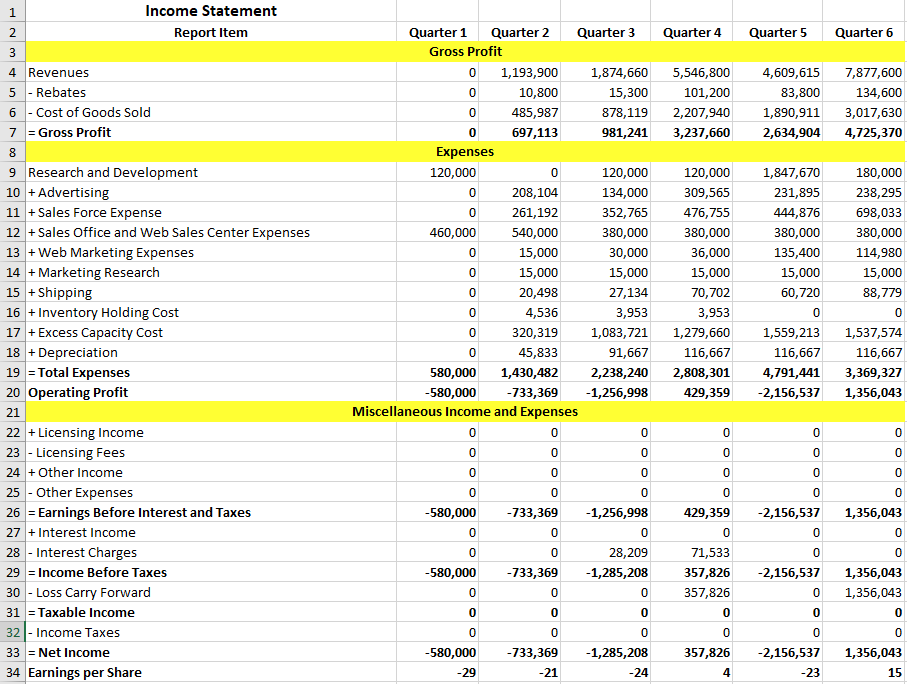

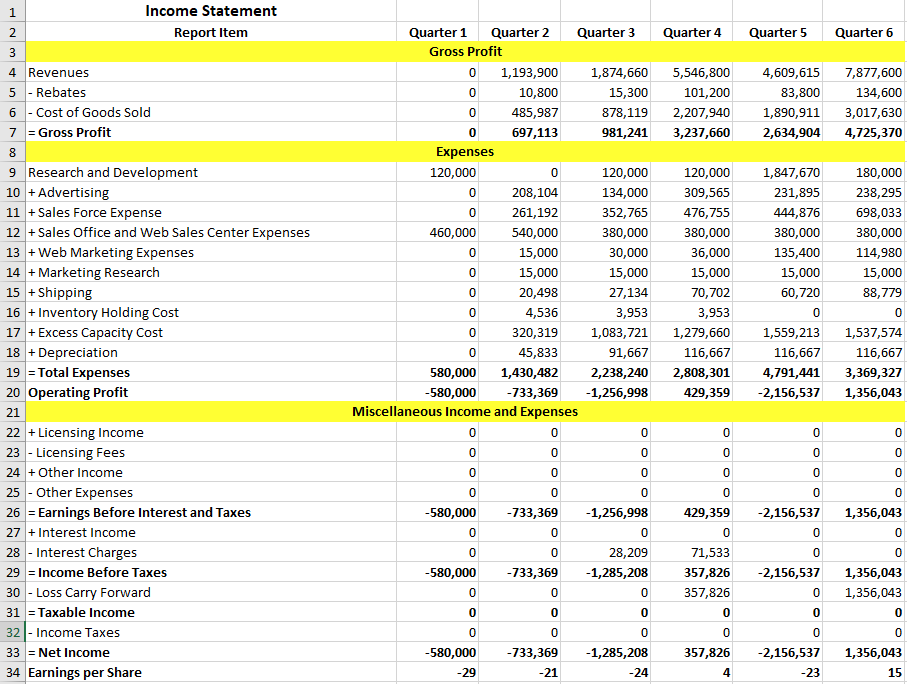

Describe this Income Statement, 3-5 paragraphs. (NO PLAGIARISM).

