Answered step by step

Verified Expert Solution

Question

1 Approved Answer

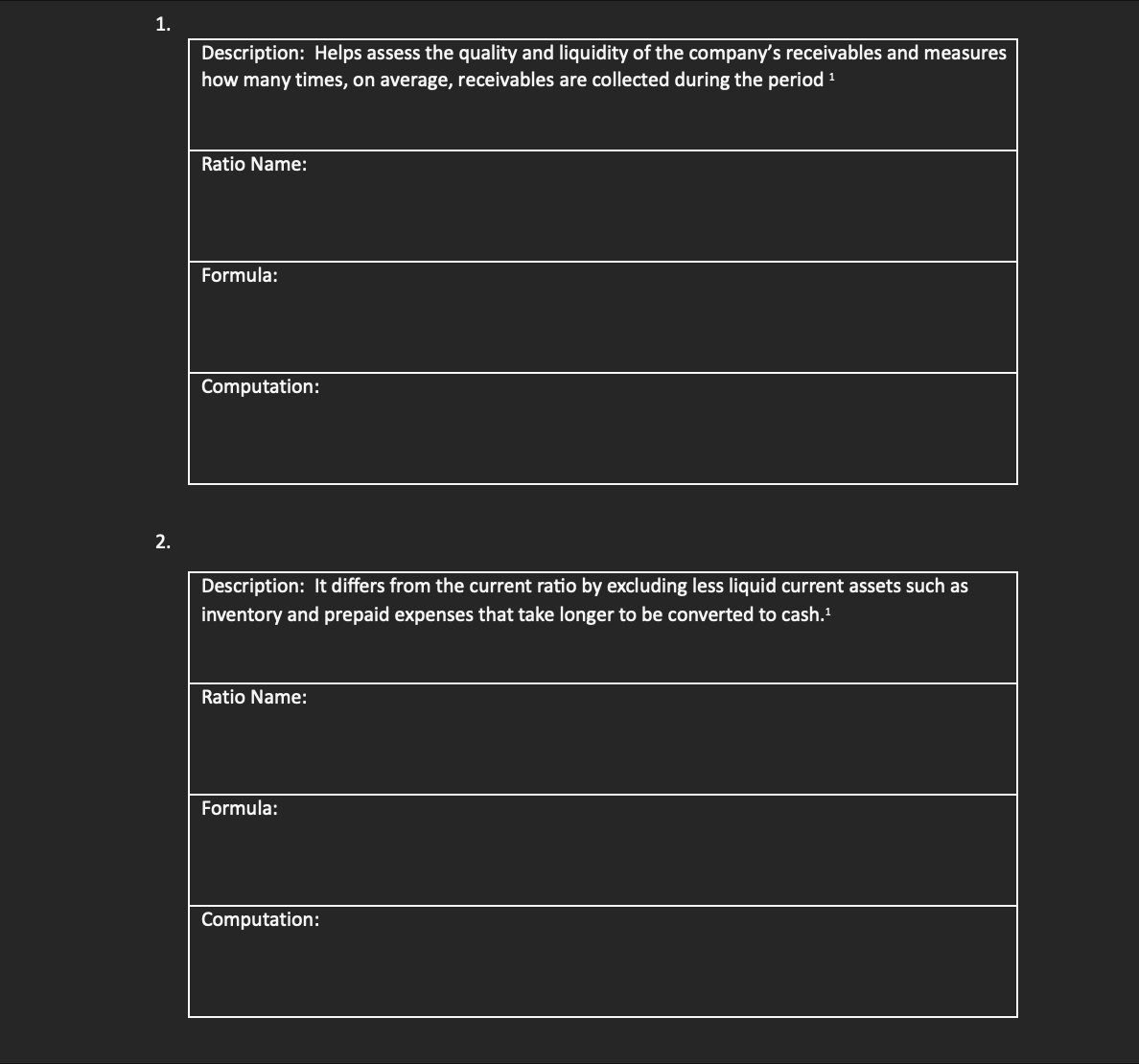

Description: Helps assess the quality and liquidity of the company's receivables and measures how many times, on average, receivables are collected during the period 1

