Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Described below are three Independent and unrelated situatlons involving accounting changes. Each change occurs during 2024 before any adjusting entrles or closing entrles are prepared.

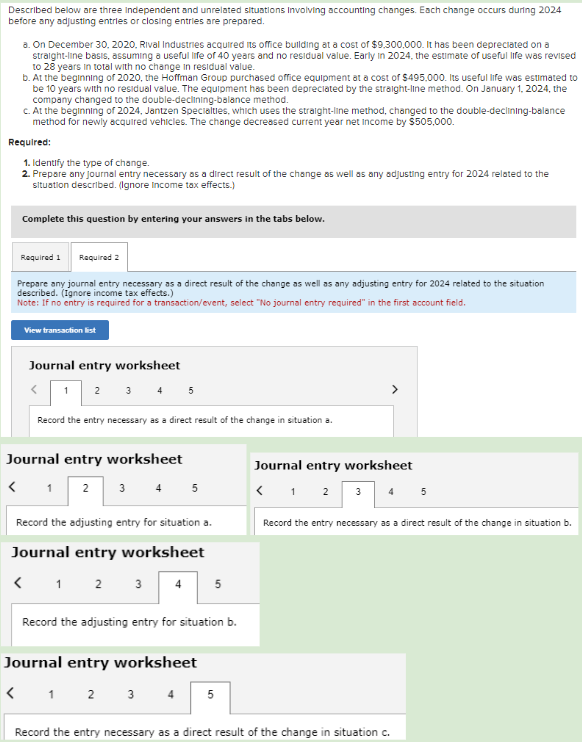

Described below are three Independent and unrelated situatlons involving accounting changes. Each change occurs during 2024 before any adjusting entrles or closing entrles are prepared. a. On December 30, 2020, Rival Industries acquired its orfice bullding at a cost of $9,300,000. It has been depreciated on a straight-Iine basis, assuming a useful life of 40 years and no residual value. Early in 2024 , the esumate of useful IIfe was revised to 28 years in total with no change in residual value. b. At the beginning of 2020 , the Hoffman Group purchased office equipment at a cost of $495,000. Its useful life was esumated to be 10 years with no residual value. The equipment has been depreclated by the straight-Ine method. On January 1, 2024, the company changed to the double-declining-balance method. c. At the beginning of 2024, Jantzen Specialties, which uses the straight-line method, changed to the double-declining-balance method for newly acquired vehicles. The change decreased current year net income by \$505,000. Required: 1. Identify the type of change. 2. Prepare any journal entry necessary as a direct result of the change as well as any adjusting entry for 2024 related to the sltustion described. (Ignore Income tox effects.) Complete this question by entering your answers in the tabs below. Prepare any journal entry necessary as a direct result of the change as well as any adjusting entry for 2024 related to the situation described. (Ignore income tax effects.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2345 Record the entry necessary as a direct result of the change in situation a. Journal entry worksheet 1 5 Record the adjusting entry for situation a. Journal entry worksheet

Described below are three Independent and unrelated situatlons involving accounting changes. Each change occurs during 2024 before any adjusting entrles or closing entrles are prepared. a. On December 30, 2020, Rival Industries acquired its orfice bullding at a cost of $9,300,000. It has been depreciated on a straight-Iine basis, assuming a useful life of 40 years and no residual value. Early in 2024 , the esumate of useful IIfe was revised to 28 years in total with no change in residual value. b. At the beginning of 2020 , the Hoffman Group purchased office equipment at a cost of $495,000. Its useful life was esumated to be 10 years with no residual value. The equipment has been depreclated by the straight-Ine method. On January 1, 2024, the company changed to the double-declining-balance method. c. At the beginning of 2024, Jantzen Specialties, which uses the straight-line method, changed to the double-declining-balance method for newly acquired vehicles. The change decreased current year net income by \$505,000. Required: 1. Identify the type of change. 2. Prepare any journal entry necessary as a direct result of the change as well as any adjusting entry for 2024 related to the sltustion described. (Ignore Income tox effects.) Complete this question by entering your answers in the tabs below. Prepare any journal entry necessary as a direct result of the change as well as any adjusting entry for 2024 related to the situation described. (Ignore income tax effects.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2345 Record the entry necessary as a direct result of the change in situation a. Journal entry worksheet 1 5 Record the adjusting entry for situation a. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started