Described below are four situations, which have arisen at four unrelated audit clients of your firm. The year end for each client is 31

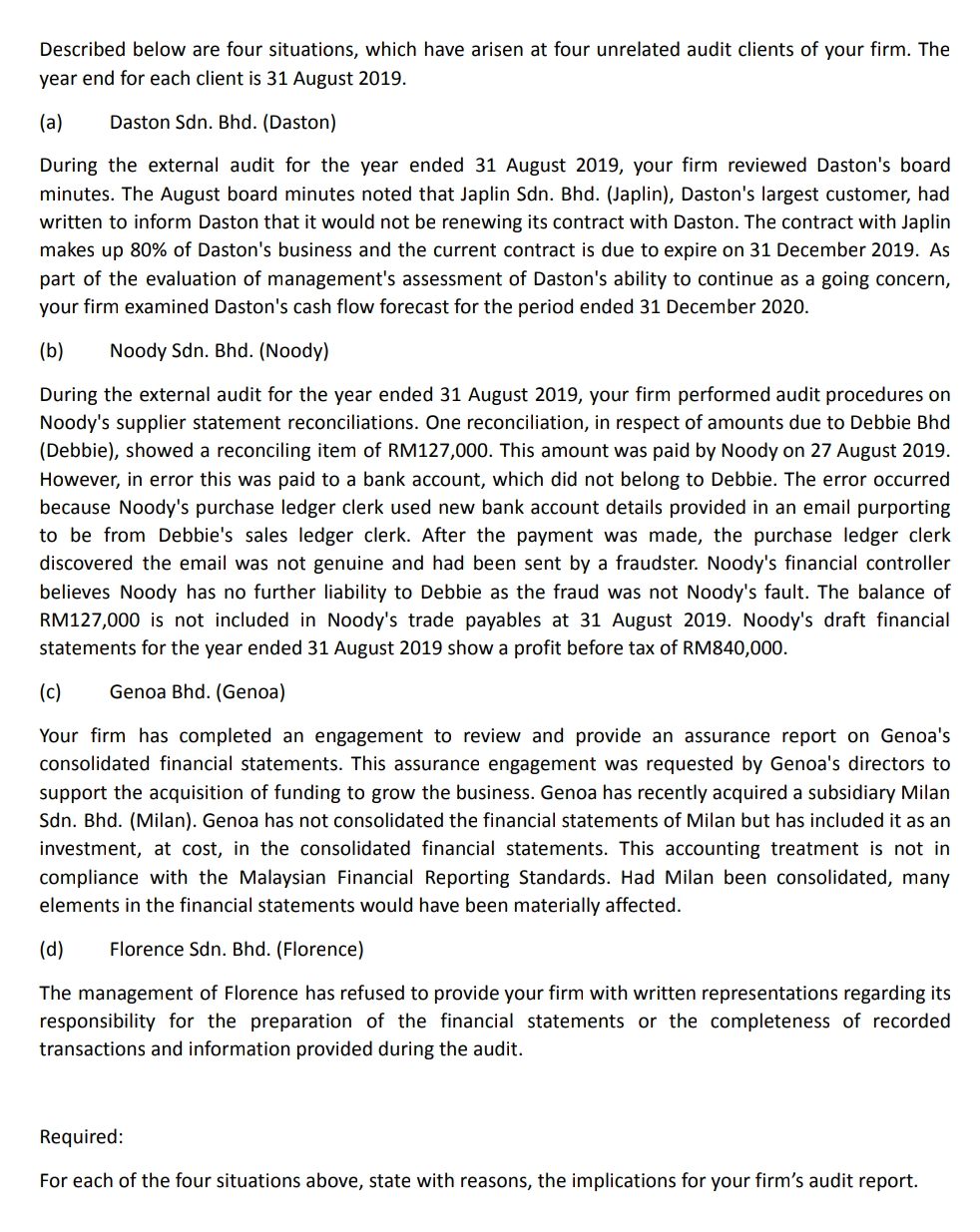

Described below are four situations, which have arisen at four unrelated audit clients of your firm. The year end for each client is 31 August 2019. (a) Daston Sdn. Bhd. (Daston) During the external audit for the year ended 31 August 2019, your firm reviewed Daston's board minutes. The August board minutes noted that Japlin Sdn. Bhd. (Japlin), Daston's largest customer, had written to inform Daston that it would not be renewing its contract with Daston. The contract with Japlin makes up 80% of Daston's business and the current contract is due to expire on 31 December 2019. As part of the evaluation of management's assessment of Daston's ability to continue as a going concern, your firm examined Daston's cash flow forecast for the period ended 31 December 2020. (b) Noody Sdn. Bhd. (Noody) During the external audit for the year ended 31 August 2019, your firm performed audit procedures on Noody's supplier statement reconciliations. One reconciliation, in respect of amounts due to Debbie Bhd (Debbie), showed a reconciling item of RM127,000. This amount was paid by Noody on 27 August 2019. However, in error this was paid to a bank account, which did not belong to Debbie. The error occurred because Noody's purchase ledger clerk used new bank account details provided in an email purporting to be from Debbie's sales ledger clerk. After the payment was made, the purchase ledger clerk discovered the email was not genuine and had been sent by a fraudster. Noody's financial controller believes Noody has no further liability to Debbie as the fraud was not Noody's fault. The balance of RM127,000 is not included in Noody's trade payables at 31 August 2019. Noody's draft financial statements for the year ended 31 August 2019 show a profit before tax of RM840,000. (c) Genoa Bhd. (Genoa) Your firm has completed an engagement to review and provide an assurance report on Genoa's consolidated financial statements. This assurance engagement was requested by Genoa's directors to support the acquisition of funding to grow the business. Genoa has recently acquired a subsidiary Milan Sdn. Bhd. (Milan). Genoa has not consolidated the financial statements of Milan but has included it as an investment, at cost, in the consolidated financial statements. This accounting treatment is not in compliance with the Malaysian Financial Reporting Standards. Had Milan been consolidated, many elements in the financial statements would have been materially affected. (d) Florence Sdn. Bhd. (Florence) The management of Florence has refused to provide your firm with written representations regarding its responsibility for the preparation of the financial statements or the completeness of recorded transactions and information provided during the audit. Required: For each of the four situations above, state with reasons, the implications for your firm's audit report.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Daston Sdn Bhd Daston The nonrenewal of the contract with Dastons largest customer which makes up 80 of Dastons business raises significant doubt ab...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started