Answered step by step

Verified Expert Solution

Question

1 Approved Answer

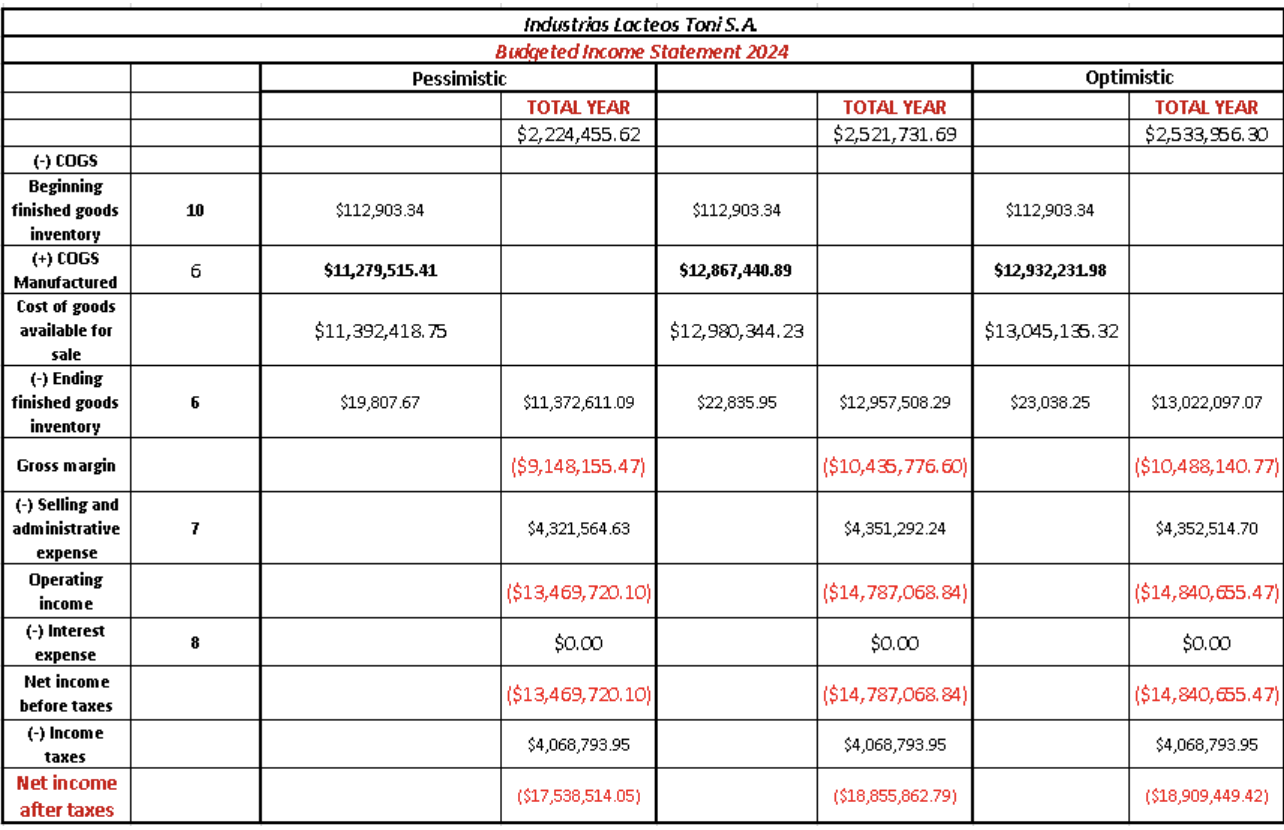

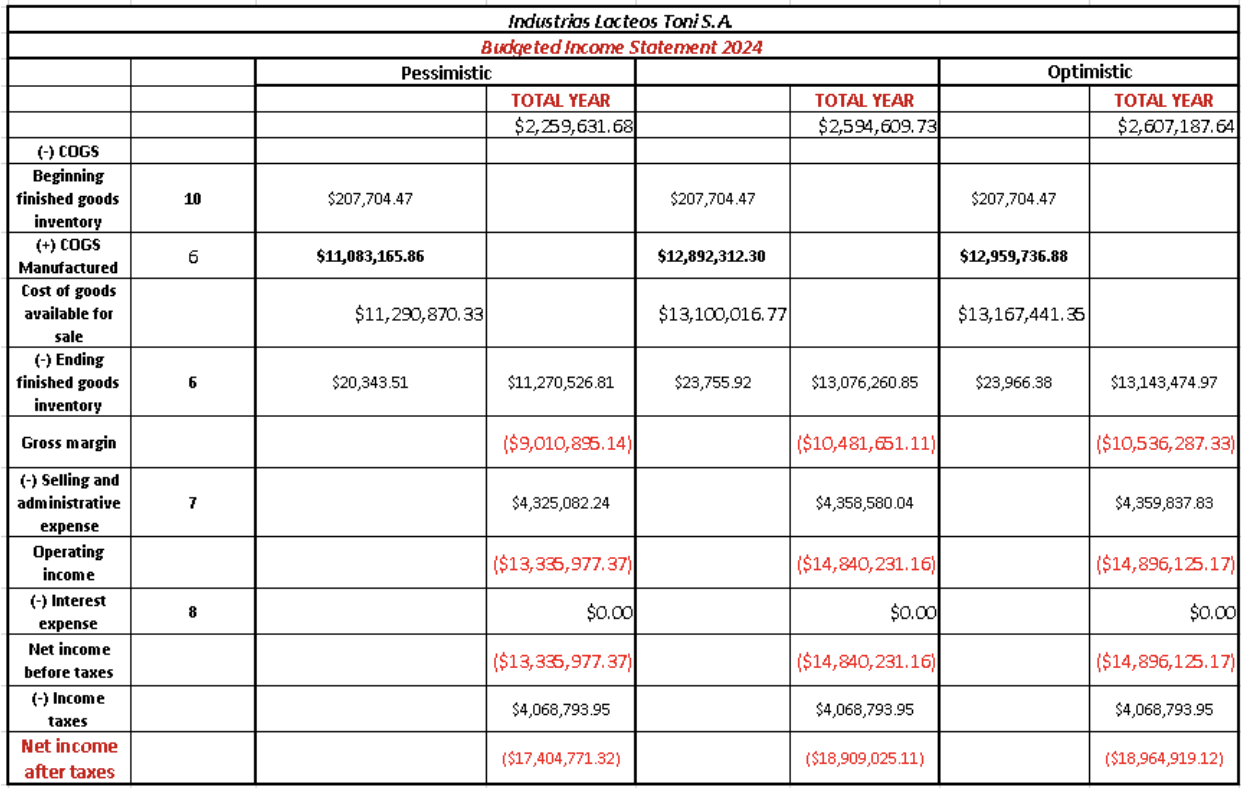

Describe the projection of these income statements for 2023, 2024. , What highlights do you found on them or in what should the company focus?

Describe the projection of these income statements for 2023, 2024. , What highlights do you found on them or in what should the company focus?

