Answered step by step

Verified Expert Solution

Question

1 Approved Answer

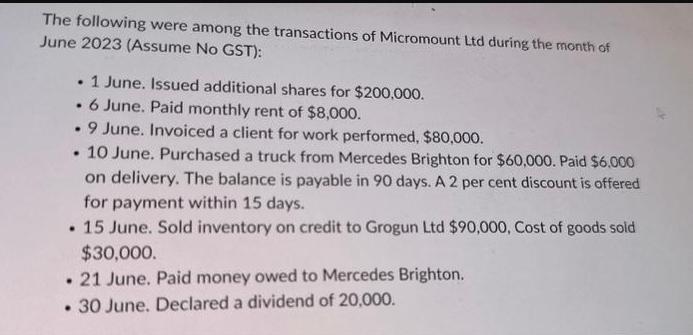

The following were among the transactions of Micromount Ltd during the month of June 2023 (Assume No GST): 1 June. Issued additional shares for

The following were among the transactions of Micromount Ltd during the month of June 2023 (Assume No GST): 1 June. Issued additional shares for $200,000. . 6 June. Paid monthly rent of $8,000. 9 June. Invoiced a client for work performed, $80,000. . 10 June. Purchased a truck from Mercedes Brighton for $60,000. Paid $6.000 on delivery. The balance is payable in 90 days. A 2 per cent discount is offered for payment within 15 days. 15 June. Sold inventory on credit to Grogun Ltd $90,000, Cost of goods sold $30,000. 21 June. Paid money owed to Mercedes Brighton. 30 June. Declared a dividend of 20,000. REQUIRED Prepare the general journal entries to record the above transactions. Narrations are not required.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the general journal entries to record the transactions of Micromount Ltd during the month o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started