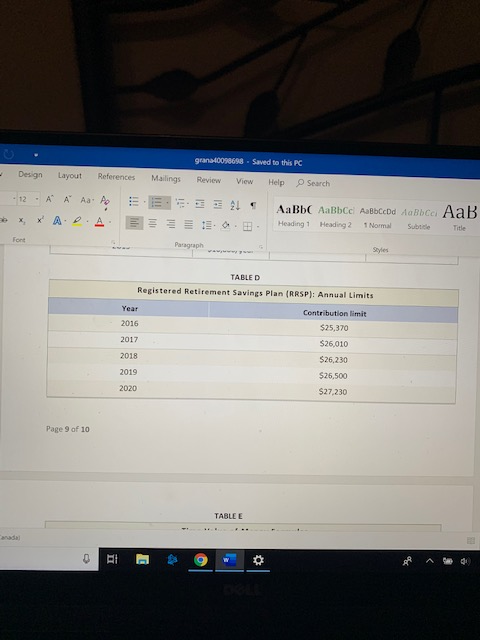

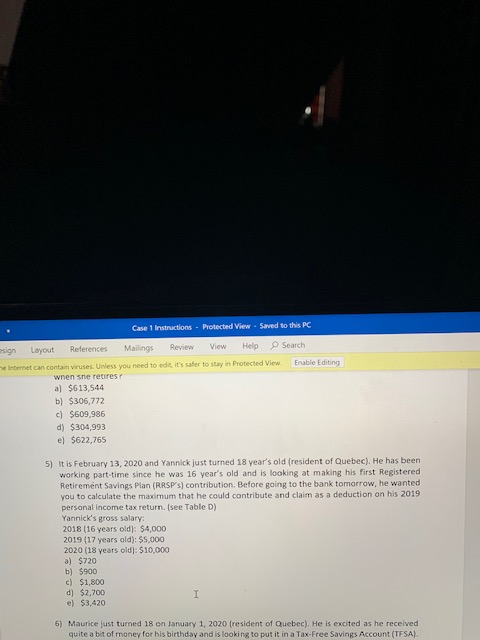

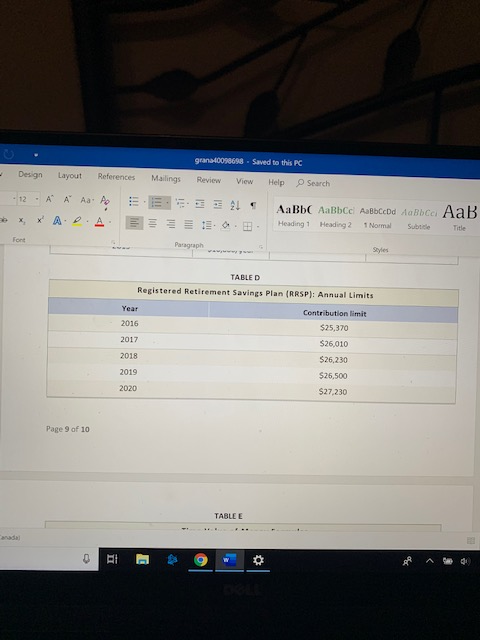

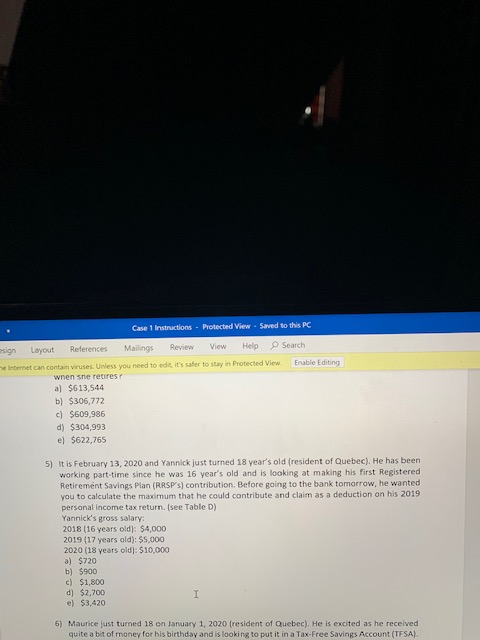

- Design Layout References grana40098698 . Saved to this PC Review View Help Mailings Search E 12. A A Aa X X A. 2. font 21 .0. A AaBb AaBbc Albccbd Aa Bbce AaB Heading 1 Heading 2 1 Normal Subtitle Title - Paragraph TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Year Contribution limit 2016 $25,370 $26,010 2018 $26,230 2019 $26,500 $27.230 2017 2020 Page 9 of 10 TABLE E A 40 Case 1 Instructions - Protected ViewSaved to this PC msign Layout References Mailings Review View Help Search bent can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing when she retires a) $613,544 b) $306,772 c) $609,986 d) $304,993 e) $622,765 5) It is February 13, 2020 and Yannick just turned 18 year's old resident of Quebec). He has been working part-time since he was 16 year's old and is looking at making his first Registered Retirement Savings Plan (RRSP's) contribution. Before going to the bank tomorrow, he wanted you to calculate the maximum that he could contribute and claim as a deduction on his 2019 personal income tax return (see Table D) Yannick's gross salary: 2018 (16 years old): $4,000 2019 (17 years old): $5,000 2020 (18 years old): $10,000 a) $720 b) $900 c) $1,800 d) $2,700 e) $3,420 6) Maurice just turned 18 on January 1, 2020 (resident of Quebec). He is excited as he received quite a bit of money for his birthday and is looking to put it in a Tax-Free Savings Account (TFSA). - Design Layout References grana40098698 . Saved to this PC Review View Help Mailings Search E 12. A A Aa X X A. 2. font 21 .0. A AaBb AaBbc Albccbd Aa Bbce AaB Heading 1 Heading 2 1 Normal Subtitle Title - Paragraph TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Year Contribution limit 2016 $25,370 $26,010 2018 $26,230 2019 $26,500 $27.230 2017 2020 Page 9 of 10 TABLE E A 40 Case 1 Instructions - Protected ViewSaved to this PC msign Layout References Mailings Review View Help Search bent can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing when she retires a) $613,544 b) $306,772 c) $609,986 d) $304,993 e) $622,765 5) It is February 13, 2020 and Yannick just turned 18 year's old resident of Quebec). He has been working part-time since he was 16 year's old and is looking at making his first Registered Retirement Savings Plan (RRSP's) contribution. Before going to the bank tomorrow, he wanted you to calculate the maximum that he could contribute and claim as a deduction on his 2019 personal income tax return (see Table D) Yannick's gross salary: 2018 (16 years old): $4,000 2019 (17 years old): $5,000 2020 (18 years old): $10,000 a) $720 b) $900 c) $1,800 d) $2,700 e) $3,420 6) Maurice just turned 18 on January 1, 2020 (resident of Quebec). He is excited as he received quite a bit of money for his birthday and is looking to put it in a Tax-Free Savings Account (TFSA)