1 N N Quarter 4 Quarter 5 Quarter 6 5,546,800 101,200 2,207,940 3,237,660 4,609,615 83,800 1,890,911 2,634,904 7,877,600 134,600 3,017,630 4,725,370 + Income Statement Report Item 3 4 Revenues 5 - Rebates 6 - Cost of Goods Sold 7 = Gross Profit 8 9 Research and Development 10 + Advertising 11 + Sales Force Expense 12 + Sales Office and Web Sales Center Expenses 13 + Web Marketing Expenses 14 + Marketing Research 15 +Shipping 16 + Inventory Holding Cost 17 + Excess Capacity Cost 18 + Depreciation 19 = Total Expenses 20 Operating Profit 21 22 + Licensing Income 23 - Licensing Fees 24 + Other Income 25 - Other Expenses 26 = Earnings Before Interest and Taxes 27 +Interest Income 28 - Interest Charges 29 = Income Before Taxes 30 - Loss Carry Forward 31 = Taxable income 32 - Income Taxes 33 = Net Income 34 Earnings per Share Quarter 1 Quarter 2 Quarter 3 Gross Profit 0 1,193,900 1,874,660 0 10,800 15,300 0 485,987 878,119 0 697,113 981,241 Expenses 120,000 0 120,000 0 208,104 134,000 0 261,192 352,765 460,000 540,000 380,000 0 15,000 30,000 0 15,000 15,000 0 20,498 27,134 0 4,536 3,953 0 320,319 1,083,721 0 45,833 91,667 580,000 1,430,482 2,238,240 -580,000 -733,369 -1,256,998 Miscellaneous Income and Expenses 0 0 0 0 0 0 0 0 0 0 0 -580,000 -733,369 -1,256,998 0 0 0 0 0 28,209 -580,000 -733,369 -1,285,208 0 0 0 0 0 0 120,000 309,565 476,755 380,000 36,000 15,000 70,702 3,953 1,279,660 116,667 2,808,301 429,359 1,847,670 231,895 444,876 380,000 135,400 15,000 60,720 0 1,559,213 116,667 4,791,441 -2,156,537 180,000 238,295 698,033 380,000 114,980 15,000 88,779 0 1,537,574 116,667 3,369,327 1,356,043 0 0 0 O 0 0 0 0 0 0 0 0 0 0 1,356,043 0 429,359 0 - -2,156,537 0 0 -2,156,537 0 71,533 357,826 357,826 0 0 1,356,043 1,356,043 0 0 0 0 0 0 0 0 -580,000 -29 -733,369 -21 -1,285,208 -24 357,826 4 -2,156,537 -23 1,356,043 15 1 N N Quarter 4 Quarter 5 Quarter 6 5,546,800 101,200 2,207,940 3,237,660 4,609,615 83,800 1,890,911 2,634,904 7,877,600 134,600 3,017,630 4,725,370 + Income Statement Report Item 3 4 Revenues 5 - Rebates 6 - Cost of Goods Sold 7 = Gross Profit 8 9 Research and Development 10 + Advertising 11 + Sales Force Expense 12 + Sales Office and Web Sales Center Expenses 13 + Web Marketing Expenses 14 + Marketing Research 15 +Shipping 16 + Inventory Holding Cost 17 + Excess Capacity Cost 18 + Depreciation 19 = Total Expenses 20 Operating Profit 21 22 + Licensing Income 23 - Licensing Fees 24 + Other Income 25 - Other Expenses 26 = Earnings Before Interest and Taxes 27 +Interest Income 28 - Interest Charges 29 = Income Before Taxes 30 - Loss Carry Forward 31 = Taxable income 32 - Income Taxes 33 = Net Income 34 Earnings per Share Quarter 1 Quarter 2 Quarter 3 Gross Profit 0 1,193,900 1,874,660 0 10,800 15,300 0 485,987 878,119 0 697,113 981,241 Expenses 120,000 0 120,000 0 208,104 134,000 0 261,192 352,765 460,000 540,000 380,000 0 15,000 30,000 0 15,000 15,000 0 20,498 27,134 0 4,536 3,953 0 320,319 1,083,721 0 45,833 91,667 580,000 1,430,482 2,238,240 -580,000 -733,369 -1,256,998 Miscellaneous Income and Expenses 0 0 0 0 0 0 0 0 0 0 0 -580,000 -733,369 -1,256,998 0 0 0 0 0 28,209 -580,000 -733,369 -1,285,208 0 0 0 0 0 0 120,000 309,565 476,755 380,000 36,000 15,000 70,702 3,953 1,279,660 116,667 2,808,301 429,359 1,847,670 231,895 444,876 380,000 135,400 15,000 60,720 0 1,559,213 116,667 4,791,441 -2,156,537 180,000 238,295 698,033 380,000 114,980 15,000 88,779 0 1,537,574 116,667 3,369,327 1,356,043 0 0 0 O 0 0 0 0 0 0 0 0 0 0 1,356,043 0 429,359 0 - -2,156,537 0 0 -2,156,537 0 71,533 357,826 357,826 0 0 1,356,043 1,356,043 0 0 0 0 0 0 0 0 -580,000 -29 -733,369 -21 -1,285,208 -24 357,826 4 -2,156,537 -23 1,356,043 15