Question

Description Question 3 (5 Marks) Your third client works for a large Queensland manufacturing company that is concerned about rises in electricity prices. They would

Description Question 3 (5 Marks)

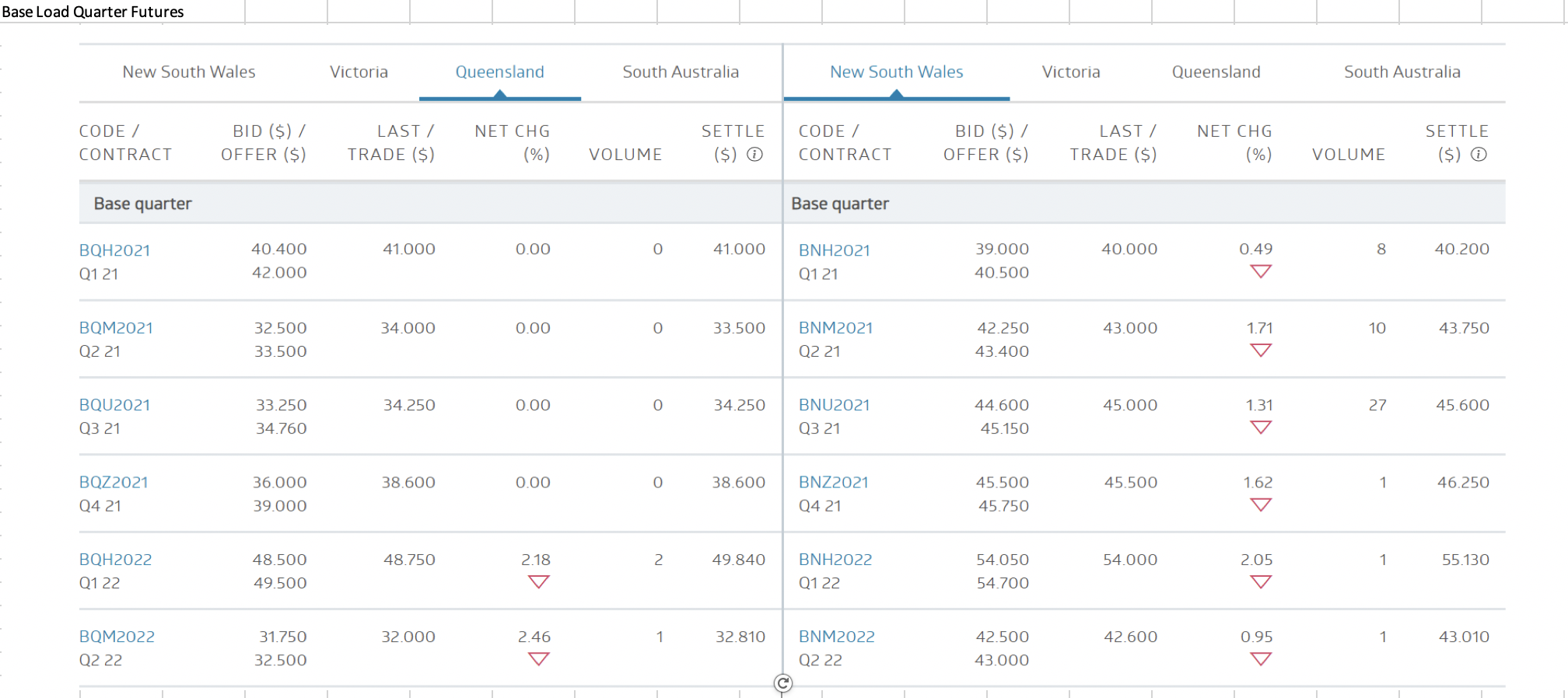

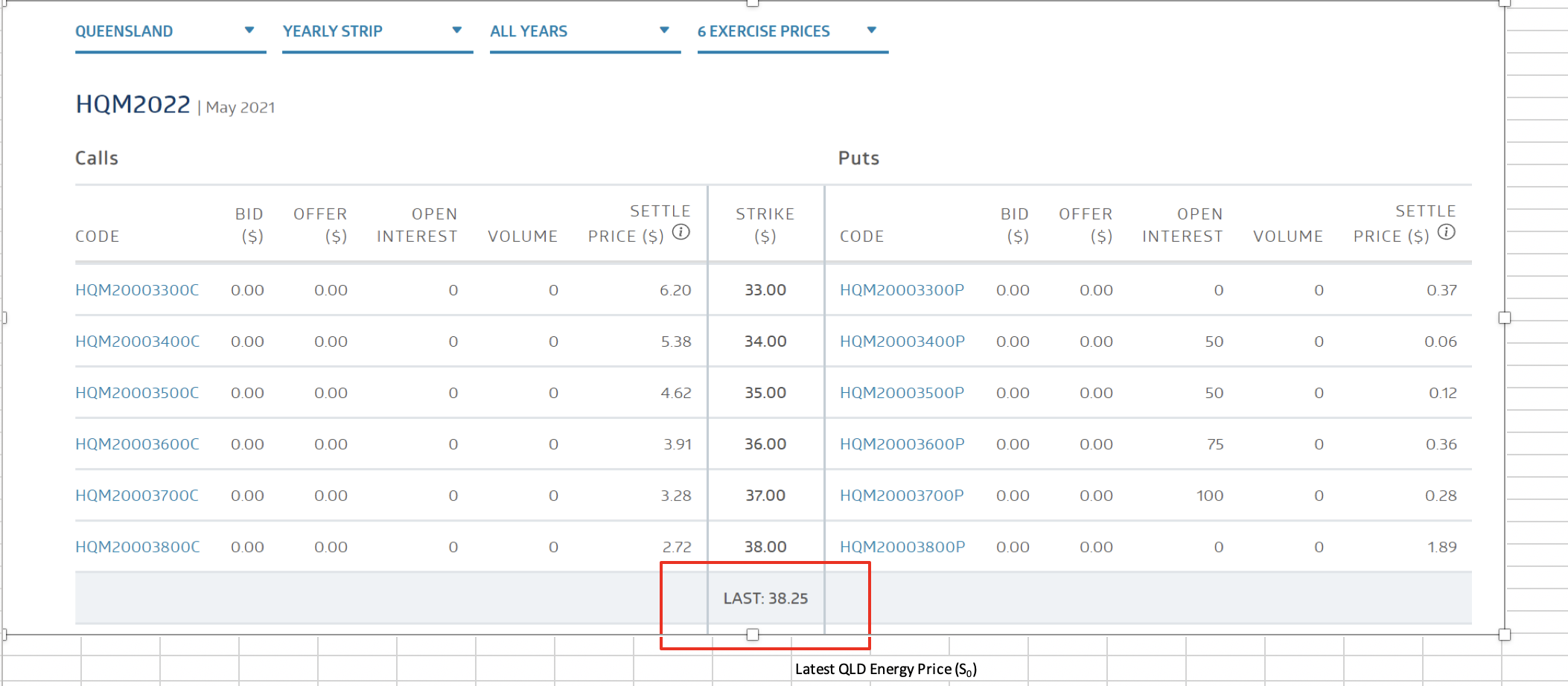

Your third client works for a large Queensland manufacturing company that is concerned about rises in electricity prices. They would like to lock in the price for the next 6 months to fulfill current orders with an estimated requirement of 150,000 megawatt hours at $35 per megawatt hour (ie. a $5,250,000 commitment). The contract will be established today (19th February 2021) and should be in place until at least September 19th, 2021. Assume that the storage costs for electricity are equal to the convenience yield (u=y)

Step 1 Choose an appropriate futures contract.

From the snapshot of QLD Energy futures prices as of February 19th provided, determine which contract should be chosen stating the day of expiry for the contract. Calculate the theoretical value for the contract. Discuss any differences between the theoretical value you have calculated and the listed value.

Step 2 Determine the number of futures contracts required.

Determine the initial value of the futures contract and the number of contracts that should be purchased to hedge this position and whether they should be buy or sell positions.

Step 3 Provide the ending balances for two (2) potential future scenarios.

Determine the financial outcome for your client assuming two different potential future outcomes: 1) an ending BQ price of $40 and 2) an ending BQ price of $30. Include the cost of the hedge.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started