Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Describe the probability histogram of the Craps distribution. Select all that apply. Symmetric Skewed Single mode ( peak ) Multiple modes ( peaks ) Normal

Describe the probability histogram of the "Craps" distribution. Select all that apply.

Symmetric

Skewed

Single mode peak

Multiple modes peaks

Normal

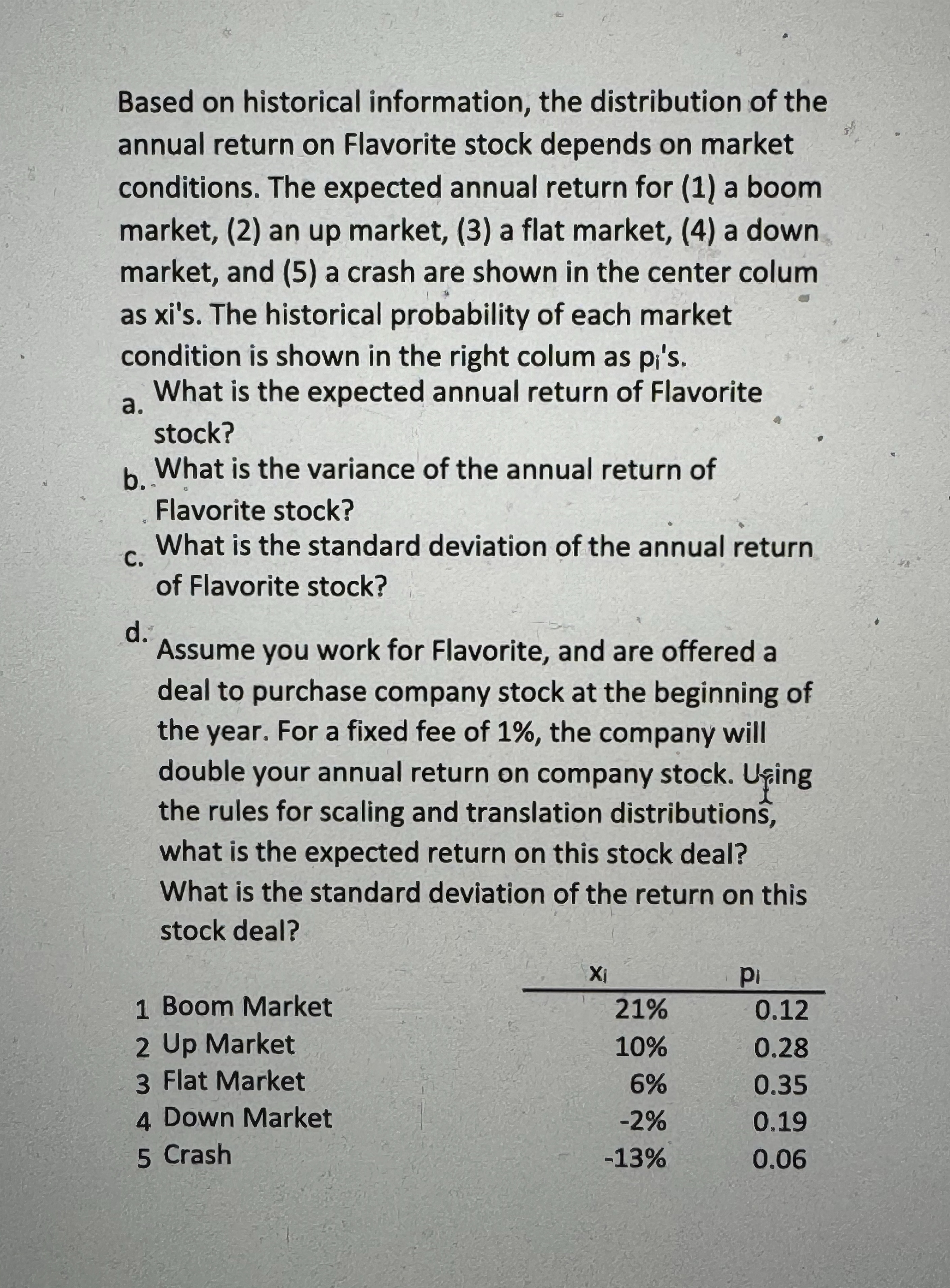

Based on historical information, the distribution of the annual return on Flavorite stock depends on market conditions. The expected annual return for a boom market, an up market, a flat market, a down market, and a crash are shown in the center colum as xi's. The historical probability of each market condition is shown in the right colum as pi's.

a What is the expected annual return of Flavorite stock?

b What is the variance of the annual return of Flavorite stock?

c What is the standard deviation of the annual return of Flavorite stock?

d Assume you work for Flavorite, and are offered a deal to purchase company stock at the beginning of the year. For a fixed fee of the company will double your annual return on company stock. Using the rules for scaling and translation distributions, what is the expected return on this stock deal? What is the standard deviation of the return on this stock deal?

tablea Expected Return

b Variance

c Standard Devation

d Expected Return Variance Standard Devation

Based on historical information, the distribution of the annual return on Flavorite stock depends on market conditions. The expected annual return for a boom market, an up market, a flat market, a down market, and a crash are shown in the center colum as xi's. The historical probability of each market condition is shown in the right colum as pi's.

a What is the expected annual return of Flavorite stock?

b What is the variance of the annual return of Flavorite stock?

c What is the standard deviation of the annual return of Flavorite stock?

d Assume you work for Flavorite, and are offered a deal to purchase company stock at the beginning of the year. For a fixed fee of the company will double your annual return on company stock. Ufing the rules for scaling and translation distributions, what is the expected return on this stock deal? What is the standard deviation of the return on this stock deal?

table

A Expected Return

B Variance

C Standard Deviation

D Expected Return

Variance

Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started