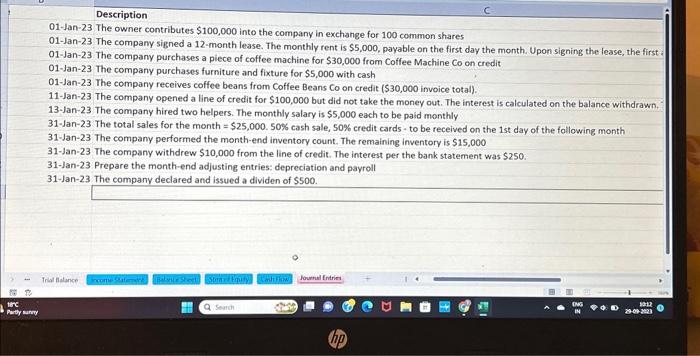

Description c 01-Jan-23 The owner contributes $100,000 into the company in exchange for 100 common shares 01-Jan-23 The company signed a 12-month lease. The monthly rent is $5,000, payable on the first day the month. Upon signing the lease, the first 01-Jan-23 The company purchases a piece of coffee machine for $30,000 from Coffee Machine Co on credit 01-Jan-23 The company purchases furniture and fixture for $5,000 with cash 01-Jan-23 The company receives coffee beans from Coffee Beans Co on credit ( $30,000 invoice total). 11-Jan-23 The company opened a line of credit for $100,000 but did not take the money out. The interest is calculated on the balance withdrawn. 13-Jan-23 The company hired two helpers. The monthly salary is $5,000 each to be paid monthly 31-Jan-23 The total sales for the month =$25,000.50% cash sale, 50% credit cards - to be received on the 1 st day of the following month 31-Jan-23 The company performed the month-end inventory count. The remaining inventory is $15,000 31-Jan-23 The company withdrew $10,000 from the line of credit. The interest per the bank statement was $250. 31-Jan-23 Prepare the month-end adjusting entries: depreciation and payroll 31-Jan-23 The company declared and issued a dividen of $500. Description c 01-Jan-23 The owner contributes $100,000 into the company in exchange for 100 common shares 01-Jan-23 The company signed a 12-month lease. The monthly rent is $5,000, payable on the first day the month. Upon signing the lease, the first 01-Jan-23 The company purchases a piece of coffee machine for $30,000 from Coffee Machine Co on credit 01-Jan-23 The company purchases furniture and fixture for $5,000 with cash 01-Jan-23 The company receives coffee beans from Coffee Beans Co on credit ( $30,000 invoice total). 11-Jan-23 The company opened a line of credit for $100,000 but did not take the money out. The interest is calculated on the balance withdrawn. 13-Jan-23 The company hired two helpers. The monthly salary is $5,000 each to be paid monthly 31-Jan-23 The total sales for the month =$25,000.50% cash sale, 50% credit cards - to be received on the 1 st day of the following month 31-Jan-23 The company performed the month-end inventory count. The remaining inventory is $15,000 31-Jan-23 The company withdrew $10,000 from the line of credit. The interest per the bank statement was $250. 31-Jan-23 Prepare the month-end adjusting entries: depreciation and payroll 31-Jan-23 The company declared and issued a dividen of $500