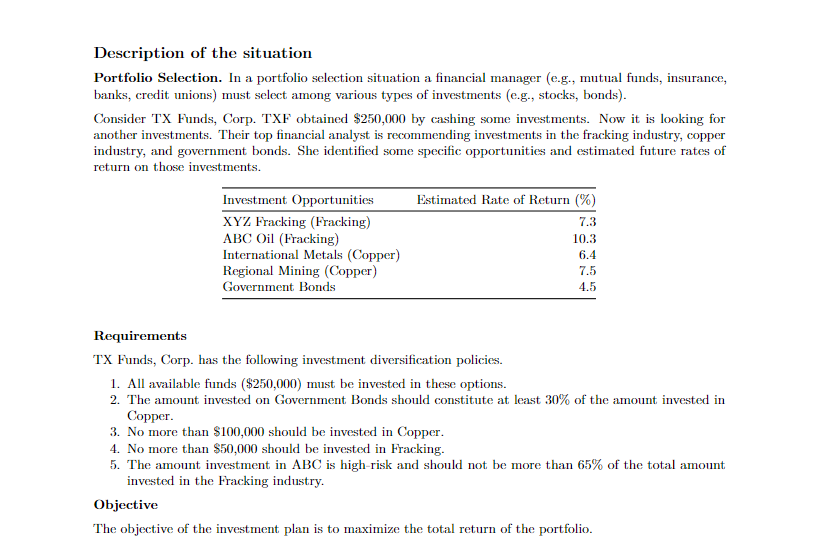

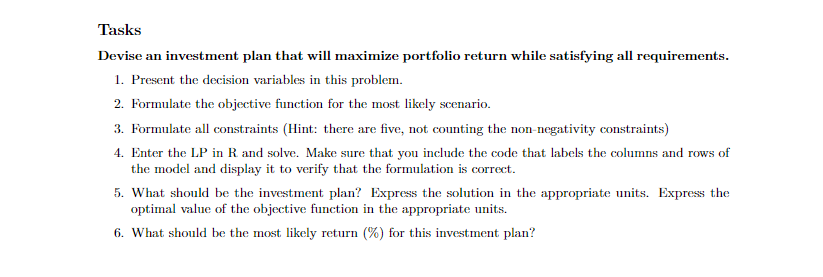

Description of the situation Portfolio Selection. In a portfolio selection situation a financial manager (e.g., mutual funds, insurance, banks, credit unions) must select among various types of investments (e.g., stocks, bonds). Consider TX Funds, Corp. TXF obtained $250,000 by cashing some investments. Now it is looking for another investments. Their top financial analyst is recommending investments in the fracking industry, copper industry, and government bonds. She identified some specific opportunities and estimated future rates of return on those investments. Investment Opportunities Estimated Rate of Return (%) XYZ Fracking (Fracking) ABC Oil (Fracking) 10.3 International Metals (Copper) 6.4 Regional Mining (Copper) 7.5 Government Bonds 7.3 4.5 Requirements TX Funds, Corp. has the following investment diversification policies. 1. All available funds ($250,000) must be invested in these options. 2. The amount invested on Government Bonds should constitute at least 30% of the amount invested in Copper. 3. No more than $100,000 should be invested in Copper. 4. No more than $50,000 should be invested in Fracking. 5. The amount investment in ABC is high-risk and should not be more than 65% of the total amount invested in the Fracking industry. Objective The objective of the investment plan is to maximize the total return of the portfolio. m Tasks Devise an investment plan that will maximize portfolio return while satisfying all requirements. 1. Present the decision variables in this problem. 2. Formulate the objective function for the most likely scenario. 3. Formulate all constraints (Hint: there are five, not counting the non-negativity constraints) 4. Enter the LP in R and solve. Make sure that you include the code that labels the columns and rows of the model and display it to verify that the formulation is correct. 5. What should be the investment plan? Express the solution in the appropriate units. Express the optimal value of the objective function in the appropriate units. 6. What should be the most likely return (%) for this investment plan? Description of the situation Portfolio Selection. In a portfolio selection situation a financial manager (e.g., mutual funds, insurance, banks, credit unions) must select among various types of investments (e.g., stocks, bonds). Consider TX Funds, Corp. TXF obtained $250,000 by cashing some investments. Now it is looking for another investments. Their top financial analyst is recommending investments in the fracking industry, copper industry, and government bonds. She identified some specific opportunities and estimated future rates of return on those investments. Investment Opportunities Estimated Rate of Return (%) XYZ Fracking (Fracking) ABC Oil (Fracking) 10.3 International Metals (Copper) 6.4 Regional Mining (Copper) 7.5 Government Bonds 7.3 4.5 Requirements TX Funds, Corp. has the following investment diversification policies. 1. All available funds ($250,000) must be invested in these options. 2. The amount invested on Government Bonds should constitute at least 30% of the amount invested in Copper. 3. No more than $100,000 should be invested in Copper. 4. No more than $50,000 should be invested in Fracking. 5. The amount investment in ABC is high-risk and should not be more than 65% of the total amount invested in the Fracking industry. Objective The objective of the investment plan is to maximize the total return of the portfolio. m Tasks Devise an investment plan that will maximize portfolio return while satisfying all requirements. 1. Present the decision variables in this problem. 2. Formulate the objective function for the most likely scenario. 3. Formulate all constraints (Hint: there are five, not counting the non-negativity constraints) 4. Enter the LP in R and solve. Make sure that you include the code that labels the columns and rows of the model and display it to verify that the formulation is correct. 5. What should be the investment plan? Express the solution in the appropriate units. Express the optimal value of the objective function in the appropriate units. 6. What should be the most likely return (%) for this investment plan