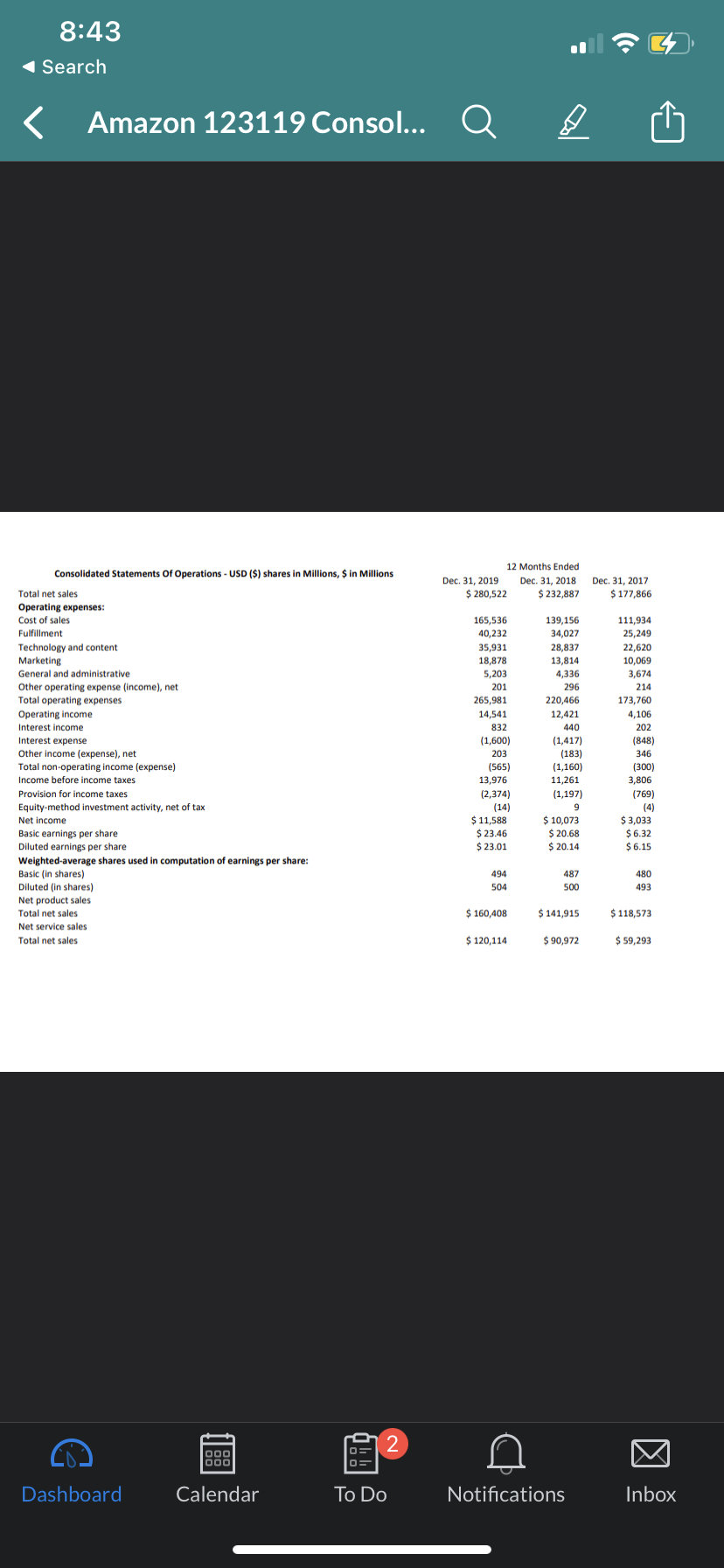

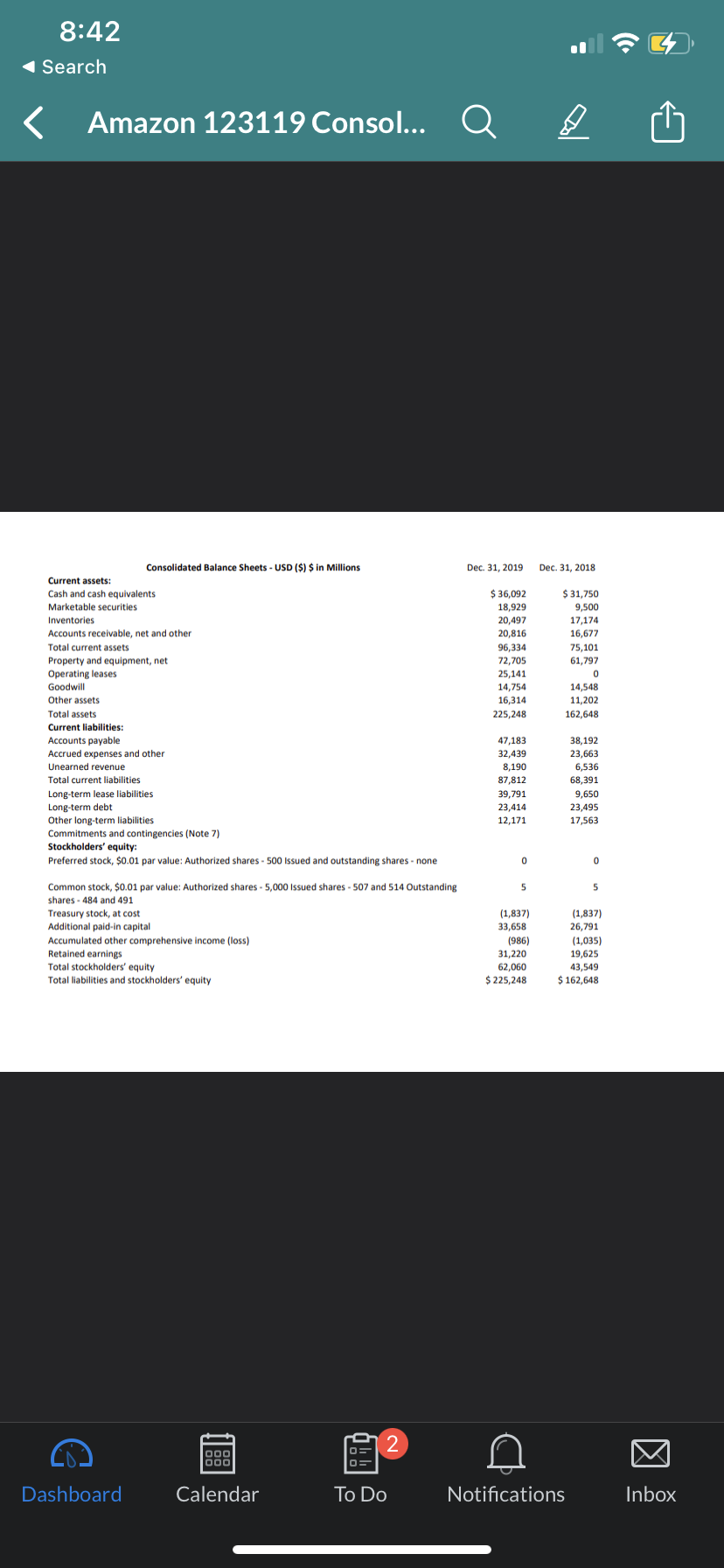

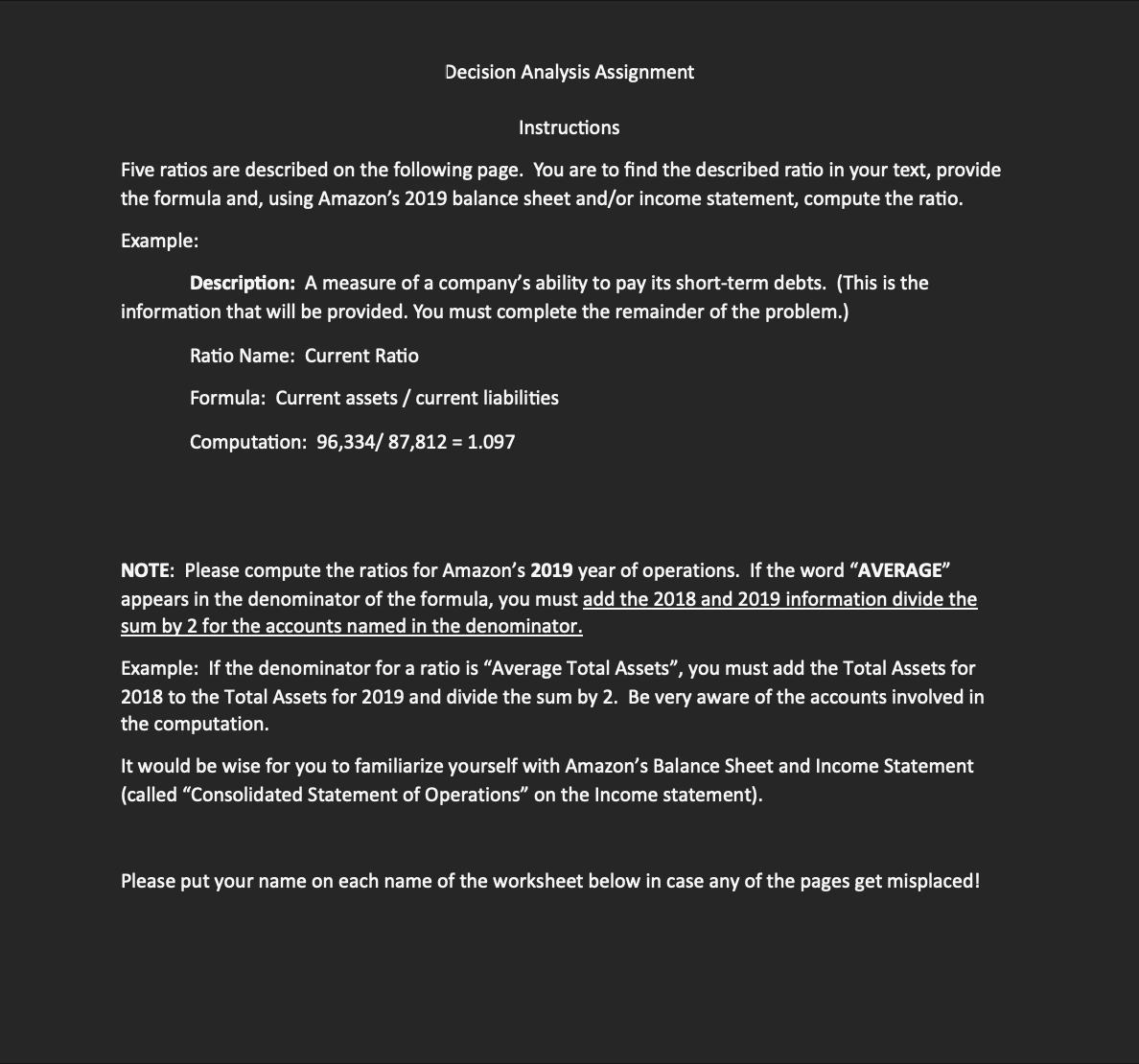

Description: Helps assess the quality and liquidity of the company's receivables and measures how many times, on average, receivables are collected during the period 1 Ratio Name: Formula: Computation: Description: It differs from the current ratio by excluding less liquid current assets such as inventory and prepaid expenses that take longer to be converted to cash. 1 Ratio Name: Formula: Computation: Decision Analysis Assignment Instructions Five ratios are described on the following page. You are to find the described ratio in your text, provide the formula and, using Amazon's 2019 balance sheet and/or income statement, compute the ratio. Example: Description: A measure of a company's ability to pay its short-term debts. (This is the information that will be provided. You must complete the remainder of the problem.) Ratio Name: Current Ratio Formula: Current assets / current liabilities Computation: 96,334/87,812=1.097 NOTE: Please compute the ratios for Amazon's 2019 year of operations. If the word "AVERAGE" appears in the denominator of the formula, you must add the 2018 and 2019 information divide the sum by 2 for the accounts named in the denominator. Example: If the denominator for a ratio is "Average Total Assets", you must add the Total Assets for 2018 to the Total Assets for 2019 and divide the sum by 2. Be very aware of the accounts involved in the computation. It would be wise for you to familiarize yourself with Amazon's Balance Sheet and Income Statement (called "Consolidated Statement of Operations" on the Income statement). Please put your name on each name of the worksheet below in case any of the pages get misplaced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started