Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Descriptions Terms The elements in a firm's capital structure. Capital compnents A table or graph of a firm's potential investments ranked from the highest internal

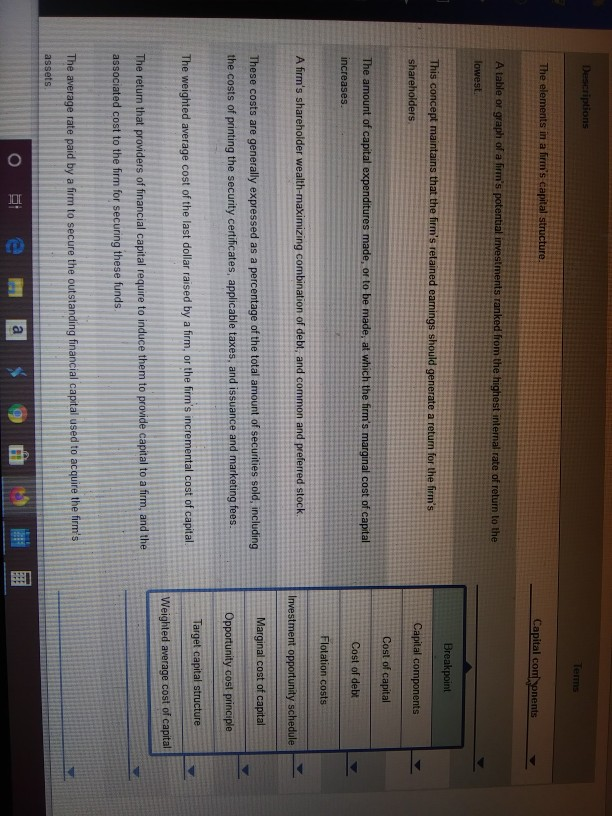

Descriptions Terms The elements in a firm's capital structure. Capital compnents A table or graph of a firm's potential investments ranked from the highest internal rate of return to the lowest Breakpoint This concept maintains that the firm's retained earnings should generate a return for the firm's shareholders Capital components Cost of capital The amount of capital expenditures made, or to be made, at which the firm's marginal cost of capital Cost of debt increases Flotation costs A firm's shareholder wealth-maximizing combination of debt, and common and preferred stock. Investment opportunity schedule Marginal cost of capital These costs are generally expressed as a percentage of the total amount of securities sold, including the costs of printing the security certificates, applicable taxes, and issuance and marketing fees. Opportunity cost principle Target capital structure The weighted average cost of the last dollar raised by a firm, or the firm's incremental cost of capital Weighted average cost of capital The return that providers of financial capital require to induce them to provide capital to a firm, and the associated cost to the firm for securing these funds The average rate paid by a firm to secure the outstanding financial capital used to acquire the firm's assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started