Answered step by step

Verified Expert Solution

Question

1 Approved Answer

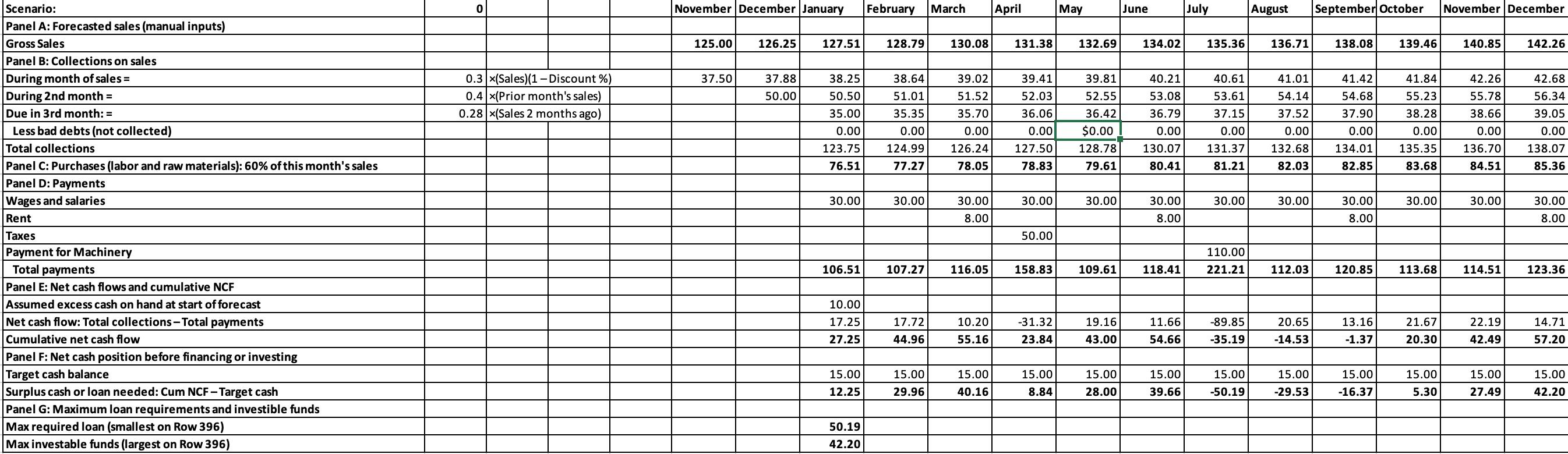

Describe s some of the short-term borrowing options that the company may adopt. 0 November December January February March April May June July August September

Describe s some of the short-term borrowing options that the company may adopt.

0 November December January February March April May June July August September October November December 125.00 126.25 127.51 128.79 130.08 131.38 132.69 134.02 135.36 136.71 138.08 139.46 140.85 142.26 37.50 40.21 40.61 0.3 x(Sales)(1 - Discount %) 0.4 x(Prior month's sales) 0.28 x(Sales 2 months ago) 37.88 50.00 Scenario: Panel A: Forecasted sales (manual inputs) Gross Sales Panel B: Collections on sales During month of sales = During 2nd month = Due in 3rd month: = Less bad debts (not collected) Total collections Panel C: Purchases (labor and raw materials): 60% of this month's sales Panel D: Payments Wages and salaries 38.64 51.01 38.25 50.50 35.00 0.00 123.75 76.51 39.02 51.52 35.70 0.00 126.24 78.05 39.41 52.03 36.06 0.00 35.35 0.00 124.99 39.81 52.55 36.42 $0.00 128.78 79.61 53.08 36.79 0.00 130.07 80.41 53.61 37.15 0.00 41.01 54.14 37.52 0.00 132.68 82.03 41.42 54.68 37.90 0.00 41.84 55.23 38.28 0.00 135.35 83.68 42.26 55.78 38.66 0.00 136.70 84.51 42.68 56.34 39.05 0.00 138.07 85.36 127.50 78.83 131.37 81.21 134.01 82.85 77.27 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 8.00 Rent 8.00 8.00 8.00 50.00 110.00 106.51 107.27 116.05 158.83 109.61 118.41 221.21 112.03 120.85 113.68 114.51 123.36 10.00 17.25 17.72 -31.32 19.16 -89.85 13.16 Taxes Payment for Machinery Total payments Panel E: Net cash flows and cumulative NCF Assumed excess cash on hand at start of forecast Net cash flow: Total collections - Total payments Cumulative net cash flow Panel F: Net cash position before financing or investing Target cash balance Surplus cash or loan needed: Cum NCF - Target cash Panel G: Maximum loan requirements and investible funds Max required loan (smallest on Row 396) Max investable funds (largest on Row 396) 10.20 55.16 11.66 54.66 20.65 -14.53 21.67 20.30 22.19 42.49 14.71 57.20 27.25 44.96 23.84 43.00 -35.19 -1.37 15.00 15.00 15.00 15.00 15.00 15.00 15.00 8.84 15.00 -50.19 15.00 -29.53 15.00 -16.37 15.00 5.30 15.00 42.20 12.25 29.96 40.16 28.00 39.66 27.49 50.19 42.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started