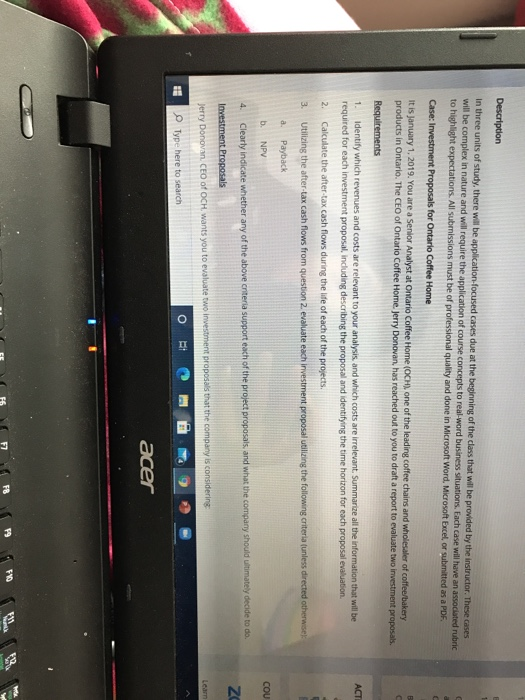

Description In three units of study, there will be application focused cases due at the beginning of the class that will be provided by the instructor. These cases will be complex in nature and will require the application of course concepts to real word business situations. Each case will have an associated rubric to highlight expectations. All subrnissions must be of professional quality and done in Microsoft Word, Microsoft Excel or submitted as a PDF. Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (CH), one of the leading coffee chains and wholesaler of coffee bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. identify which revenues and costs are relevant to your analysis and which costs are irrelevant. Summarize all the information that will be required for each investment proposal, including describing the proposal and identifying the time horizon for each proposal evaluation. 2. Calculate the after-tax cash flows during the life of each of the projects. 3. Utilizing the after-tax cash flows from question 2. evaluate each investment proposal utilizing the following criteria (unless directed otherwise Payback ACT a. b. NPV COU 4 Clearly indicate whether any of the above criteria support each of the project proposals, and what the company should ultimately decide to do ZO Investment Proposals Jerry Donovan CEO of OCH wants you to evaluate two investment proposals that the company is considering Learn o Type here to search acer Description In three units of study, there will be application focused cases due at the beginning of the class that will be provided by the instructor. These cases will be complex in nature and will require the application of course concepts to real word business situations. Each case will have an associated rubric to highlight expectations. All subrnissions must be of professional quality and done in Microsoft Word, Microsoft Excel or submitted as a PDF. Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (CH), one of the leading coffee chains and wholesaler of coffee bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. identify which revenues and costs are relevant to your analysis and which costs are irrelevant. Summarize all the information that will be required for each investment proposal, including describing the proposal and identifying the time horizon for each proposal evaluation. 2. Calculate the after-tax cash flows during the life of each of the projects. 3. Utilizing the after-tax cash flows from question 2. evaluate each investment proposal utilizing the following criteria (unless directed otherwise Payback ACT a. b. NPV COU 4 Clearly indicate whether any of the above criteria support each of the project proposals, and what the company should ultimately decide to do ZO Investment Proposals Jerry Donovan CEO of OCH wants you to evaluate two investment proposals that the company is considering Learn o Type here to search acer