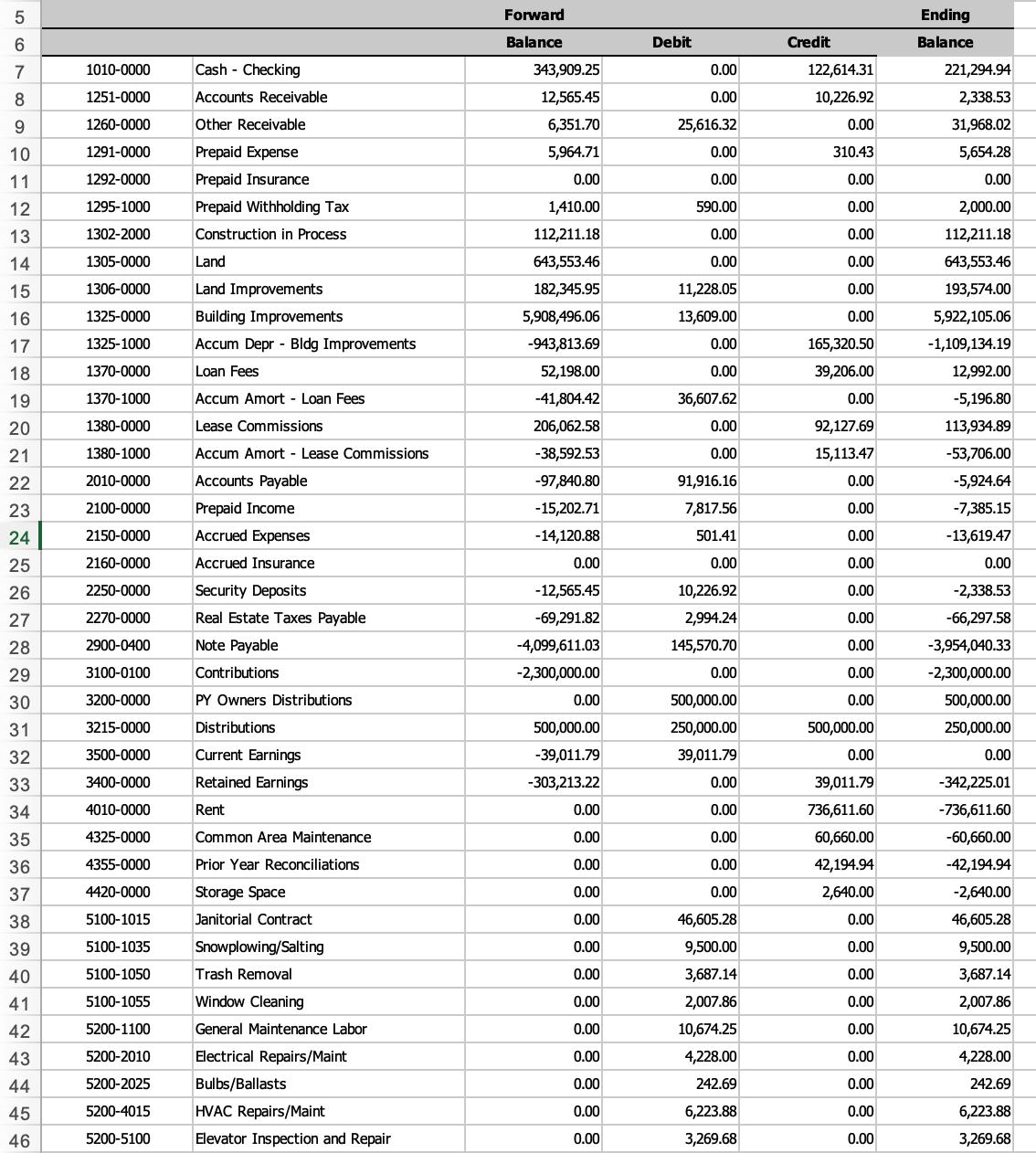

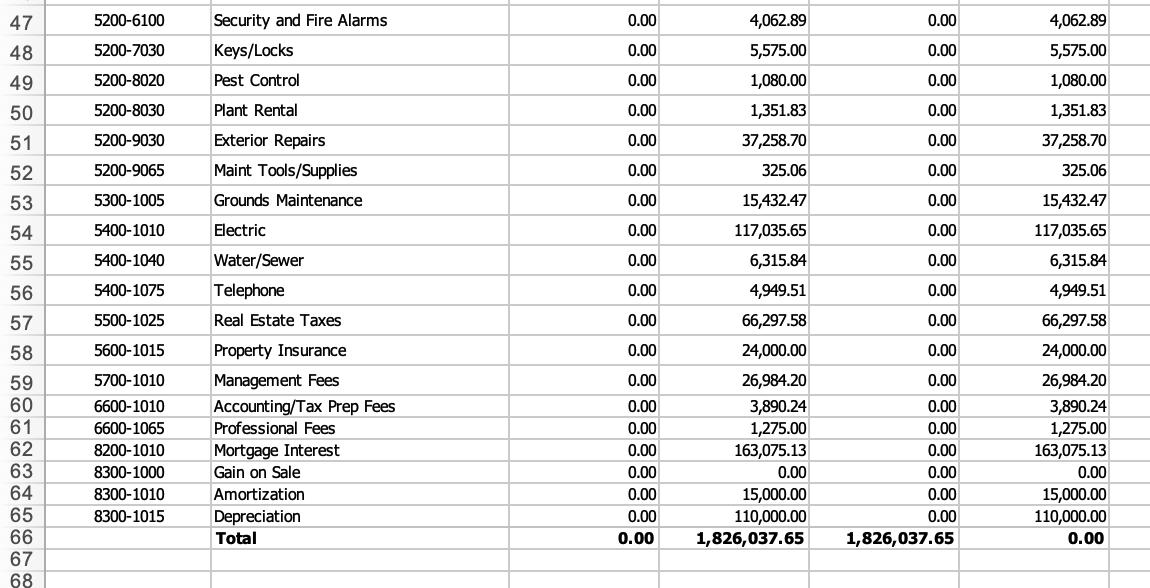

567 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 1010-0000 1251-0000 1260-0000 1291-0000 1292-0000 1295-1000 1302-2000 1305-0000 1306-0000 1325-0000 1325-1000 1370-0000 1370-1000 1380-0000 1380-1000 2010-0000 2100-0000 2150-0000 2160-0000 2250-0000 2270-0000 2900-0400 3100-0100 3200-0000 3215-0000 3500-0000 3400-0000 4010-0000 4325-0000 4355-0000 4420-0000 5100-1015 5100-1035 5100-1050 5100-1055 5200-1100 5200-2010 5200-2025 5200-4015 5200-5100 Cash Checking Accounts Receivable Other Receivable Prepaid Expense Prepaid Insurance Prepaid Withholding Tax Construction in Process Land Land Improvements Building Improvements Accum Depr - Bldg Improvements Loan Fees Accum Amort Loan Fees Lease Commissions Accum Amort - Lease Commissions Accounts Payable Prepaid Income Accrued Expenses Accrued Insurance Security Deposits Real Estate Taxes Payable Note Payable Contributions PY Owners Distributions Distributions Current Earnings Retained Earnings Rent Common Area Maintenance Prior Year Reconciliations Storage Space Janitorial Contract Snowplowing/Salting Trash Removal Window Cleaning General Maintenance Labor Electrical Repairs/Maint Bulbs/Ballasts HVAC Repairs/Maint Elevator Inspection and Repair Forward Balance 343,909.25 12,565.45 6,351.70 5,964.71 0.00 1,410.00 112,211.18 643,553.46 182,345.95 5,908,496.06 -943,813.69 52,198.00 -41,804.42 