Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Describe the character of each of these book/tax differences as 1) a permanent or temporary difference or neither, and 2) if a temporary

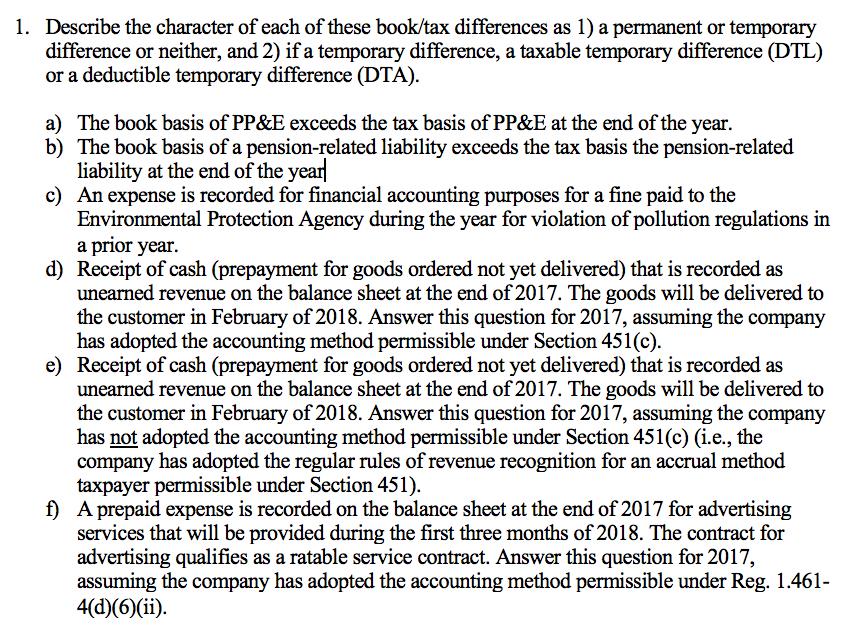

1. Describe the character of each of these book/tax differences as 1) a permanent or temporary difference or neither, and 2) if a temporary difference, a taxable temporary difference (DTL) or a deductible temporary difference (DTA). a) The book basis of PP&E exceeds the tax basis of PP&E at the end of the year. b) The book basis of a pension-related liability exceeds the tax basis the pension-related liability at the end of the year c) An expense is recorded for financial accounting purposes for a fine paid to the Environmental Protection Agency during the year for violation of pollution regulations in a prior year. d) Receipt of cash (prepayment for goods ordered not yet delivered) that is recorded as unearned revenue on the balance sheet at the end of 2017. The goods will be delivered to the customer in February of 2018. Answer this question for 2017, assuming the company has adopted the accounting method permissible under Section 451(c). e) Receipt of cash (prepayment for goods ordered not yet delivered) that is recorded as unearned revenue on the balance sheet at the end of 2017. The goods will be delivered to the customer in February of 2018. Answer this question for 2017, assuming the company has not adopted the accounting method permissible under Section 451(c) (i.e., the company has adopted the regular rules of revenue recognition for an accrual method taxpayer permissible under Section 451). f) A prepaid expense is recorded on the balance sheet at the end of 2017 for advertising services that will be provided during the first three months of 2018. The contract for advertising qualifies as a ratable service contract. Answer this question for 2017, assuming the company has adopted the accounting method permissible under Reg. 1.461- 4(d)(6)(ii).

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Book basis of PPE exceeds the tax basis of PPE this is due to the difference in depreciation rates ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started