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Indistrias Locteos ToniS.A. } \\ \hline \multicolumn{8}{|c|}{ Budgeted income Statement 2024} \\ \hline & & \multicolumn{2}{|c|}{ Pessimistic } & & & \multicolumn{2}{|c|}{ Optimistic } \\ \hline & & & TOTAL YEAR & & TOTAL YEAR & & TOTAL YEAR \\ \hline & & & $2,224,455.62 & & $2,521,731.69 & & $2,533,956.30 \\ \hline (-) cogs & & & & & & & \\ \hline \begin{tabular}{c} Beginning \\ finished goods \\ inventory \end{tabular} & 10 & $112,903.34 & & $112,903.34 & & $112,903.34 & \\ \hline \begin{tabular}{c} (+) COGS \\ Manufactured \end{tabular} & 6 & $11,279,515.41 & & $12,867,440.89 & & $12,932,231.98 & \\ \hline \begin{tabular}{c} Cost of goods \\ available for \\ sale \end{tabular} & & $11,392,418.75 & & $12,990,344.23 & & $13,045,136.32 & \\ \hline \begin{tabular}{c} (-) Ending \\ finished goods \\ inventory \end{tabular} & 6 & $19,807.67 & $11,372,611.09 & $22,835.95 & $12,957,508.29 & $23,038.25 & $13,022,097.07 \\ \hline Gross margin & & & $9,148,155.47 & & ($10,435,776.60) & & ($10,488,140.77) \\ \hline \begin{tabular}{c} (-) Selling and \\ administrative \\ expense \end{tabular} & 7 & & $4,321,564.63 & & $4,351,292.24 & & $4,352,514.70 \\ \hline \begin{tabular}{c} Operating \\ income \end{tabular} & & & $13,469,720,10 & & {$14,787,068.84 & & \$14,840,655.47) \\ \hline \begin{tabular}{l} (-) Interest \\ expense \end{tabular} & 8 & & $0.00 & & $0.00 & & $0.00 \\ \hline \begin{tabular}{l} Net income \\ before taxes \end{tabular} & & & $13,469,720.10} & & {$14,787,068.84} & & $14,840,655.47 \\ \hline \begin{tabular}{c} (-) Income \\ taxes \end{tabular} & & & $4,068,793.95 & & $4,068,793.95 & & $4,068,793.95 \\ \hline \begin{tabular}{l} Net income \\ after taxes \end{tabular} & & & ($17,538,514.05) & & ($18,855,862.79) & & ($18,909,449.42) \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Industrias Lacteos ToniS.A. } \\ \hline \multicolumn{8}{|c|}{ Budgeted income Stotement 2024} \\ \hline & & \multicolumn{2}{|l|}{ Pessimistic } & & & \multicolumn{2}{|c|}{ Optimistic } \\ \hline & & & TOTAL YEAR & & TOTAL YEAR & & TOTAL YEAR \\ \hline & & & $2,259,631.68 & & $2,594,609.73 & & $2,607,187,64 \\ \hline (-) coGs & & & & & & & \\ \hline \begin{tabular}{c} Beginning \\ finished goods \\ inventory \end{tabular} & 10 & $207,704.47 & & $207,704.47 & & $207,704.47 & \\ \hline \begin{tabular}{c} (+) COGS \\ Manufactured \end{tabular} & 6 & $11,083,165.86 & & $12,892,312.30 & & $12,959,736.88 & \\ \hline \begin{tabular}{c} Cost of goods \\ available for \\ sale \end{tabular} & & $11,290,870.33 & & $13,100,016.77 & & $13,167,441.35 & \\ \hline \begin{tabular}{c} (-) Ending \\ finished goods \\ inventory \end{tabular} & 6 & $20,343.51 & $11,270,526.81 & $23,755.92 & $13,076,260.85 & $23,966.38 & $13,143,474.97 \\ \hline Gross margin & & & $9,010,895.14 & & $10,481,61.11 & & ($10,536,287,33) \\ \hline \begin{tabular}{l} (-) Selling and \\ administrative \\ expense \end{tabular} & 7 & & $4,325,082.24 & & $4,358,580.04 & & $4,359,837.83 \\ \hline \begin{tabular}{c} Operating \\ income \end{tabular} & & & ($13,335,977.37) & & ($14,840,231.16) & & ($14,896,125.17) \\ \hline \begin{tabular}{c} (-) Interest \\ expense \end{tabular} & 8 & & $0.00 & & $0.00 & & $0.00 \\ \hline \begin{tabular}{l} Net income \\ before taxes \end{tabular} & & & ($13,335,977.37) & & ($14,840,231.16) & & $14,896,125.17 \\ \hline \begin{tabular}{c} (-) Income \\ taxes \end{tabular} & & & $4,068,793.95 & & $4,068,793.95 & & $4,068,793.95 \\ \hline \begin{tabular}{l} Net income \\ after taxes \end{tabular} & & & ($17,404,771.32) & & ($18,909,025.11) & & ($18,964,919.12) \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started