206,062.58 -38,592.53 -97,840.80 -15,202.71 -14,120.88 0.00 -12,565.45 -69,291.82 -4,099,611.03 -2,300,000.00 0.00 500,000.00 -39,011.79 -303,213.22 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Debit 0.00 0.00 25,616.32 0.00 0.00 590.00 0.00 0.00 11,228.05 13,609.00 0.00 0.00 36,607.62 0.00 0.00 91,916.16 7,817.56 501.41 0.00 10,226.92 2,994.24 145,570.70 0.00 500,000.00 250,000.00 39,011.79 0.00 0.00 0.00 0.00 0.00 46,605.28 9,500.00 3,687.14 2,007.86 10,674.25 4,228.00 242.69 6,223.88 3,269.68 Credit 122,614.31 10,226.92 0.00 310.43 0.00 0.00 0.00 0.00 0.00 0.00 165,320.50 39,206.00 0.00 92,127.69 15,113.47 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 500,000.00 0.00 39,011.79 736,611.60 60,660.00 42,194.94 2,640.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Ending Balance 221,294.94 2,338.53 31,968.02 5,654.28 0.00 2,000.00 112,211.18 643,553.46 193,574.00 5,922,105.06 -1,109,134.19 12,992.00 -5,196.80 113,934.89 -53,706.00 -5,924.64 -7,385.15 -13,619.47 0.00 -2,338.53 -66,297.58 -3,954,040.33 -2,300,000.00 500,000.00 250,000.00 0.00 -342,225.01 -736,611.60 -60,660.00 -42,194.94 -2,640.00 46,605.28 9,500.00 3,687.14 2,007.86 10,674.25 4,228.00 242.69 6,223.88 3,269.68

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to refer to various tasks related to accounting and financial management Lets address each task separately 1 Preparing monthly fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started